- Bitcoin price crashes over 6% on Wednesday, slipping past pool of liquidity between $60,600 and $59,005.

- Over $230 million worth of crypto positions have been liquidated, comprising $189 million in longs and over $40 million in short positions.

- Volatility levels are high in BTC and crypto ahead of FOMC meeting, which could turn markets.

Bitcoin (BTC) price shocked markets when it dumped over 5% on Wednesday as reverberations of the flush crash spread across the market. It came ahead of a key macro event, which explained the skyrocketing volatility.

Also Read: Bitcoin price dips into $60K range as spot traders flock to Coinbase Lightning Network

Daily digest market movers: Bitcoin could test Bull Market Support Band at $55K

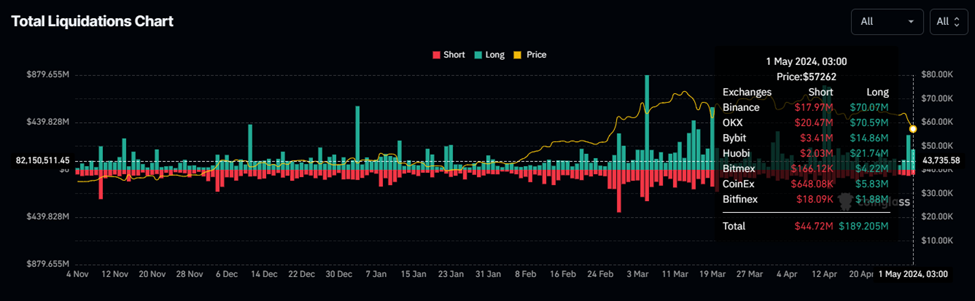

Bitcoin price has crashed 6% in the past 24 hours to trade for $57,495 as of press time. The dump that saw BTC slip below the pool of liquidity between $60,600 and $59,005 has caused over $230 million in total crypto positions to be liquidated across the market. This comprises $189 million in longs and $44 million in short positions. Specifically for BTC, over $80 million in longs were liquidated against $15 million in shorts.

Total liquidations

The dump comes with skyrocketing volatility attributed to a macro market event. The Federal Open Market Committee (FOMC) meeting is expected today. The best case is no change in the interest rates, but the commentary could be slightly hawkish. The Fed should be finding itself squeezed between a rock and a very hard place considering recent data showed “lack of further progress on inflation."

The April 16 reversal caught the market by surprise, considering the Fed was talking about how many rate cuts are coming this year. Now, it is a question of whether rate cuts even come at all.

The sharp crash in Bitcoin price reinforces the idea that whatever Fed Chair Jerome Powell has to say on Wednesday, it is likely priced in already.

According to Standard Chartered, however, Bitcoin could drop further to as low as $50,000. The speculation comes after the area that acted as support since early March was lost, bringing the total losses to 23.5% since the $73,777 all-time high.

❖ BITCOIN COULD DROP FURTHER TO AS LOW AS $50K, STANDARD CHARTERED SAYS

— *Walter Bloomberg (@DeItaone) May 1, 2024

Bitcoin’s (BTC) breakdown through the $60K technical level opens the way for another move lower to the $50K-$52K range, investment bank Standard Chartered said in emailed comments on Wednesday.…

Amid an ongoing flush crush, the global cryptocurrency market capitalization has dropped by 4.3% to $2.14 trillion in the past 24 hours.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Technical analysis: How far down will Bitcoin price go?

Bitcoin price’s 6% crash on Wednesday has seen the pioneer crypto test the Bull Market Support Band, which helps traders gauge potential levels of support during bullish market conditions and make informed trading decisions based on price action around these levels.

If this support band holds, Bitcoin price could bounce. However, a slip through it could see BTC extend the dump to the $50,168 support level.

Notice the lower highs on the Relative Strength Index (RSI), which is a show of falling momentum. This bearish outlook is reinforced by the red shade on the Awesome Oscillator (AO), signifying growing bearish sentiment.

Furthermore, the DXY Compare indicator is also rising, a trajectory that has historically been countercurrent with Bitcoin price. This adds credence to the bearish thesis.

BTC/USDT 1-week chart

On the other hand, it is worth noting that the Bitcoin Bull Market Support Band always serves strong support during every bull cycle of BTC. If history rhymes, BTC could wick through the support and bounce back.

— Seth (@seth_fin) May 1, 2024

The Best Time to buy #Bitcoin is when it hits Bull Market Support Band. Holding Bitcoin with no leverage is chill.

Look how many times $BTC price revisit this Band.

FOMC today at 20:00. Will be Important! I will report on the FOMC later today!

ZOOM OUT!!!! Chill!!… https://t.co/8jOaxchJe3 pic.twitter.com/MujMCuDOO7

As reported in a previous article, only a candlestick close above $72,000 would suggest Bitcoin price is out of the woods. This would set the tone for a reclaiming of the $73,777 peak of March 14, with the potential to establish a new all-time high above it.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.