- Dollar devaluation brings attention to BTC as a store of value.

- Regulatory attention paves the way to Bitcoin's mass adoption.

- Technical correction may push BTC to $11,000 before the growth is resumed.

Bitcoin (BTC) jumped above $11,000 at the end of the previous week and stopped within a whisker of a local resistance created by $11,500. At the time of writing, BTC/USD is changing hands at $11,350, mostly unchanged both on a day-to-day basis and since the beginning of Monday. The pioneer digital currency gained over 6% in the last seven days. However, it is still below the 2020 high.

Bitcoin's market capitalization has increased to $2210 billion, 58.4% from the total value of all digital assets in circulation.

A sustainable move above $11,000 has improved BTC perspectives and offered hope that the coin is ready to realize its bullish potential. From the fundamental point of view, at least three factors imply that the flagship cryptocurrency is well-positioned for a further trip to the North.

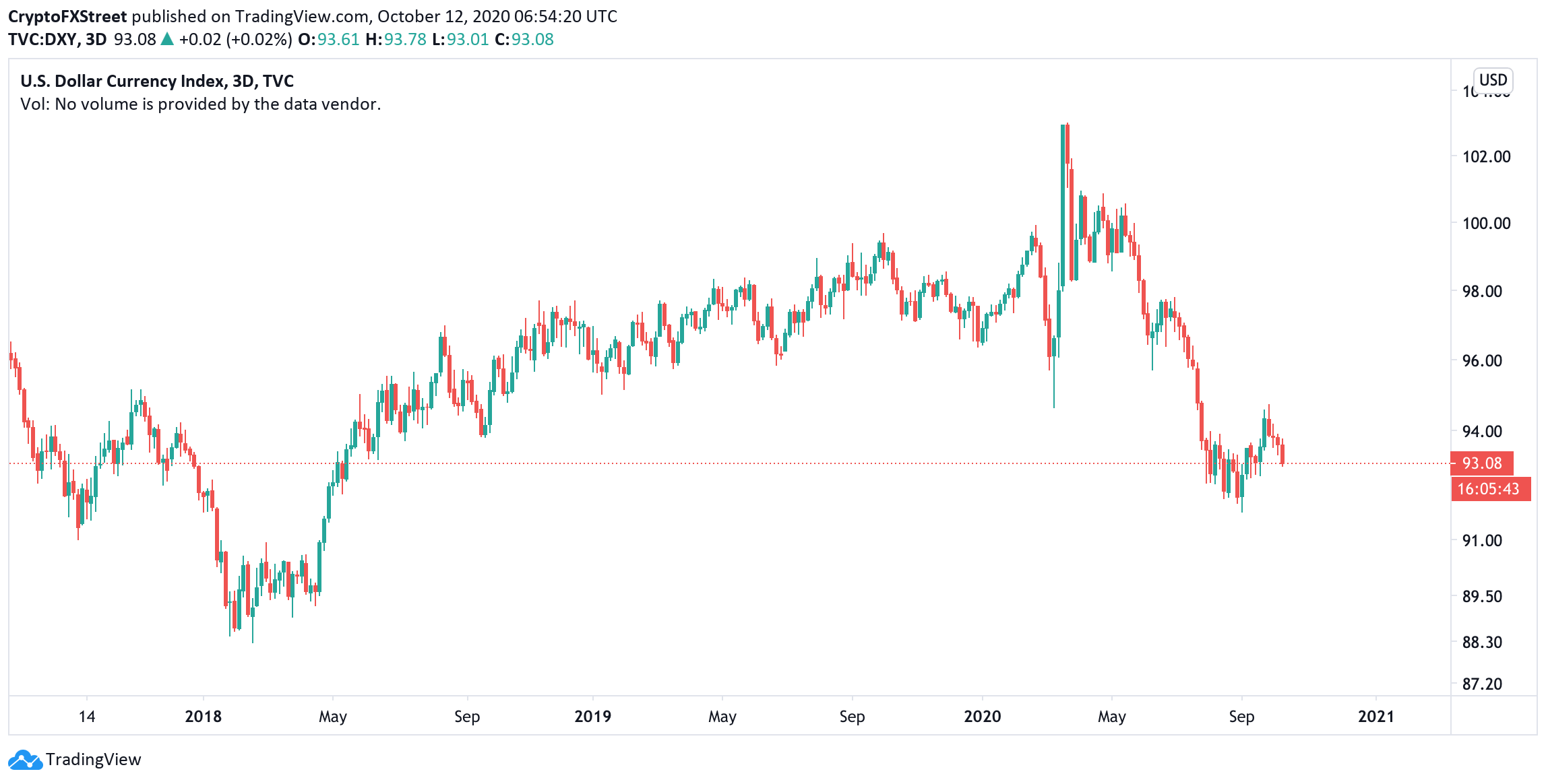

1. U.S. Dollar is losing ground

The U.S. currency used to be the vital financial safe-haven in times of market and geopolitical turbulence. However, times change slowly but surely. Overaccomodative monetary policy and the FED's attempts to print its way out of the economic crisis have been eroding people's confidence in the U.S. Dollar as a reserve currency.

