The increasing institutional interest in Bitcoin is “not hard to see” as U.S. regulators green light custody this week.

Bitcoin (BTC) will pass $20,000 if United States banks invest even 1% of their assets, one analyst believes.

Discussing institutional uptake of Bitcoin on July 23, Capriole digital asset manager Charles Edwards said that it was “not hard to see” the unfolding trend.

“Not hard to see where this is going”

“If US banks put just 1% of their assets into Bitcoin as an investment, hedge or insurance… the Bitcoin price more than doubles,” he wrote on Twitter, adding:

“Just 1 NASDAQ stock (Grayscale) already owns 2% of circulating Bitcoin supply today. It's not hard to see where this is going.”

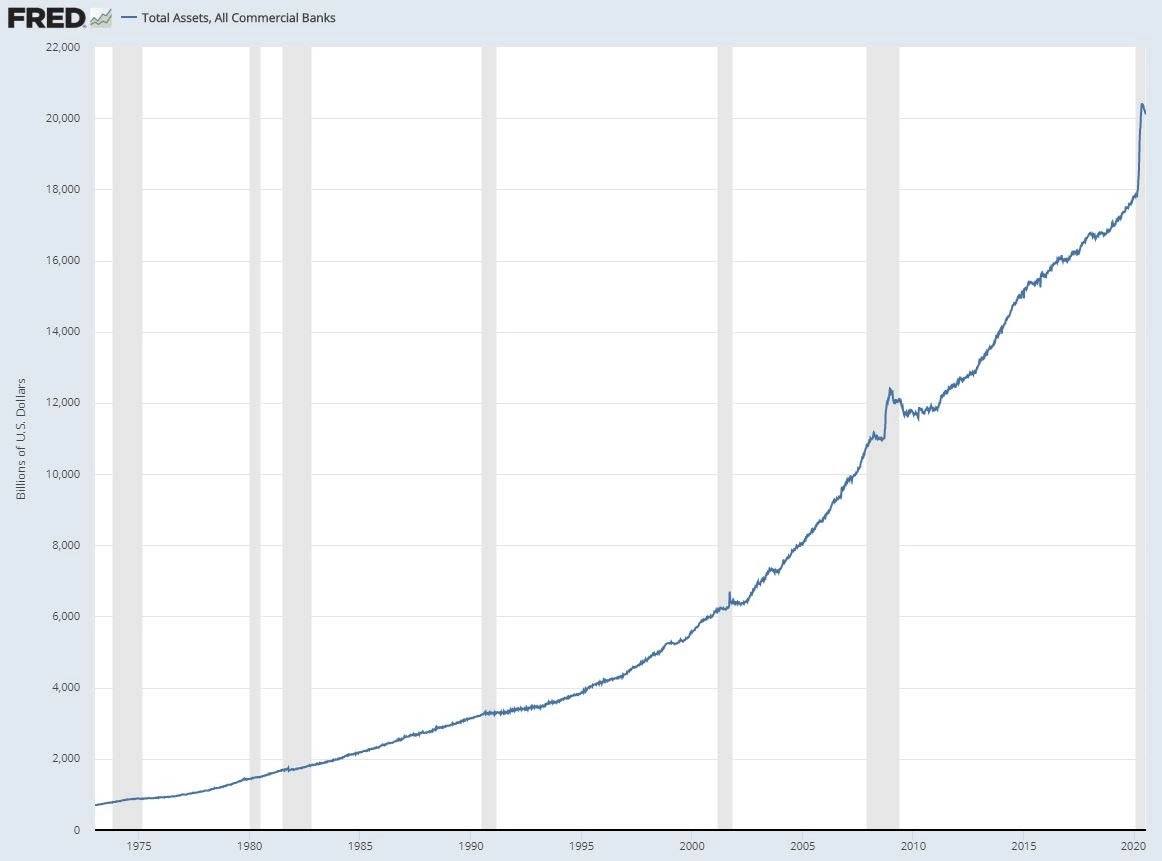

Edwards uploaded a chart of U.S. banks’ burgeoning asset balances as proof of the potential impact that a lean towards BTC would have on the largest cryptocurrency.

Grayscale, as Cointelegraph reported, is now a giant among Bitcoin hodlers, together with payment company Square responsible for buying up the majority of mined coins this year.

US bank asset balances chart, Source: Charles Edwards/ Twitter

Institutions quietly pile into BTC

Edwards’ comments are meanwhile timely. This week, U.S. lenders received the green light from regulators to engage in cryptocurrency custody activities.

Whether an influx from the sector would ultimately benefit Bitcoin as an asset remains a contentious topic. Previously, concerns circulated that institutional attention in the form of products such as a Bitcoin exchange-traded fund (ETF) would be detrimental to price discovery.

“It's not a matter of good or bad, it's just a fact,” Edwards added.

Nonetheless, other recent moves only serve to reinforce the market’s upward trajectory. Paul Tudor Jones, the maverick investor who has become increasingly bullish on Bitcoin, recently revealed that he had already put as much as 2% of his wealth in BTC.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: Is BTC sell-off over?

Bitcoin price declined over 6% this week until Friday as the escalation of the conflict between Iran and Israel added fuel to this sell-off. The decline was also supported by falling institutional demand for ETFs, which recorded outflows of more than $280 million this week.

Three reasons why Solana could see a double-digit decline

Solana price appears to have found some support on Friday, recovering slightly from the sharp sell-off registered earlier this week. However, on-chain metrics and technical indicators show increasing chances of a further decline in prices, suggesting that the rebound could be short-lived.

Tron network revenue exceeds Bitcoin, Ethereum and Solana in Q3

The Tron network (TRX) generated the highest revenue in the third quarter since its inception, outperforming leading cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bitcoin finds support around $60,000

Bitcoin is hovering around its key support level; a sustained close below this threshold could signal further declines. On the other hand, Ethereum and Ripple have closed below their critical support levels, indicating further downsides.

Bitcoin: Is BTC sell-off over?

Bitcoin price declined over 6% this week until Friday as the escalation of the conflict between Iran and Israel added fuel to this sell-off. The decline was also supported by falling institutional demand for ETFs. BTC bulls seem to be holding strong at a critical support level.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.