- Bitcoin price remains below $63,000, distancing itself further from $73,777 all-time high.

- BTC whales cling firmly to their holdings despite a month of market dips.

- Halving is out four days, expected on April 20, causing increased anticipation and speculation in the market.

Bitcoin (BTC) price is edging lower as markets count only days to the halving. Nevertheless, the dump has not shaken the faith of large holders as they continue to cling to their holding even after a month of steady dumps.

Also Read: Bitcoin bull plans thwarted by US Dollar rally

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Daily digest market movers: Increased demand and speculation before Bitcoin halving

Bitcoin price continues shedding after slipping below an ascending trendline. It is in the lower section of a market range measured between $60,678 and $73,777, where selling pressure climaxed and buying pressure peaked respectively.

However, despite the ongoing dump, large holders are not selling, with Santiment researchers reporting that the whales continue to hold onto their coins. Specifically, they choose to block out all manner of FUD.

#Bitcoin key stakeholders aren't budging on their holdings, despite the concerning volatility that brought the top market cap #cryptocurrency's market value as low as $61.5K over the weekend.

— Santiment (@santimentfeed) April 15, 2024

With #FUD circulating among traders as markets close in on the April 19th #halving,… pic.twitter.com/TYmvQA6WBc

It comes as the countdown to the halving continues, slated for April 20, which is only four days away as only 500 blocks remain. Reports indicate that Google searches for “halving” are skyrocketing.

Google searches for "Halving" are going parabolic.

— Bitcoin Archive (@BTC_Archive) April 16, 2024

Awareness Adoption pic.twitter.com/8jsf8JsG73

Typically, in the days leading up to and on the day of the halving, there is increased anticipation and speculation in the market. In some instances, BTC price has increased significantly before or after the halving, driven by increased demand and speculation. Already, the implied volatility for April expiry surged by 13% over the weekend, moving from 62% to 75%. This suggests a short-term price turbulence ahead.

#BTC implied volatility for April expiry soared from 62% to 75% over the weekend, hinting at short-term price turbulence ahead. pic.twitter.com/1t0EYz4DUt

— Kaiko (@KaikoData) April 16, 2024

In the same spirit, analysts such as @CryptoCapo_ urge traders to brace for a sell-off that will see Bitcoin price drop below $60,000, where the pioneer cryptocurrency could establish a potential local bottom.