Dollar Index hit the recovery high at 94.11 on September 24 and resumed the decline. At the time of writing, DXY sits at 93.00. Once this psychological barrier is out of the way, the index may retest the low of 91.75 reached on September 1, which is also the lowest level since April 2018.

DXY chart

According to Goldman Strategists, the U.S. Dollar will continue moving down on the expectations of Joe Biden winning the U.S. election.

The risks are skewed toward dollar weakness, and we see relatively low odds of the most dollar-positive outcome -- a win by Mr. Trump combined with a meaningful vaccine delay, they wrote in a note Friday.

The massive dollar devaluation comes hand in hand with the inflation threat and brings Bitcoin (BTC) to the fore as a store of value and a hedge against inflation. A limited supply brings BTC on par with gold as a store of value, while its decentralized nature protects it from manipulations and abuse.

2. Regulatory clarity is a welcome thing

The regulatory clean-up launched by the authorities worldwide is actually a good thing for the industry as it makes it more mature and suitable for mass adoption.

The vast majority of cryptocurrency experts accept this truth and emphasize that the restrictions are necessary in the long run. They help reduce fraudulent activity within the space and protect the customers. Moreover, the market reaction to the news confirms the idea that the regulators are no longer regarded as an evil force.

According to the report published by Fundstrat Global Advisors LLC, this trend will harm individual companies and people, but Bitcoin's trend will stay unaffected.

Actions unsurprisingly indicate U.S. and global regulators are committed to stomping out an illicit activity, securities violations, money laundering, price manipulation, and noncompliance with banking regulations. On balance, we view recent news as a positive for crypto markets, despite select smaller pockets of risk, and we believe the prevailing bull market trend is intact.

3. BitMEX woes passed unnoticed

The regulatory scandal around the trading platform for cryptocurrency derivatives is dying out. Vivien Khoo, a new Interim CEO, has ties with CME and other regulatory structures worldwide. Arthur Hayes and Samuel Reed resigned from their top positions, while the latter was released on bail right after the resignation.

While the development is bad for BitMEX founders as they are effectively kicked out of business, the cryptocurrency market will benefit as the exchange will stay afloat and continue business as usual.

Basically, this is just another example of how the industry integrates with the existing regulatory and legal frameworks.

