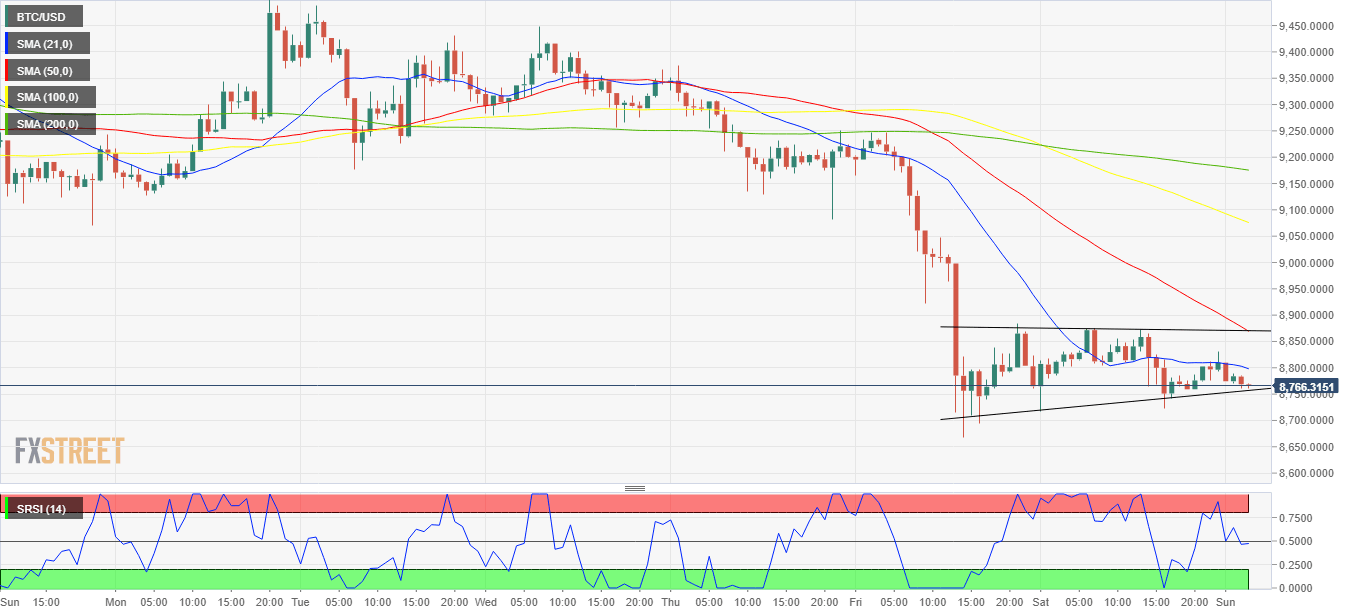

Bitcoin price analysis: Teasing ascending triangle breakdown, eyes on $ 8,600

- Bitcoin targets two-week lows of 8,668, as technical set up turns bearish

- Ascending triangle pattern on hourly sticks points to further downside.

Bitcoin (BTC/USD), the most dominant cryptocurrency, reverses Saturday’s dead cat bounce from two-week lows of 8,668.60 as the sellers return in early Sunday trading. The recent profit-taking rally in the coin lost legs, as the technical charts painted a bearish picture amid a generalized downbeat tone seen across the crypto space so far this Sunday. At the time of writing, the No. 1 coin holds the lower ground near 8,750 region, down over 0.50% on the day while its market capitalization decreased slightly from $ 160.12 billion to $ 159.13 billion.

Technically, the spot extends its range play in a potential ascending triangle formation, now teasing the pattern breakdown, as it flirts with the rising trendline (pattern) support at 8,758. The selling pressure will intensify on the breakdown, opening floors towards a retest of the two-week lows reached last Friday. A failure to resist the last, the bears will target the next support at 8,600 (round number), below which the pattern target near 8,575 will come into play. The downside appears more compelling, as the price trades below all the key hourly Simple Moving Averages (HMA). Meanwhile, the hourly Relative Strength Index (RSI) has turned flat just below the midline, backing the bearish bias.

Should the coin manage to recover above the 21-HMA at 8,797, the bulls may attempt another run towards the 8,870 level, the confluence of the bearish 50-HMA and horizontal trendline (pattern) resistance.

All in all, the risks remain to the downside, as the weekend love appears to fade.

BTC/USD 1-hour chart

BTC/USD Levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.