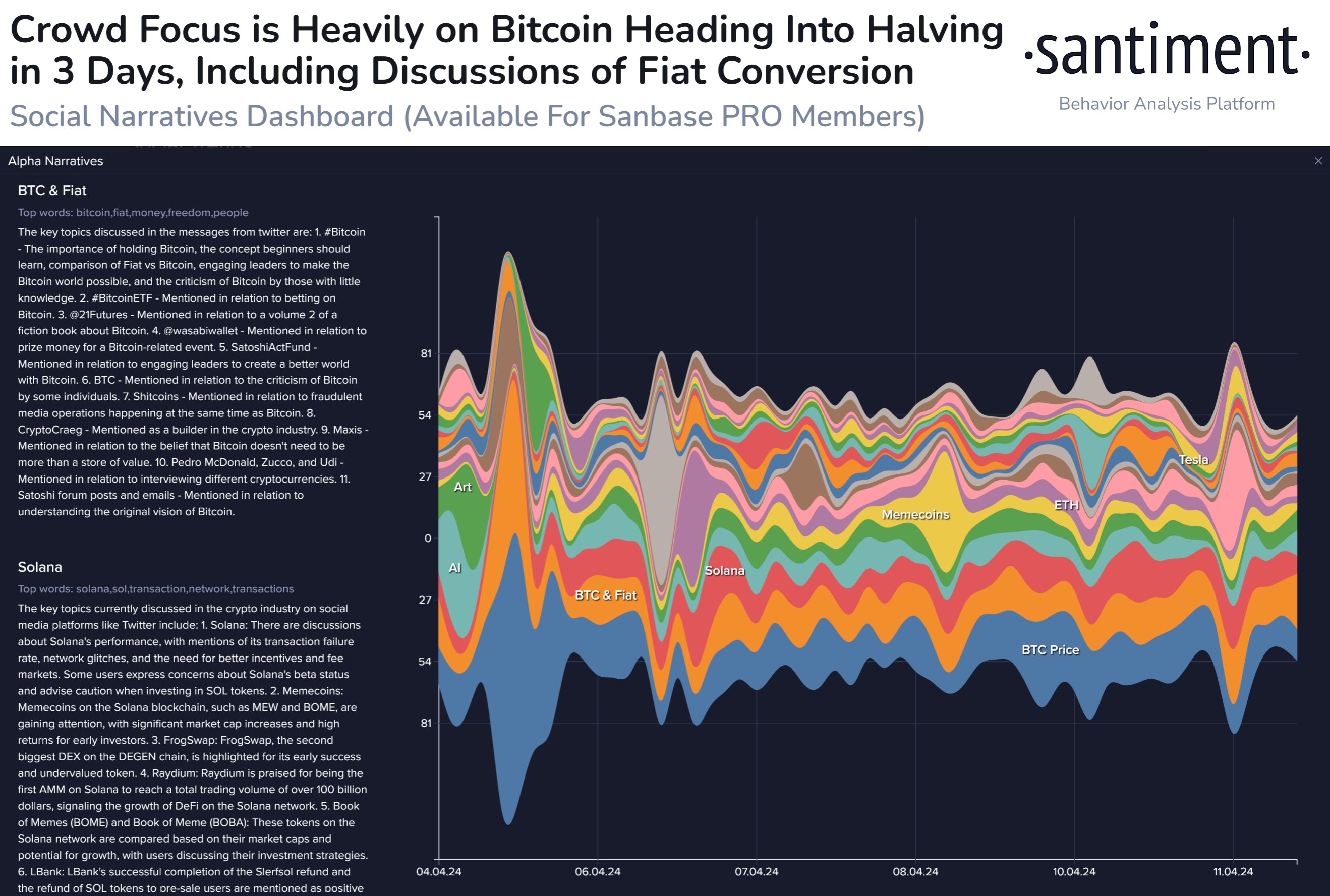

Traders are also increasing conversations about “BTC and the viability of holding through a potential extended correction past the halving,” Santiment reports.

BTC, fiat discussions post-halving

With altcoin sectors such as AI, gaming, DeFi, memecoins, and others shedding significantly, mainstream attention will continue to grow in favor of BTC and fiat liquidations amid growing FUD.

Technical analysts: Bitcoin price outlook amid growing FUD

Bitcoin price downside momentum continues to grow after breaking below the ascending trendline. The nose-diving Relative Strength Index (RSI) shows momentum is falling, accentuated by the position of the Awesome Oscillator (AO) in negative territory.

The DXY indicator is also climbing, putting downward pressure on Bitcoin price as investors move their funds into traditional safe-haven assets like the US Dollar.

Increased selling pressure could see Bitcoin price drop to the bottom of the market range at $60,678. In a dire case, the downtrend could extend for BTC price to slip below the $60,000 psychological level to levels as low as $59,005, a liquidity collection for the intraday low of March 5.

BTC/USDT 1-day chart

On the other hand, if the bulls seize the opportunity to buy the dip, the ensuing buying pressure could send Bitcoin price north. A move above the ascending trendline, and effectively the 50% Fibonacci placeholder, would draw in more bulls.

Enhanced buying pressure above the aforementioned level could set the pace for a move above $69,000, before Bitcoin price can reclaim the $73,777 ATH. In a highly bullish case, the price could clear this range high to record a new peak above the $74,000 or $75,000 thresholds.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin breaks all-time high above $106,000, triggers nearly $120 million in liquidations

Bitcoin hit a record high above $106,000 on Monday, after recent developments on President-elect Donald Trump’s strategic Bitcoin reserve and demand from institutional traders.

Ripple week in review: Can XRP's recent pullback prove a slingshot effect

XRP weekly active addresses dropped by over 180K after its recent price correction. XRP investors continue record profit-taking for the second consecutive week with nearly $2.2 billion in realized profits.

BiT Global slams Coinbase with $1 billion lawsuit over delisting of WBTC

In a lawsuit filed on Friday, BiT Global, headed by Tron founder Justin Sun, charged Coinbase exchange for violating antitrust laws after it delisted the Wrapped Bitcoin token from its platforms and requested $1 billion in damages.

Crypto Today: XRP, BNB advance as Blackrock records 16-day Ethereum buying spree

The cryptocurrency sector valuation grazed the $3.6 trillion mark on Thursday, recording $252 billion worth of inflows since the market crash halted on Tuesday. In the last 24 hours, 85,893 traders were liquidated with the total liquidations coming in at $204.96 million.

Bitcoin: BTC reclaims $100K mark

Bitcoin (BTC) reclaimed the $100K level, trading near $100,100 on Friday after a recent decline earlier this week. The recent pullback in BTC was mostly due to high-leverage traders and some holders booking profits. Despite Microsoft’s rejection of adding Bitcoin to the company’s balance sheet, institutional demand remained strong, recording a total inflow of $1.72 billion until Thursday.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.