Bitcoin price dips, $130 million in total liquidations with economist anticipating long weekend for BTC bulls

- Bitcoin price has recorded double-digit losses since spot ETFs started trading on January 11, 8% drop on Friday.

- BTC suffers partly in the wake of Grayscale GBTC dumping as holders leverage open redemption options.

- Renowned economist anticipates tough weekend for BTC holders, as trading volumes drop 40%. Liquidations hit $13 million.

Bitcoin (BTC) price is trading with a bearish bias, coming on the back of Grayscale (GBTC) dumping as investors seize the opportunity to redeem their Grayscale trust, selling BTC to the open market.

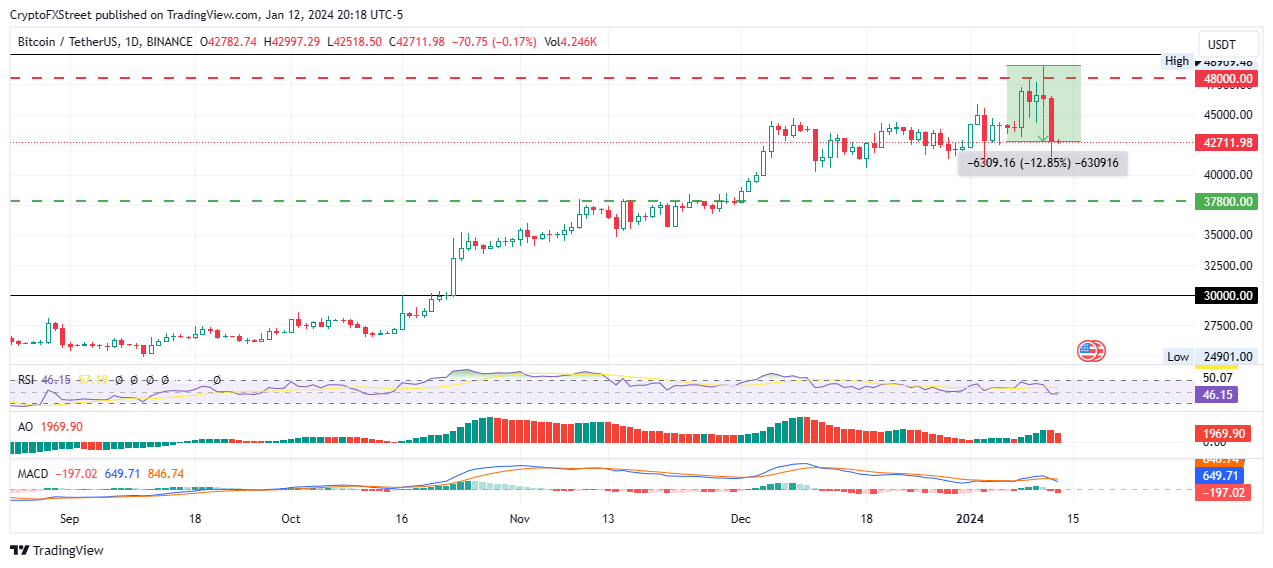

Bitcoin price drop liquidates $130 million positions

Bitcoin (BTC) price dropped 8% on Friday and saw up to $130 million in total liquidations. This comprised $112.84 million longs and $17.57 million worth of short positions.

BTC liquidations

With this, up to $1.19 billion in open interest went down the drain as GBTC holders seized the opportunity to exit from the $25 billion held in the Grayscale trust, as the opening of redemptions finally provided a way out.

Bitcoin Price is dumping as people are dumping their GBTC shares.

— Ran Neuner (@cryptomanran) January 12, 2024

GBTC held $25bn+ worth of Bitcoin that has been locked up for years with no option to be sold. As soon as the redemption option opened, for the first time people are starting to exit - as they exit the Bitcoin… pic.twitter.com/EqHgpHyVdd

According to Bloomberg ETF analyst James Seyffart, the Grayscale GBTC had an outflow of $484 million, while other players in the ETF market like ARK Invest were recording inflows of up to $42.5 million, with the former moving Bitcoin to Coinbase addresses, a move pointing to users redeeming.

UPDATE: Looks like @Grayscale's $GBTC saw $484 million in outflows today. @ARKInvest/@21Shares' $ARKB saw $42.5 million of INflows. @BitwiseInvest's $BITB flat on flows today. Don't have the data on any of the others yet. Total out of $GBTC is now ~$579 million pic.twitter.com/Ocuw9eHaHs

— James Seyffart (@JSeyff) January 13, 2024

Renowned economist and strategist Peter Schiff anticipates a long weekend for BTC holders as the retail market takes a back seat. He anticipates more sell pressure especially “if the new Bitcoin ETFs gap way down on Monday.”

Bitcoin has already fallen from just above $49K yesterday, to just below $42K today. That's over a 14% decline. It could be a long weekend for #Bitcoin bulls. If the new #BitcoinETFs gap way down on Monday it will be interesting to see how investors react. I doubt they'll #HODL.

— Peter Schiff (@PeterSchiff) January 12, 2024

At the time of writing, Bitcoin price is $42,711, with multiple indicators flashing bearish as the weekend sets in. Nevertheless, the big picture bullishness is still not threatened, until such a time when Bitcoin price descends to the $30,000 psychological level.

BTC/USDT 1-day chart

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.