Bitcoin price climbing above $26,000 brings profit to BTC-related stocks

- Bitcoin price noted a slight recovery today following days of red candlesticks, bringing the cryptocurrency up by 4%.

- Crypto-affiliated publicly traded companies such as miner Riot Platform, Coinbase, MicroStrategy, etc., observed a jump in their stock prices.

- This is because the correlation between these companies and Bitcoin is positive.

Bitcoin price is known to have a bullish impact on other altcoins when it rises, but the cryptocurrency is seemingly affecting the stock market too this time. Companies affiliated with digital assets are enjoying gains as Bitcoin bounces, even as the rest of the market remains relatively calm.

Read more - Total Crypto market cap falls below $1 trillion as whales dump Bitcoin and Ethereum

Bitcoin price rise pushes up stocks

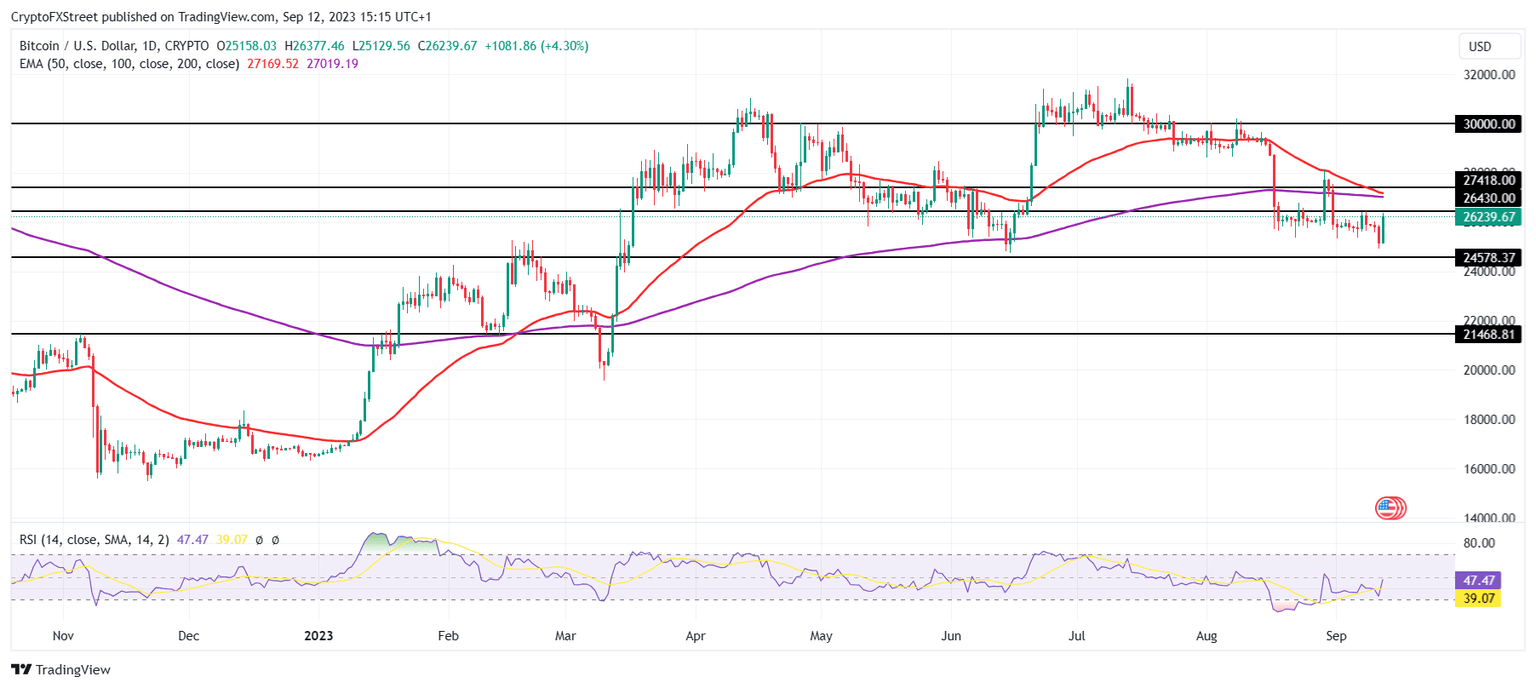

Bitcoin price, at the time of writing, can be seen hovering above $26,200 after increasing by a little more than 4% in the past 24 hours. Tuesday’s green candlestick comes as a relief to investors after the death cross of the previous day.

A flip of the $26,430 resistance into support could be key in establishing a sustained recovery rally for BTC.

BTC/USD 1-day chart

In addition to Bitcoin price, altcoins might also feel a bullish wave of recovery. The impact does not stop there: optimism has also reached the stock market. Publicly traded companies listed on the Nasdaq 100 and the S&P 500 index affiliated with cryptocurrencies are noting a surge in their value.

These companies include the likes of Bitcoin miners Riot Platform (RIOT) and Marathon Holdings (MARATHON). The former is noting an increase of 5% at the time of writing, rising by nearly 10% during the intra-day trading hours. Additionally, Michael Saylor’s MicroStrategy (MSTR) crypto exchange Coinbase (COIN), among others, is observing increases as well.

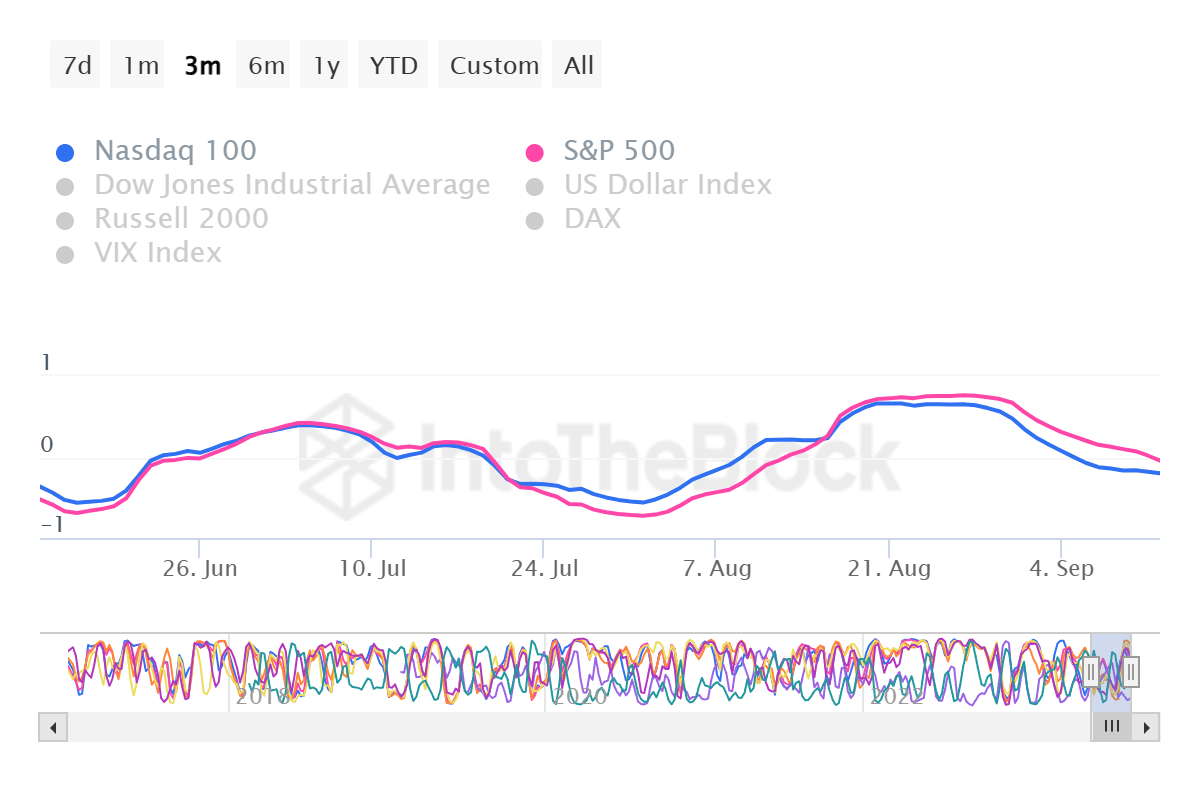

Bitcoin and stocks’ correlation

The stock markets, both Nasdaq 100 and S&P 500 index, share a slight negative correlation with Bitcoin -0.2 and -0.04, respectively. This makes the crypto-affiliated companies’ price rise an interesting deviation from the indices as a whole.

Bitcoin and stock markets’ correlation

However, the likes of RIOT, MARATHON and MSTR remain an exception since their correlation with Bitcoin is closer to 1. COIN, too, shares a correlation of 0.39, which, despite being low, is still positive.

Bitcoin correlation with crypto companies

Read more - Bitcoin adds 265k new users in 24 hours as G20 closes in on crypto regulation standardization

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.