- Cryptocurrency trading volume ascends to highest levels since April 2018 as cryptocurrencies recover slightly.

- Bitcoin path of least resistance is downwards as the bears regain control.

The cryptocurrency market is slowly retracing downwards in the wake of the gains that have dominated in the last three days. Bitcoin, for example, is trending 1.22% lower on Thursday. Besides, it has slipped below $3,900. All of the top twenty cryptocurrencies are bleeding with losses between 1.22% and 6%. In fact, it appears that the bears are back to revenge after the bulls greatly outperformed them.

According to the data on CoinMarketCap, Bitcoin trading volume is trending lower after hitting 2019 high at $9.9 billion. In the last 24 hours, the volume has decreased to $8.7 billion. Similarly, the market cap, which stepped above $70 billion yesterday is standing at $69 billion at press time.

However, the total trading volume on the market hit highs around $33.7 billion on Monday this week. This was the highest level the volume has reached since the bull rally in April 2018 where the market achieved a trading volume of $40 billion. Currently, the trading volume has retraced below $30 billion to $29 billion.

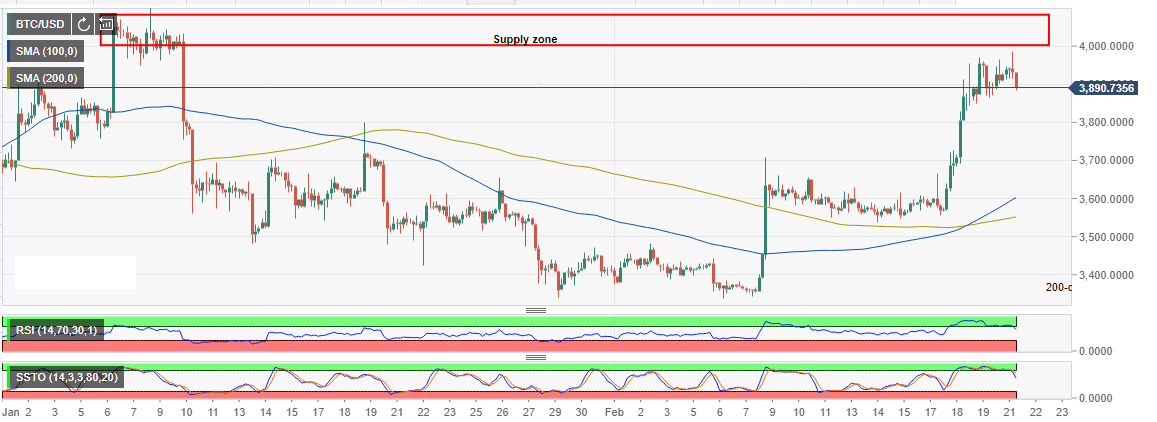

Bitcoin price almost brushed shoulders with $4,000 but formed highs around $3,987.33 before starting to correct lower. It is trading at $3,897.59 at the time of writing. Moreover, there is a growing bearing trend that if not checked, it could lead to further breakdown towards $3,800 (next support). The 50-day Simple Moving Average (SMA) in above the longer term 100-day SMA to show that the bulls still have some influence on the price in spite of the recoil. However, other indicators like the Relative Strength Index (RSI) and the stochastic are pointing to the south to show that the bears have more control. Therefore, the path of least resistance is downwards.

More:

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

ALT, WLD, ENA, ID set for $200 million token unlocks next week

The circulating supply of ALT, WLD and ID will see a hike next week, with over $200 million unlocks in sight. All tokens involved in upcoming unlocks are up in the past 24 hours. ALT will see the highest unlock share, with $115 million worth of new tokens entering circulation.

Why these altcoins may not rise despite Ethereum ETF impact

Altcoins market cap against Ethereum has been on a multi-year decline. Ethereum has outperformed several altcoins despite wider market assumptions that they provide leveraged exposure to its price. 2x long ETH could yield better results than purchasing altcoins ahead of the Ethereum ETF launch, said analyst.

Institutions anticipate potential Tuesday Ethereum ETF launch after making strategic moves

Grayscale lowered its Ethereum Mini Trust fees to 0.15% in a bid to reduce potential outflows from ETHE when ETH ETFs go live. Galaxy Digital increased its staked Ethereum assets to $3.3 billion after acquiring CryptoManufaktur, reveals CoinDesk.

Binance to begin investing customer fiat funds in US Treasuries

Binance received court approval on Friday, allowing it to invest certain customers' fiat funds in US Treasury bills. Following the announcement, the BNB token saw a 5% rise as crypto community members debated the potential impact of this approval on Ethena's USDe token.

Bitcoin: Will BTC continue its bullish momentum?

Bitcoin (BTC) price increased by 5.5% this week until Friday after breaking above a descending trendline. Currently, it is trading slightly higher by 0.23% at $64,166.