The best efforts of mainstream media to spark another price crash fail as BTC/USD rebounds after a mere 10% drop.

Bitcoin (BTC) saw a fresh price dip on May 21 amid reports that China had reiterated its pledge to crack down on mining and trading.

BTC/USD 1-minute candle chart (Bitstamp). Source: TradingView

China and Bitcoin: Old news

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD shed 10% in minutes on Friday as mainstream media turned up the volume on familiar bad news.

The pair had recently regained $42,000 after a record-breaking recovery from a $30,000 dip on Wednesday, with the latest concerns erasing some of its progress.

These focused on a Chinese government statement that revealed plans to "crack down on Bitcoin mining and trading behavior, and resolutely prevent the transmission of individual risk."

As Cointelegraph reported, China had already reiterated its plans to control cryptocurrency activities within its jurisdiction, but media sources had taken comments from officials as a threat to the industry. With no official changes in policy coming on Friday either, commentators were likewise quick to lay the blame on those spreading bad publicity.

Research had previously shown that the Bitcoin network is resilient to changes in conditions, with a loss of mining power in one location soon compensated elsewhere.

In a separate development, regulators in Hong Kong were planning to ban retail trading of cryptocurrency — with an exception for millionaires.

At press time, Bitcoin was already rebounding from local lows of $36,680.

Market resilience solidifies

More broadly, the impact of negative news had slowed following the $30,000 dip, potentially due to the market now being cleansed of overleveraged traders.

A tweet from Tesla CEO Elon Musk further criticizing its energy consumption on Thursday had likewise failed to cause the same shock as the first last week.

"Bitcoin hashing (aka mining) energy usage is starting to exceed that of medium-sized countries. Almost impossible for small hashers to succeed without those massive economies of scale," he had claimed.

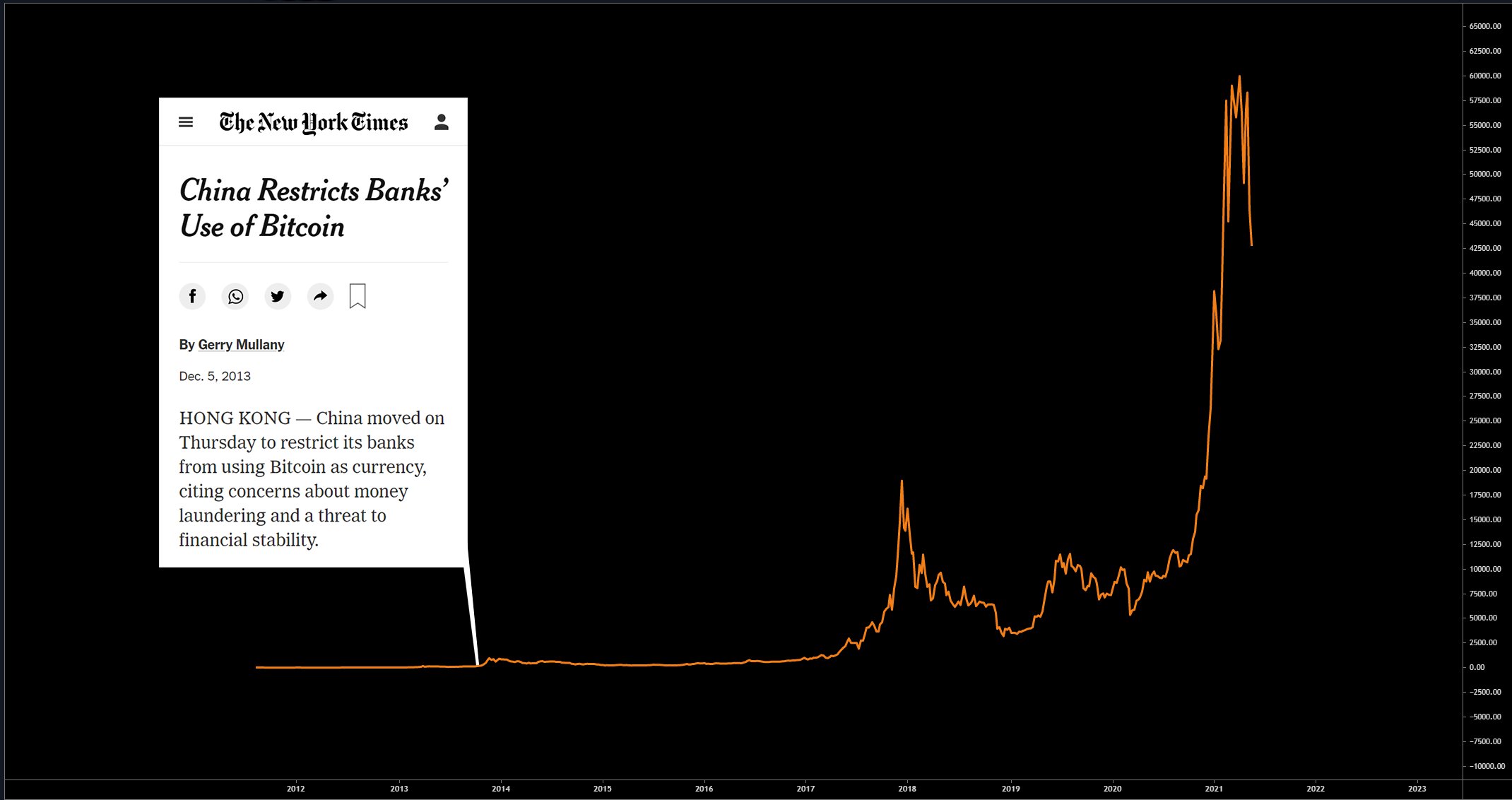

BTC/USD chart with Chinese press activity highlighted. Source: Documenting Bitcoin/ Twitter

Meanwhile, popular Twitter account Documenting Bitcoin became the latest to highlight the uncanny bullish consequences of Chinese "FUD" surrounding Bitcoin. BTC/USD tends to see its biggest gains in the period following a round of doomsday noises from Beijing.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.