Bitcoin price could continue to decline as on-chain data suggests BTC bears are in charge

- Bitcoin could continue to slump further as on-chain analytics suggest the leading cryptocurrency is in a sustained bear market.

- A quarter of network entities holding BTC is now in a negative position.

- The longer-term investors are underwater, the further Bitcoin could fall and more coins would be sold.

Blockchain data suggests that the leading cryptocurrency may be in a sustained bear market as over 4.7 million Bitcoins are now held at an unrealized loss. Several bearish signals indicate that the bellwether cryptocurrency could continue to decline.

A quarter of Bitcoin investors are now underwater

Blockchain analytics firm Glassnode recently noted that there has been decreasing interest and demand for Bitcoin. Over the past month, around 219,000 BTC wallets have been emptied.

According to Glassnode, the recent spending behavior could be due to the financial cost and psychological pain of holding an investment that is underwater. The proportion of on-chain entities in profit ranges between 65.78% and 76.70% of the network, meaning over a quarter of all network entities are in a negative position.

The report further noted that the recent decline in Bitcoin price may be due to the broader market uncertainty surrounding looming interest rate hikes by the Federal Reserve and the conflict in Ukraine.

According to Glassnode, Bitcoin price may continue to decline as the longer-term investors are underwater on their position, the further BTC will fall into unrealized loss, and more likely those coins held will be spent and sold.

However, the supply-side dynamics of the recent downturn look relatively optimistic compared to previous bear markets. Long-term investors are seemingly more likely to hold their coins and use derivatives to hedge risk rather than sell their crypto assets.

Bitcoin price tests last crucial support

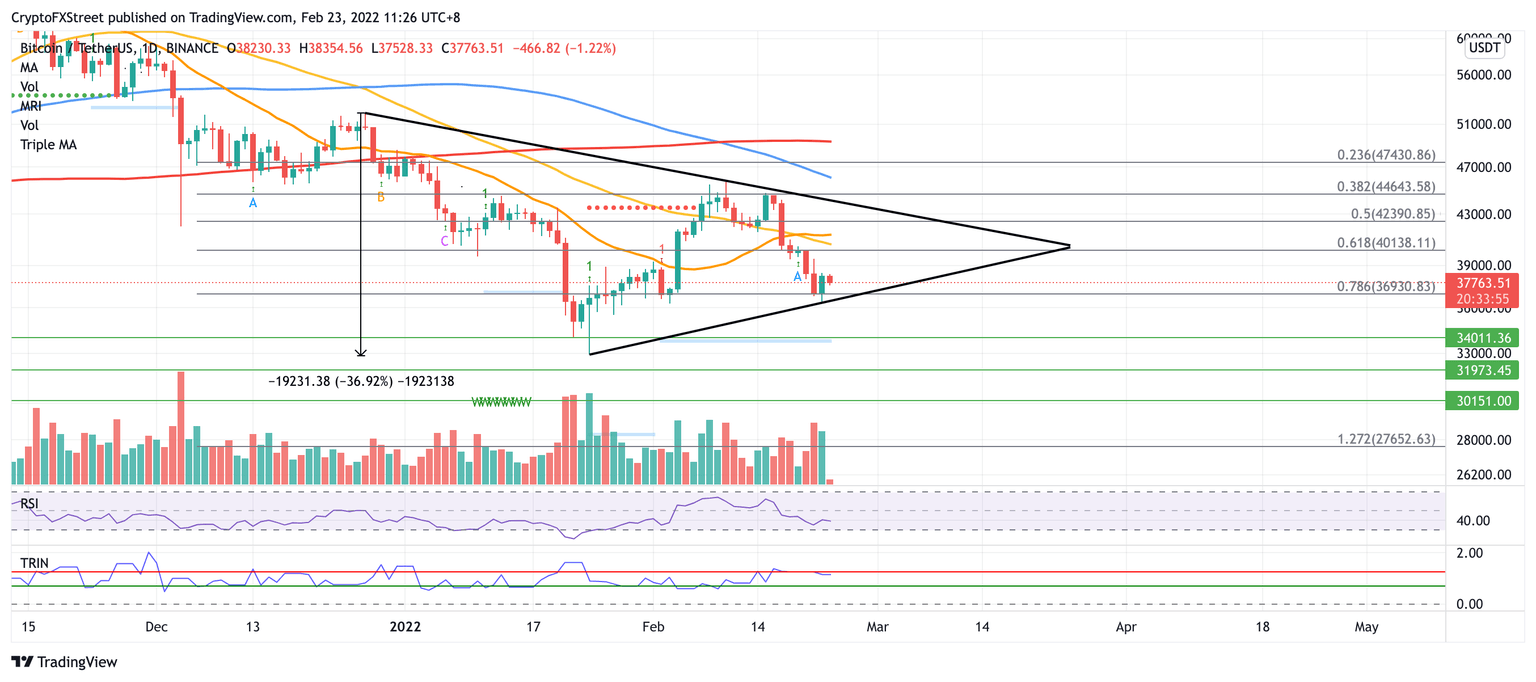

Bitcoin price has formed a symmetrical triangle pattern on the daily chart, suggesting that the leading cryptocurrency could continue to consolidate.

The bellwether cryptocurrency will test the critical line of defense at $36,930, where the 78.6% Fibonacci retracement level meets the lower boundary of the governing technical pattern. Additional selling pressure may see Bitcoin price tag the January 22 low at $34,011.

BTC/USDT daily chart

However, if buying pressure increases, Bitcoin price could aim for the 50-day Simple Moving Average (SMA) at $40,501.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.