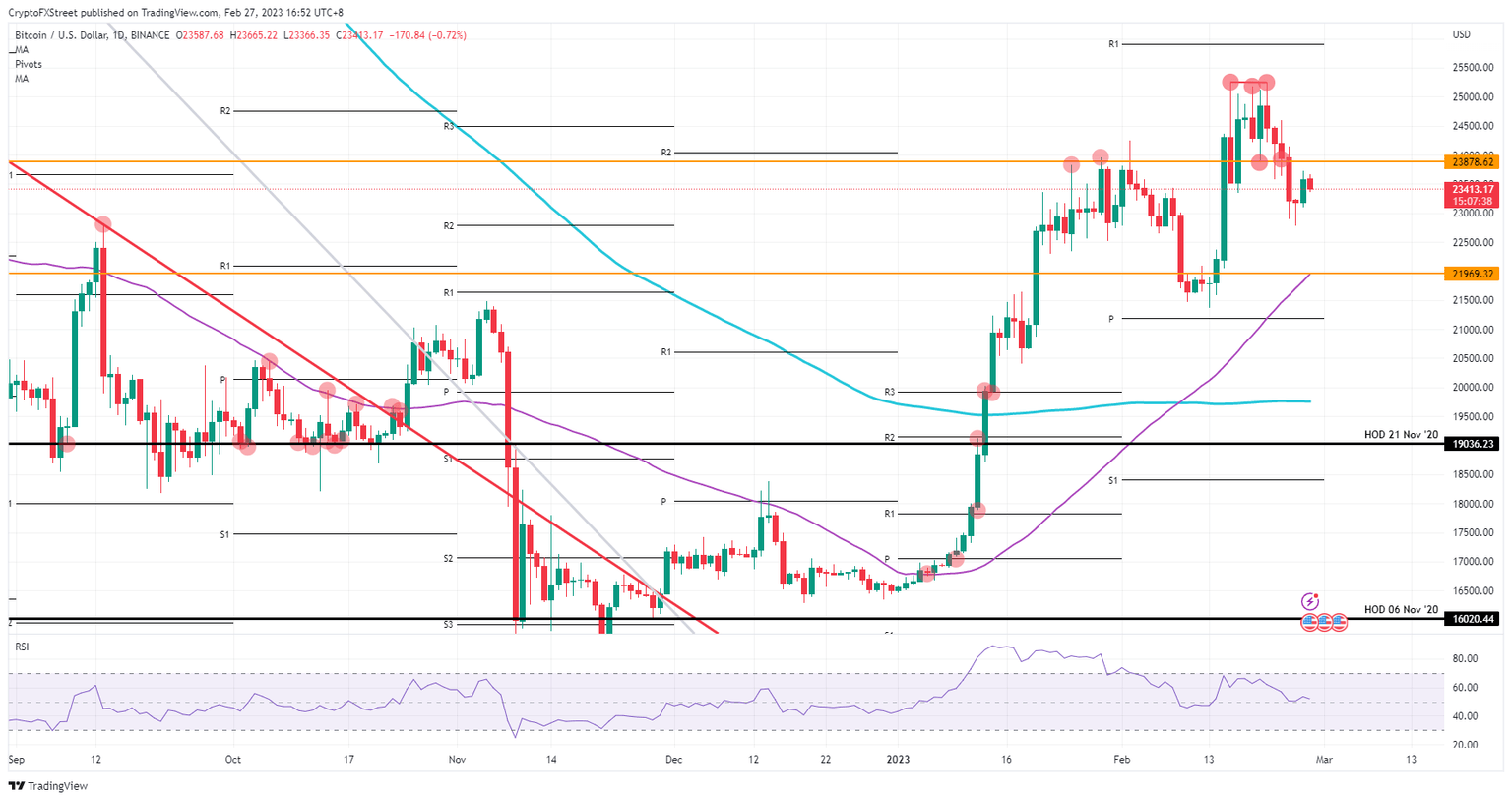

Bitcoin price continuous sell-off toward $22,000 as trading week kicks off where it ended last week

- Bitcoin price sees selling pressure return after a hiatus over the weekend.

- BTC is only 6% away from crucial support at $22,000.

- The lighter economic calendar this week could relieve the price action.

Bitcoin (BTC) price cannot bank on headlines this Monday that a breakthrough in Brexit negotiations has happened. Markets would rather continue their sell-off, which ended on Friday at the end of the official trading week. With a rather light economic calendar this week, markets look set to trade sideways and not make any big waves either up or down.

Bitcoin price has one big question mark that could form an issue this week

Bitcoin price saw a big chunk of its sell-off from last week pared back as Saturday price action went nowhere. On Sunday, bulls finally came in to push the price up over 1.5%. Several headlines emerged this Monday in ASIA-PAC trading that a Brexit deal is on the table. Markets are unmoved by it as the deal still needs to pass the House of Commons, and the Democratic Unionist Party (DUP) has not yet issued a statement on whether it will support it.

BTC is set up to face a week of headline-driven news in terms of Brexit and a rather light economic calendar. Traders though need to be aware that markets are facing a wave of oversupply as the European Central Bank (ECB) is set to start selling its portfolio. Expect that risk assets will be on the down foot with BTC set to tank 7% toward $21,969 to find vital support.

BTC/USD daily chart

With a rather light economic calendar this week, risk assets could book some gains in the meantime. A big turnaround toward $23,878 would see more bulls buy into the price action. Although a breakout looks viable, do not expect an attack at the triple top at $25,246 from last week.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.