- On Tuesday, Mt. Gox transferred 44,527 BTC, equivalent to $2.84 billion, to an internal wallet.

- Micheal Dell, CEO of Dell Technologies, expressed his fascination with Bitcoin on Twitter.

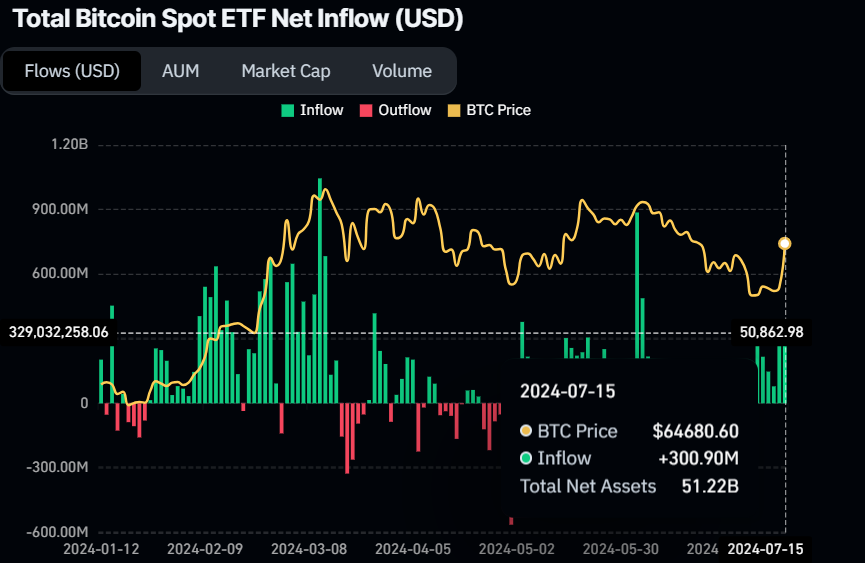

- U.S. spot Bitcoin ETFs saw inflows of $300.90 million on Monday.

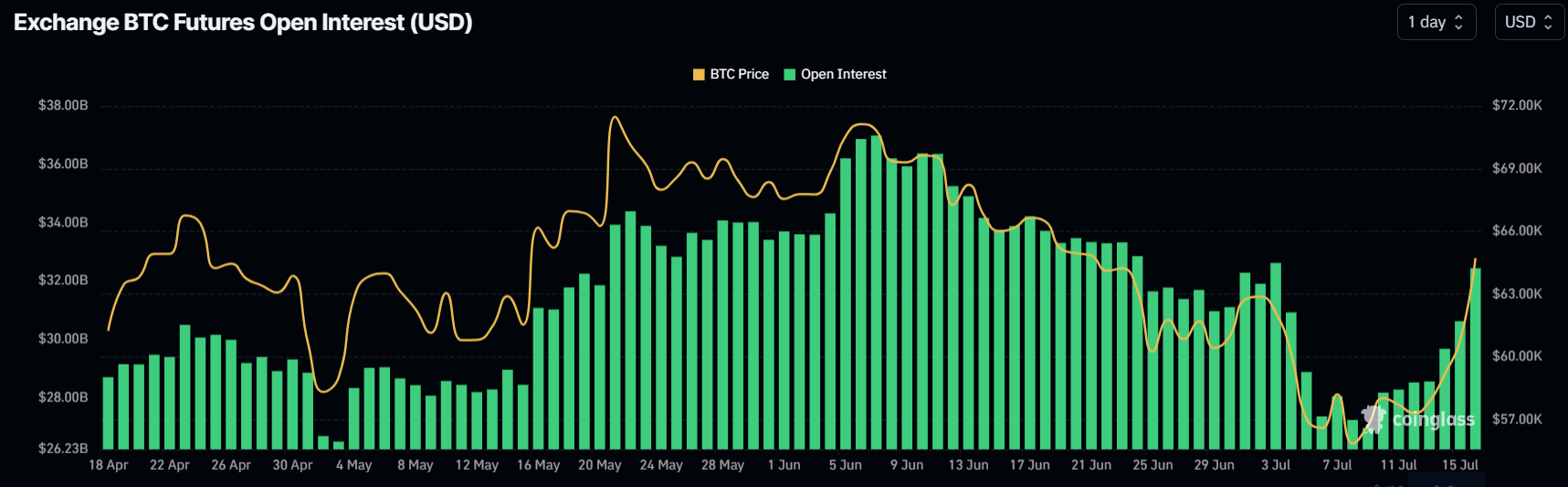

- On-chain data shows that $71.02 million short positions were liquidated, and open interest is rising.

