Bitcoin Price Analysis: BTC/USD toughest hurdles lie at $6,703 and $6,816 – Confluence Detector

- Bitcoin price bulls are focused on closing the week above $7,000 but can they deal with the resistance at $6,703 and $6,816?

- The zone between $6,500-$6,600 comes out the strongest buyer congestion zone amid increasing selling activities.

The cryptocurrency market space is starting to turn bullish in the course of the European session after the bears dominated the Asian session. The drab action follows a recovery from the week’s low at $6,466 (also intraday low). The fall to this level occurred after buyers failed to sustain gains above $6,900 let alone break the critical resistance at $7,000.

At the time of writing, Bitcoin price is trading at $6,676 after adjusting upwards from the opening value of $6,621. The prevailing trend is bullish but the low volatility means that investors should not anticipate rapid price movements to the north.

Looking at the 1-hour chart, Bitcoin has tested the region between $6,500 and $6,500 twice in this week. In other words, this is Bitcoin’s current key support area and a possible buy zone in anticipation for gains towards $7,000. A break above $76,700 could easily allow extended bullish action targeting $7,000. However, buyers must be ready to battle several resistance levels at the descending trendline, the 50 SMA and the 100 SMA.

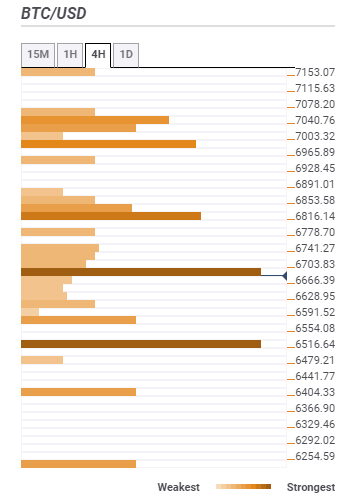

Bitcoin confluence key resistance and support levels

Resistance one: $6,703 – This is the strongest resistance according to the confluence detector. The zone is highlighted by the Bollinger Band 15-minutes upper curve, the SMA 50 15-mins, the previous high 4-hour and the 23.6% Fibo level one-day among others.

Resistance two: $6,816 – Is the second resistance zone and home to the SMA ten 4-hour, the BB 4-hour middle curve, the SMA 200 15-mins, and the Fibo 61.8% one-day.

Resistance three: $7,003 – A break above $7,000 must be strong enough to rise above this zone to ensure that a reversal is kept at bay. Calling this zone home is the SMA 200 1-hour. SMA 50 4-hour and the 61.8% one-week.

Support one: $6,591 – Bitcoin initial support as highlighted by the BB 1-hour lower curve.

Support two: $6,516 – This is the strongest support zone as shown by the pivot point one-day support two.

Support three: $6,404 – Hosts the pivot point one-day support two and the SMA 200 4-hour.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren