- Bitcoin clings to recent recovery gains above the 7300 level.

- The coin looks vulnerable amid not so favorable technical set up.

- 200-HMA at 7,234 could cap losses if the sellers return.

The bulls appear exhausted in Saturday’s trading so far, as the recovery from two-week lows in Bitcoin (BTC/USD), the most favorite cryptocurrency, loses momentum on the 7,300 handle. At the time of writing, the spot trades near 7,345, gaining 1.30% over the last 24 hours while up nearly 0.50% on a weekly basis. Its market capitalization stands at $ 133.73 billion or 68.20% of the total market value.

Markets turn cautious and fail to buy into Friday’s recovery, as they see it as dead cat bounce amid bearish intraday technical set up while holiday-thinned volumes continue to persist.

Technical Overview

BTC/USD 1-hour chart

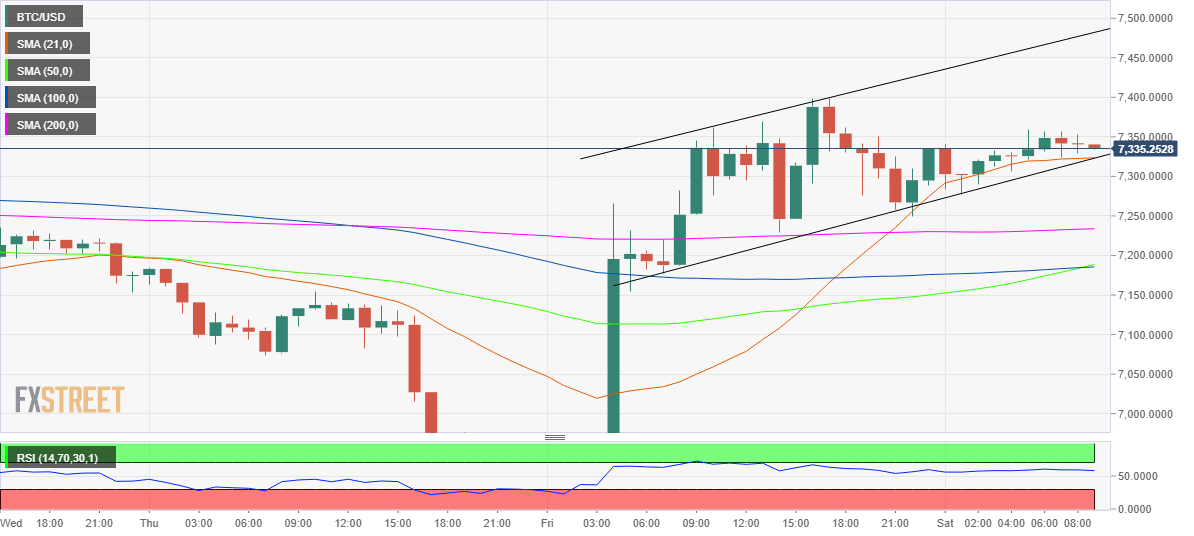

Having witnessed a solid comeback from near 6,855 levels on Friday, the BTC bulls are unable to extend the bullish momentum, leaving the coin listless in a tight range that portrays a rising channel formation. The natural tendency of the pattern is to the downside. Therefore, a break below the 7,323 level, the confluence of the 21- hourly Simple Moving Averages (HMA) and channel trendline support, will confirm a breakdown and bring back the 200-HMA horizontal support at 7,234 on the sellers’ radar.

The downslide will accelerate below the last, as the buyers seek the next strong support near the 7,185 region for their rescue. At the level, the horizontal 100-HMA and bullish 50-HMA coincide.

Alternatively, a bounce-back towards the 7,400 handle cannot be ruled out If the coin manages to defend the above-mentioned rising trendline (pattern) support. On a recovery above 7,400, the bulls could likely run into the next upside hurdle aligned at 7,482, the pattern resistance. For now, the hourly Relative Strength Index (RSI) trades flat but above the mid-line, suggesting that the sellers are likely to have a hard time fuelling a downside break. Therefore, Saturday’s daily closing remains pivotal to gauge the near-term direction in the No.1 coin.

BTC/USD key levels to watch

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Grayscale files S-3 form for Digital Large Cap ETF comprising Bitcoin, Ethereum, XRP, Solana, and Cardano

Grayscale, a leading digital asset manager operating the GBTC ETF, has filed the S-3 form with the United States (US) Securities and Exchange Commission (SEC) in favor of a Digital Large Cap ETF.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, and XRP brace for volatility amid Trump’s ‘Liberation Day’

Bitcoin price faces a slight rejection around its $85,000 resistance level on Wednesday after recovering 3.16% the previous day. Ripple follows BTC as it falls below its critical level, indicating weakness and a correction on the horizon.

Top crypto news: VanEck hints at BNB ETF, Circle files S-1 application for IPO

Asset manager VanEck registered a BNB Trust in Delaware on Tuesday, marking its intention to register for an ETF product with the Securities & Exchange Commission (SEC).

Solana Price Forecast for April 2025: SOL traders risk $120 reversal as FTX begins $800M repayments on May 30

Solana price consolidated below $130 on Tuesday, facing mounting headwinds in April as investors grow wary of looming FTX sell-offs.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.