Bitcoin price consolidation may be nearing the end, indicator suggests

Bitcoin may soon move out of its seven-week trading range of $30,000 to $40,000, with an indicator tracking the cyclical nature of price volatility suggesting a big move is overdue.

-

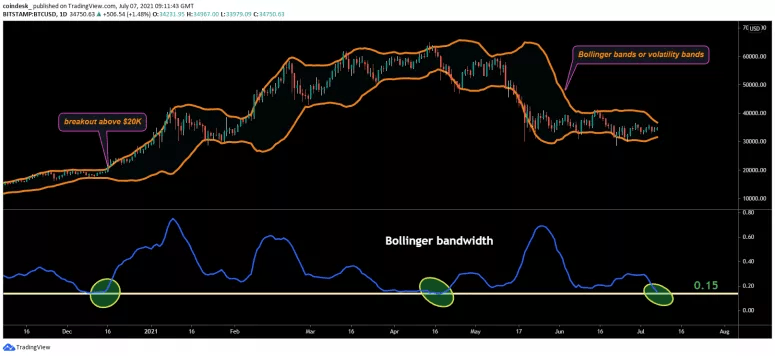

Bollinger bandwidth, a measure of volatility calculated by dividing the spread between the Bollinger bands by the 20-day average of the cryptocurrency's price, has declined to a 2 1/2-month low of 0.15.

-

The cryptocurrency saw big moves in December and April after the bandwidth fell to 0.15.

-

Bollinger bands are volatility bands placed two standard deviations either side of the 20-day average of price.

Bitcoin's daily chart

Source: TradingView

-

Bitcoin dropped from $60,000 to $48,000 after the Bollinger bandwidth dipped to 0.15 in mid-April.

-

A similar reading in December paved the way for a bullish breakout from the multi-week price consolidation below $20,000.

-

The cryptocurrency saw big moves during the 2017 bull run each time the bandwidth narrowed to 0.15.

-

Moves signaled by Bollinger bandwidth are direction-agnostic, as history shows. It means the anticipated change can be bullish or bearish.

-

The forthcoming Grayscale unlockings and blockchain data pointing to renewed buying by wealthy investors indicate that this time the move is likely to be bullish.

-

The upside is expected to gather steam above the 50-day moving average (MA) resistance, currently at $36,000.

-

"We expect buyers to step in above the 50-day MA," Katie Stockton, founder and managing partner of Fairlead Strategies, said in a weekly research note published Monday. "A breakout above the 50-day MA would indicate a test of $44,000-$45,000 resistance."

-

A move below $30,000 could bring deeper losses, she said, indicating that is a less likely outcome.

-

While concerns of an early scaling back of stimulus by the Federal Reserve pose a downside risk, the minutes of the Fed's June meeting scheduled for release at 18:00 UTC Wednesday are unlikely to be as hawkish as the June policy statement.

-

"Between weaker U.S. data and the Fed's desire to temper hawkish bets, the Fed minutes could sound more cautious and balanced than the FOMC statement and Fed projections," BK Asset Management's Kathy Lien said, according to FXStreet.

-

According to some analysts, bitcoin (BTC, +1.97%) digested most of the negative news during the mid-May sell-off from $58,000 to $30,000. As such, the downside, if any, appears limited.

-

Bitcoin is trading near $34,700 at press time, representing a 1.6% gain on the day, CoinDesk 20 data show.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.