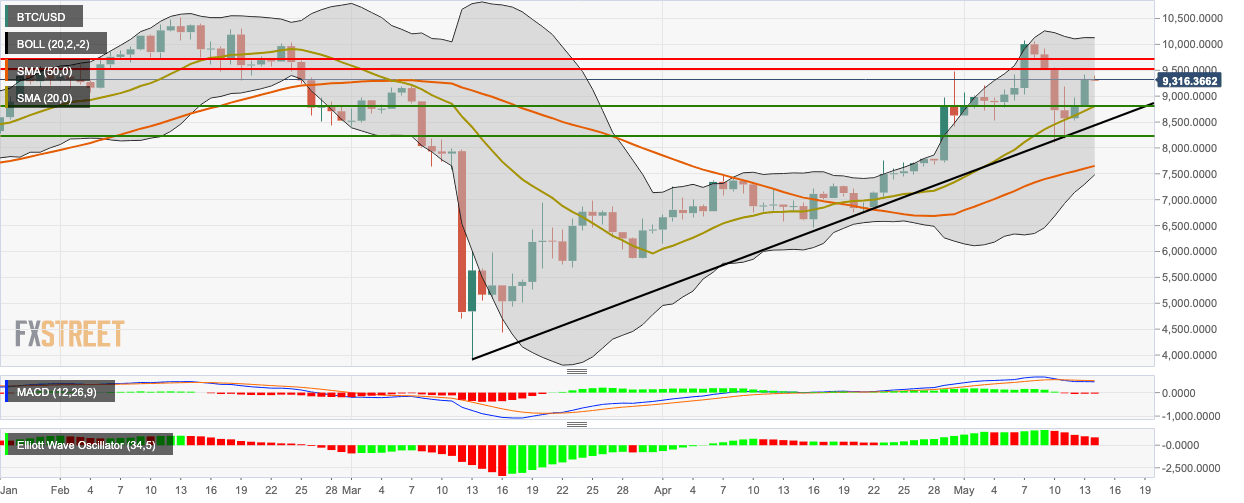

Bitcoin Price Analysis: BTC/USD runs out of steam as it nears the $9,500 level

- BTC/USD recovery begin to falter ahead of key resistance level.

- The Elliott Oscillator has had five straight red sessions.

- The 20-day Bollinger jaw has narrowed, which indicates decreasing price volatility.

BTC/USD daily chart

BTC/USD dropped a bit from $9,320 to $9,303 following a hugely bullish Wednesday. The Elliott Oscillator has had five straight red sessions, while the MACD shows sustained bearish momentum. The 20-day Bollinger jaw has narrowed, which indicates decreasing price volatility.

The price faces two resistance levels on the upside at $9,500 and $9,735. On the downside, there are two healthy support levels at $8,815.35 and $8,214.40.

Key levels

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.