- Bitcoin price seemingly took a major hit on Monday, falling to $40,000 at one point before recovering to $42,000.

- According to the Coinbase Premium Gap (CPG) plunge, the crash was caused by the intervention of whales.

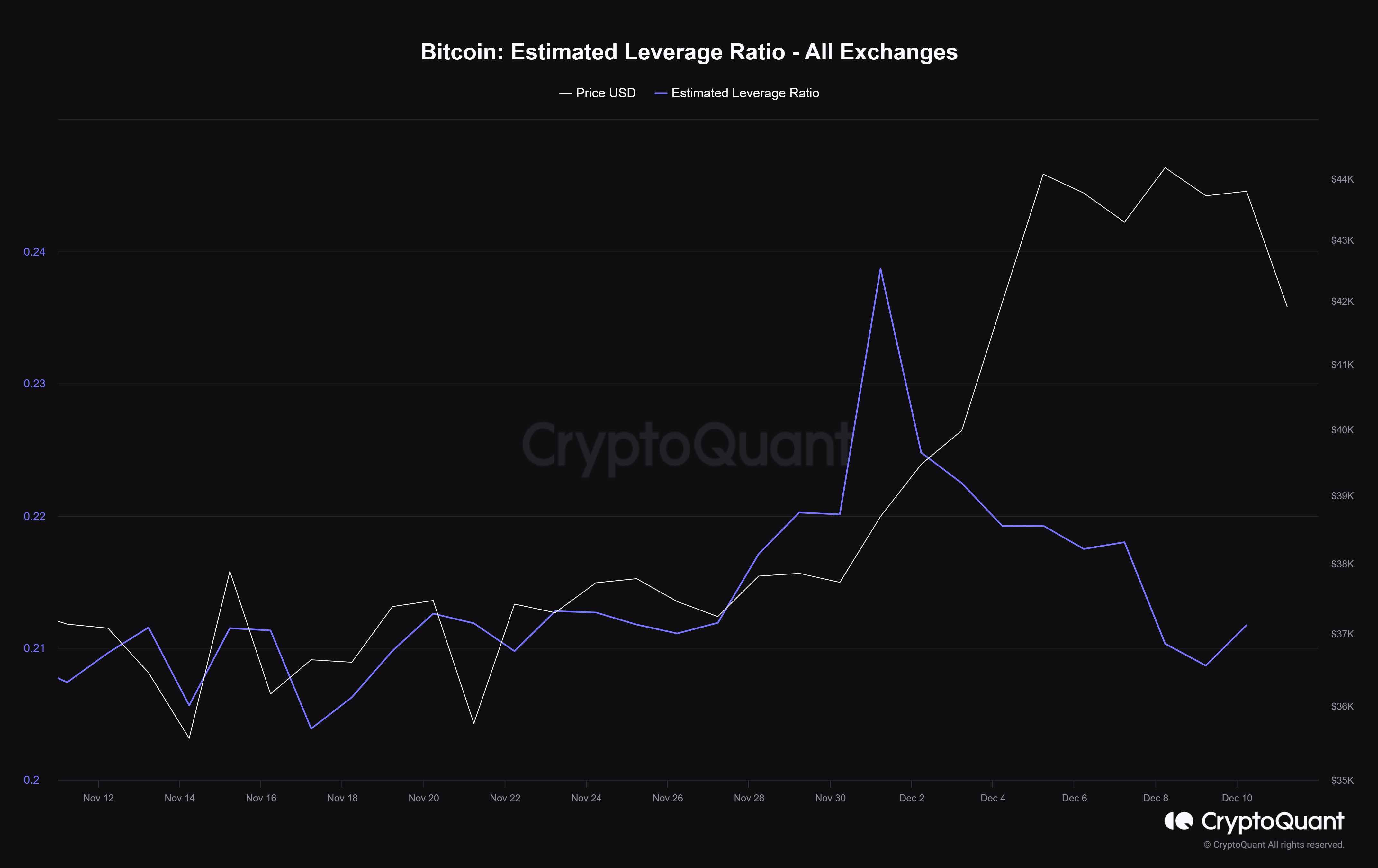

- Since the beginning of December, investors have avoided taking high-leverage risk in the derivatives trade.

Bitcoin price is seeing the highest decline it has in almost a month. The market was expecting a bullish continuation until the Securities & Exchange Commission (SEC) approves a spot BTC ETF in January 2024. However, the sudden drop in the market surprised investors on Monday, which resulted in the breakdown of this optimism, also known as “panic”, caused by whale selling.

Daily Digest Market Movers: Bitcoin whales crash the market

Bitcoin price nearly fell below $40,000 over the past 24 hours and liquidated over $340 million worth of long contracts in the span of mere minutes. While the definite reason behind this crash is uncertain, the most plausible reason is whale selling.

This is evidenced by the Coinbase Premium Gap (CPG) noting the premium falling to -250. The CPG, put simply, is an indicator that tracks the difference between the Bitcoin price listed on Coinbase (USD pair) and Binance (USDT pair). This provides an idea of whether US dominant investors (Coinbase) or global users (Binance) are buying or selling more than the other.

Premium of CPG(Coinbase Premium Gap) 250 Occurred chart https://t.co/FBzSNVkW1j

— mignolet (@mignoletkr) December 11, 2023

via @cryptoquant_com @CryptoQuant_KR

Whenever this premium gap is positive, the US investors are considered to be driving the buying, whereas a negative value points at global users, creating buying pressure.

However, as the indicator plummeted on Monday, it suggested that there has been an intervention by whales. This was further verified by the decline in Binance's exchange reserves, which noted the selling of about 16,000 BTC worth over $671 million that had been accumulated in the past week.

This sell-off caused panic among users, resulting in a crash of 7% during the intra-day trading hours, which saw BTC fall to $40,654 at its lowest. The cryptocurrency has since recovered, trading at $41,839 at the time of writing.

Since December began, traders have been refraining from taking high-leverage risk in the derivatives market. This is evidenced by the dip in the leverage ratio. Monday’s crash is likely going to further this skepticism and keep traders from making large bets until January.

Estimated leveraged ratio

Technical Analysis: Bitcoin price to stabilize around $42,000

Bitcoin price recovered slightly in the last couple of hours to rise back to $42,000. This price is a crucial technical and psychological support level that BTC could hover around for the next couple of hourly trading sessions.

As observed in the chart below, the cryptocurrency was bound to observe some correction, given the bearish divergence noted last week. The divergence caused by Bitcoin price charting higher highs and the Relative Strength Index (RSI) posting lower highs tends to foreshadow a decline, which is what has happened in the last two days.

Going forward, if BTC fails to sustain above $42,000, it might witness a retest of $40,000, which could send it toward $38,000.

BTC/USD 1-day chart

But if bulls attempt to take the control back and investors buy BTC at the slightly lower price, Bitcoin price could recover. Breaching $43,000 would invalidate the bearish thesis and set the crypto asset back on track to trade at $44,000.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rate affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.