- Arkham Intelligence data shows that a wallet associated with the US government transferred 10,000 BTC, worth $593.5 million, to Coinbase Prime on Wednesday.

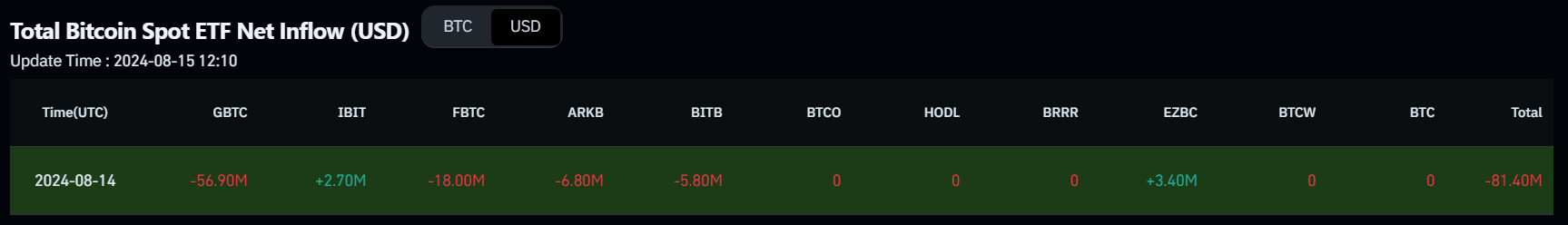

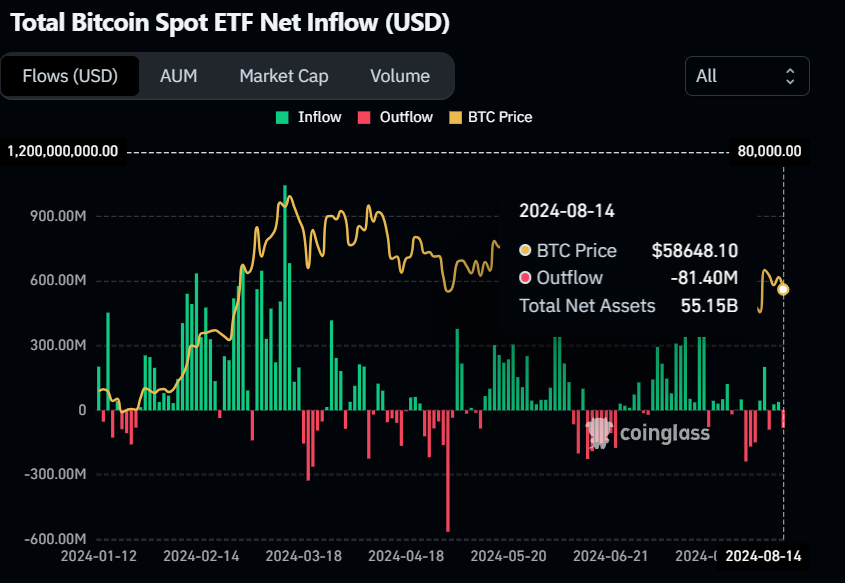

- Bitcoin Spot ETFs recorded a mild outflow of $81.40 million on Wednesday.

- On-chain data shows that BTC's daily active addresses are decreasing, signaling a bearish move ahead.

Bitcoin (BTC) price trades in the red for a second consecutive day on Thursday, down by 1.16% at $58,105. Sentiment around the main crypto asset seems to have deteriorated after Arkham Intelligence data showed that a wallet associated with the US government transferred 10,000 BTC, worth $593.5 million, to Coinbase Prime. Additionally, Bitcoin Spot ETFs recorded a mild outflow of $81.40 million, snapping a streak of two days of minor inflows.

Daily digest market movers: US government transfer weighs on Bitcoin

- Arkham Intelligence data shows that on Wednesday, a wallet associated with the US government transferred 10,000 BTC, worth $593.5 million, to Coinbase Prime. These funds were related to Silk Road Confiscated Funds by the US Department of Justice (DOJ).

- Historical data from Lookonchain shows that US government-related transfers earlier this year have led to an approximate 5% drop in Bitcoin's price within three days. As Wednesday’s transfer of 10,000 BTC was the largest known this year so far, it could generate FUD (Fear, Uncertainty, Doubt) among traders, potentially contributing to a decline in Bitcoin's price.

BREAKING: 10K Silk Road BTC ($593.5M) moved to Coinbase Prime

— Arkham (@ArkhamIntel) August 14, 2024

Wallet bc1ql received 10K BTC from a known US Government wallet 2 weeks ago. This BTC has just been sent on to 33J, a Coinbase Prime deposit wallet. pic.twitter.com/kNLsiJzL95

The #USGovernment transferred 15,940 $BTC($966.4M) to #CoinbasePrime in three transactions this year.

— Lookonchain (@lookonchain) August 15, 2024

Within three days of the first two transfers, the price of $BTC both dropped by ~5%.https://t.co/ugCqZSoS46https://t.co/agZkQtiKlIhttps://t.co/0RaZJ2fMs8 pic.twitter.com/EBdPjO7m9C

- Data from Coinglass shows that US-listed Bitcoin Spot ETFs recorded a mild outflow of $81.40 million on Wednesday. This highlights the importance of monitoring these net flows to gauge market dynamics and investor sentiment. Still, these outflows are very small, considering that the total Bitcoin reserves held by the 11 US spot Bitcoin ETFs are now at $55.15 billion.

Bitcoin Spot ETF Net Inflow (USD) chart

- Santiment's Daily Active Addresses index, which helps track network activity over time. A rise in the metric signals greater blockchain usage, while declining addresses point to lower demand for the network.

- In BTC's case, Daily Active Addresses declined 6.5% from Tuesday to Thursday and have been falling constantly since mid-March, indicating that demand for BTC's blockchain usage is decreasing.

%20[12.43.18,%2015%20Aug,%202024]-638593112622690990.png)

Bitcoin Daily Active Addresses index chart

Technical analysis: BTC finds rejection around $62,000 level

Bitcoin price has retested and failed to overcome the 61.8% Fibonacci retracement level of $62,066, drawn from the swing high of $70,079 on July 29 to the low of $49,101 on August 5. As of Thursday, it trades down 1.16% at $58,105 at the time of writing.

If $62,066 holds as resistance and BTC continues to decline, it could crash 15% from the current level towards $58,105 and even retest its daily support level of $49,917.

On the daily chart, the Relative Strength Index (RSI) and Awesome Oscillator (AO) trade below their neutral levels of 50 and zero, respectively, suggesting an impending bearish trend.

BTC/USDT daily chart

However, if Bitcoin price is able to close above the August 2 high of $65,596, it would set a higher high on the daily chart, possibly leading to a 6% price increase and testing the weekly resistance at $69,648.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.