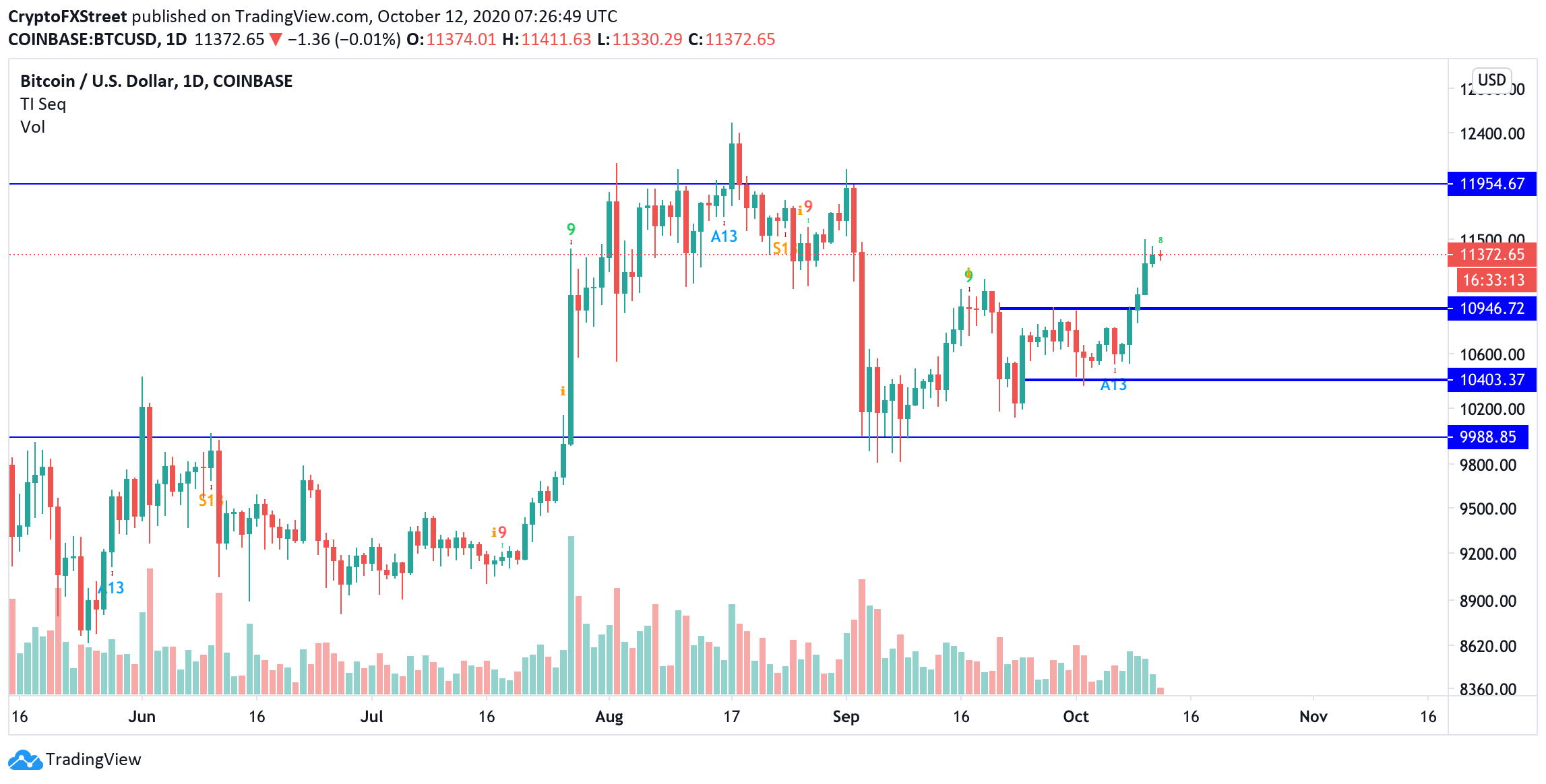

BTC/USD: The technical picture

Meanwhile, the technical picture may be a bit less optimistic, at least in the short run. T.D. Sequential indicator hints that the price may be ready for a downside correction both on 12=hour and daily chart, while a failure to close above $11,500 within the nearest sessions will signal that the bullish momentum is fading away.

BTC/USD daily chart

If the signal is confirmed, the price may retreat to $11,00o that served as a strong resistance since the beginning of October. This area is likely to slow down the sell-off and trigger a new recovery wave.

On the other hand, a sustainable move above $11,500 will confirm that the bullish trend has resumed and push the price towards the initial target of $12,000.

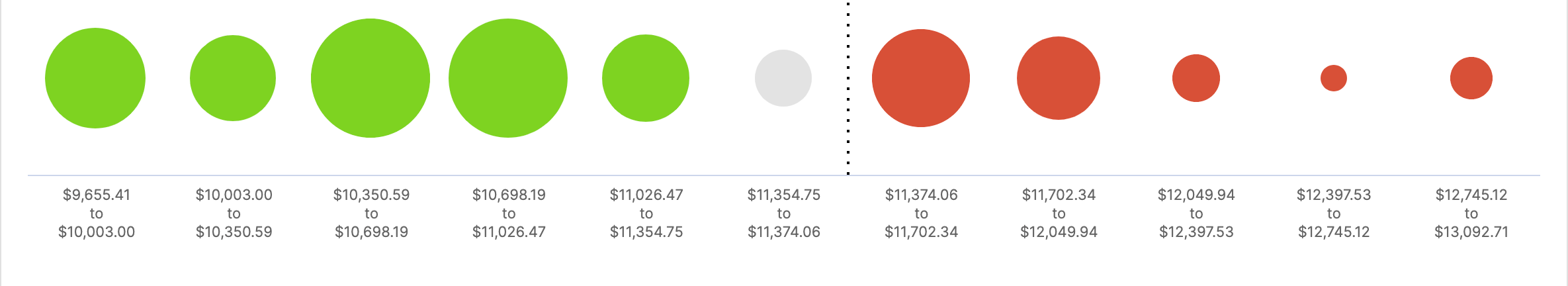

The on-chain data confirms that there is a strong barrier located at $11,000. Over 1.5 million addresses containing 1 million BTC are likely to protect their breakeven and absorb the downside pressure. If it is broken, the sell-off may continue towards $10,400.

Bitcoin's IOMP data

Source: Intotheblock

On the upside, we have 1 million addresses with over 600,000 BTC sitting around the above-mentioned resistance of $11,500 with very little in terms of resistance above this level.

To conclude: the fundamental environment is positive for Bitcoin's growth; however, the coin may retreat to $11,000 before the growth is resumed. From the technical point of view, the upside is considered as a path of least resistance. A sustainable move above $11,500 will confirm the bullish trend.

On the other hand, strong support comes at $11,000. The move below this area will negate the immediate bullish scenario and push the price towards $10,400.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

XRP chart signals 27% jump after SEC-Ripple appeals pause and $50 million settlement

Ripple (XRP) stabilized above $2.00 exemplifying a similar pattern to the largest cryptocurrency by market capitalization, Bitcoin (BTC), which holds firmly above $84,000 at the time of writing on Thursday.

Bitwise lists four crypto ETPs on London Stock Exchange

Bitwise announced on Wednesday that it had listed four of its Germany-issued crypto Exchange-Traded products (ETPs) on the London Stock Exchange. It aims to expand access to its products for Bitcoin (BTC) and Ethereum (ETH) investors and widen its footprint across European markets.

RAY sees double-digit gains as Raydium unveils new Pumpfun competitor

RAY surged 10% on Wednesday as Raydium revealed its new meme coin launchpad, LaunchLab, a potential competitor to Pump.fun — which also recently unveiled its decentralized exchange (DEX) PumpSwap.

Ethereum Price Forecast: ETH face value- accrual risks due to data availability roadmap

Ethereum (ETH) declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.