- Bitcoin recovery from the recent dip to $9,250 stalls under $9,500.

- BTC/USD is relatively in the hands of the bulls who lack enough momentum to sustain gains above $9,500.

Bitcoin buyers have been reduced to defenders after another rejection from $10,000. Initially, they defended the support between $9,500 and $9,600 but the strong arm of the bears caught up with them, resulting in losses towards $9,000. The region at $9,250 is now being defended as the key support area. On the upside, recovery has been capped under $9,500. There was a break above $9,500 but buyers lost steam at $9,567 during the Asian session.

At the time of writing, Bitcoin is trading at $9,466, which is a 0.46% loss from the opening value at $9,512. BTC/USD bulls are not giving up the fight to $10,000 in spite of the stronger bearish grip. The main goal is to sustain gains above $9,500 and step above the resistance at $9,600. This way, other buyers watching from the sidelines can join the market and aid in pushing the price to $10,000.

From a technical perspective, it is true to say that bulls are relatively in control. Although, we cannot forget the fact that they lack the momentum to sustain the gains. For example, the RSI is horizontal at 60 to show that there is enough energy to hold Bitcoin above $9,520 if not $9,400. Moreover, the MACD is comfortable seating in the positive region, further emphasizing the influence bulls have on the price.

BTC/USD daily chart

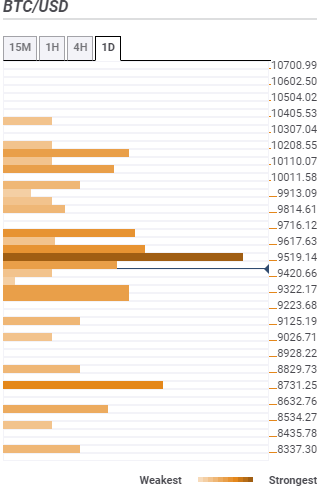

Bitcoin confluence resistance and support areas

Resistance one: $9,519 – Is the region that hosts the previous high one-hour, SMA 200 1-hour, and the Bollinger Band 1-hour middle.

Resistance two: $9,617 – Highlighted by the SMA 100 15-minutes and the SMA five one-day.

Resistance three: $9,716 – Where the Fibonacci 61.8% one-day, SMA 200 15-minutes, and the Bollinger Band 4-hour middle curve meet.

Support one: $9,420 – A weak support area highlighted by only the SMA ten one-day.

Support two: $9,322 – A medium-strong support area home to the Bollinger band one-day Middle, the previous low one-day, and SMA 100 4-hour.

Support three: $8,731- A support areas hosting the Fibonacci 23.6% one-month and the pivot point daily support three.

Bitcoin intraday levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH ETFs total net assets plummet over 60%; Justin Sun says he won't sell ETH

Ethereum traded just below $1,600 on Thursday following a 60% plunge in the total net assets of US spot Ether ETFs.

Binance Coin price nears $600 breakout as CZ reacts to BNB listing on Kraken

Binance Coin price posted considerable gains on Thursday, fuelled by investor optimism tied to its upcoming listing on the U.S.-based crypto exchange Kraken.

Binance CEO affirms company's involvement in advising countries on Bitcoin Reserve

Binance CEO Richard Teng shared in a report on Thursday that the cryptocurrency exchange has advised different governments on crypto regulations and the need to create a strategic Bitcoin reserve.

Slovenia moves to impose 25% tax on crypto traders

Slovenia has become the latest European Union member state to crack down on untaxed crypto gains, unveiling a proposal to impose a 25% tax on personal profits from digital asset disposals starting in 2026.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637256452655414486.png)