Bitcoin Price Analysis: BTC/USD stages a quick bounce above $50,000 after the 11% sell-off

The wild ride in Bitcoin continues in Tuesday’s Asian trading, as the BTC sellers are back in control, knocking off prices by almost 11%.

Although, strong bids emerged just above $48,500 levels, prompting the flagship cryptocurrency to stage a quick recovery back beyond the $50,000 mark.

The volatility around the most favorite digital remains elevated, as markets rethink the recent record rally, in the wake of the cautious comments from US Treasury Secretary Janet Yellen, Tesla’s founder Elon Musk and Microsoft co-founder Bill Gates.

Billionaire Elon Musk tweeted last Saturday that its value ‘seems high’ last Saturday. Meanwhile, Yellen said that the granddaddy of cryptocurrencies is extremely inefficient for conducting transactions. Her comments triggered Monday’s 17% flash crash from near-record highs reached at $58,367 on Sunday, as the rates fell as low as $47,821.

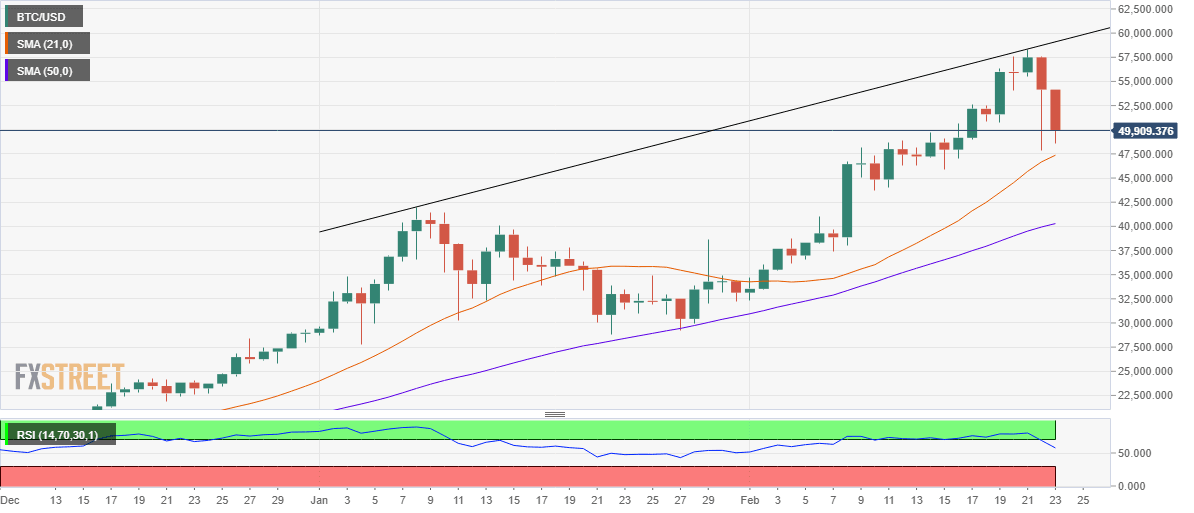

Bitcoin holds above the critical 21-DMA support

Despite the renewed sell-off, the BTC bulls have managed to defend the critical support of the bullish 21-daily moving average (DMA) at $47,336. Should the latter cave in, Bitcoin could see a fresh decline towards the 50-DMA at $40,287.

BTC/USD: Daily chart

On the flipside, the record highs could be back on the buyers’ radars, if they manage to find a foothold above the $50K mark. The critical barrier awaits at the rising trendline resistance of $59,098.

The 14-day Relative Strength Index (RSI) has turned south but holds above the midline, keeping doors open towards the all-time-highs.

BTC/USD additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.