Bitcoin (BTC) is seeing a “reset” in investor behavior at $30,000 and the trend need only continue to spark a price rise.

According to on-chain monitoring resource Ecoinometrics on July 13, the only way is “up” for BTC/USD if hodlers continue accumulating coins.

"Intriguing" data points to fresh demand

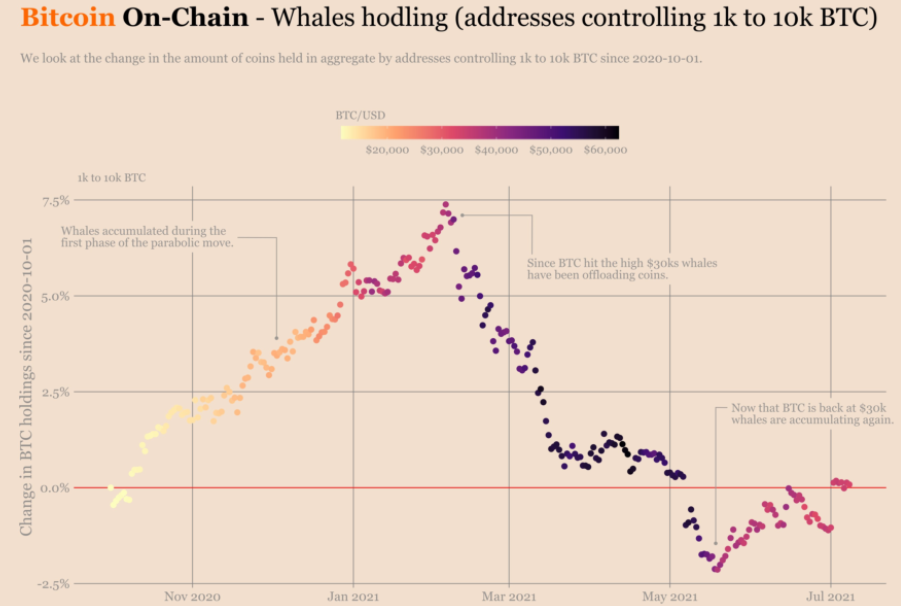

Analyzing who bought coins since the start of the latest bull run in October 2020, Ecoinometrics showed that major change is afoot compared to last year.

At the start, it was smaller investors, or “small fish,” who were accumulating. This began when Bitcoin passed its previous all-time high of $20,000 and continued all the way up to the new peak of $64,500.

At $20,000, however, larger investors began selling, albeit not in sufficient quantities to end the bull run.

Whales, on the other hand, added selling pressure once BTC/USD hit $30,000 for the first time. The result, analysts say, was the tipping point at May’s highs. “Apparently $30k is a key level that stopped the trend of coins accumulation by whales,” Ecoinmetrics commented.

The reason that selling pressure ultimately took over could lie with whale sentiment that Bitcoin was gaining “too much, too soon,” and that the market was thus deemed unsustainable.

Now that $30,000 has returned, cold feet are nowhere to be found – investors, both big and small, are buying again.

“Whales and small fish have started accumulating again while other categories have turned neutral,” the findings continue.

“If that interpretation is correct, then what we had with this correction is a reset. Would that trend of accumulation continue, there is only one direction Bitcoin can go and that’s up.”

Bitcoin whale hodling behavior chart. Source: Ecoinometrics/ Twitter

A glimmer of hopium

That perspective provides a refreshing counterargument to the bearish tone taken by many market commentators over the past few weeks.

Even the classic stock-to-flow price model has fielded concerns of invalidation, something its creator denies, while on-chain activity has been marked by low volumes and a lack of solid support above $30,000.

Calls for a major price move are not in short supply, meanwhile, with hopes for an upward move lingering despite sliding below $32,000 on Wednesday.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Is Altcoin Season here as Bitcoin reaches a new all-time high?

Bitcoin reaches a new all-time high of $98,384 on Thursday, with altcoins following the suit. Reports highlight that the recent surge in altcoins was fueled by the victory of crypto-friendly candidate Donal Trump in the US presidential election.

Shanghai court confirms legal recognition of crypto ownership

A Shanghai court has confirmed that owning digital assets, including Bitcoin, is legal under Chinese law. Judge Sun Jie of the Shanghai Songjiang People’s Court shared this opinion through the WeChat account of the Shanghai High People’s Court.

BTC hits an all-time high above $97,850, inches away from the $100K mark

Bitcoin hit a new all-time high of $97,852 on Thursday, and the technical outlook suggests a possible continuation of the rally to $100,000. BTC futures have surged past the $100,000 price mark on Deribit, and Lookonchain data shows whales are accumulating.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.