Bitcoin (BTC) sees a 3% price decline on Tuesday, trading around the $63,000 level at the time of writing. On-chain data shows a liquidation of $71.02 million in short positions and a rise in open interest. Additionally, US spot Bitcoin ETFs recorded $300.90 million in inflows on Monday. The transfer of 44,527 BTC, valued at $2.84 billion, from Mt. Gox to an internal wallet on Tuesday possibly contributed to market uncertainty, potentially influencing Bitcoin's price drop today.

Daily digest market movers: Bitcoin price sheds 3% as Mt. Gox transfers weigh

- Lookonchain data shows that Mt. Gox transferred 44,527 BTC, equivalent to $2.84 billion, to an internal wallet on Tuesday, possibly in preparation for creditor repayments. With Mt. Gox currently holding 138,985 BTC valued at $8.87 billion, the defunct exchange, famously exploited in 2014, announced plans to reimburse Bitcoin and Bitcoin Cash to users in July. Previously, users suffered nearly $9 billion in cryptocurrency losses. This movement of funds may have triggered FUD (Fear, Uncertainty, Doubt), contributing to Bitcoin's 3% price decline on Tuesday.

Mt. Gox moved 44,527 $BTC(2.84B) to an internal wallet 5 minutes ago, which may be preparing for repayment.#MtGox currently holds 138,985 $BTC($8.87B).https://t.co/f2q66eQNuk pic.twitter.com/JlqkZdzkPC

— Lookonchain (@lookonchain) July 16, 2024

- Michael Dell, the founder and CEO of Dell Technologies, has expressed his fascination with Bitcoin on social media. Dell, with a net worth of approximately $108 billion, shared a recent video of Blackrock CEO Larry Fink discussing Bitcoin on CNBC. This move is significant as Dell's endorsement could influence the tech and finance industries' perception of Bitcoin.

- Given Dell's influence and the scale of Dell Technologies, his interest in Bitcoin could impact its acceptance and further adoption in the US tech industry. In the video, Fink manages $10.5 trillion in assets and explains his shift from skepticism to endorsing Bitcoin as a legitimate "digital gold" and a necessary alternative for economic stability.

Fascinating #Bitcoin pic.twitter.com/LYzl423eBm

— Michael Dell (@MichaelDell) July 15, 2024

- On Monday, US spot Bitcoin ETFs saw inflows of $300.90 million. This indicates increasing investor confidence and may predict a short-term rise in Bitcoin's price. Monitoring the net inflow data of these ETFs is important for grasping market dynamics and investor sentiment. Presently, the combined reserves of Bitcoin held by the 11 US spot Bitcoin ETFs amount to $51.22 billion.

Bitcoin Spot ETF Net Inflow (USD) chart

- According to the Coinglass Bitcoin Total Liquidations chart, $71.02 million in short positions were liquidated on Monday, compared to $9.94 million in long positions. This discrepancy suggests that when more shorts are liquidated than longs, upward pressure on the asset's price often results, driven by short covering, heightened volatility, and potential shifts in market sentiment towards a more bullish outlook.

Bitcoin Liquidation chart

- Additionally, Biticoin's Open Interest (OI) chart shows that OI surged from $30.63 billion on Monday to $32.44 billion on Tuesday, reaching its highest level since July 4. This uptick indicates an influx of new capital and increased buying activity within the market.

Bitcoin Open Interest chart

Technical analysis: BTC faces resistance around $65,000 level

Bitcoin price broke above a descending trendline on Sunday and rallied 6.5% the next day.When writing, BTC has faced resistance around the daily resistance level of $64,913 and trades down 3% around $62,641.

Sideline buyers looking for opportunities can do so between the $59,200 and $57,800 levels, the broken trendline resistance turned support.

If the trendline holds as throwback support, BTC could rally 10% from that level, targeting its daily resistance of $64,913.

On the daily chart, the Relative Strength Index (RSI) is currently above the neutral level of 50, and the Awesome Oscillator (AO) is also approaching its neutral threshold. Both indicators must maintain their positions above the medium line for the bullish momentum to be sustained. This scenario would contribute additional momentum to the ongoing recovery rally.

Furthermore, surpassing the $64,913 level could allow an additional 3.5% rise to retest the weekly resistance at the $67,209 level.

BTC/USDT daily chart

However, If Bitcoin's daily candlestick closes below the $56,405 level and forms a lower low in the daily timeframe, it may signal persistent bearish sentiment. This scenario could trigger a 7.5% decline in Bitcoin's price, targeting its daily support at $52,266.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.