Bitcoin Price Analysis: BTC/USD may retest $9,500 during US trading hours – Confluence Detector

- Bitcoin settled above $9,000, however, the critical $9,500 remains intact.

- The technical picture implies that the upside momentum may gain traction.

Bitcoin price managed to hit highs of $9,398 on Wednesday before retreating to $9,250 by press time. The level at $9,000 remains the pivotal support for the first digital coin. If it is broken, the sell-off may continue towards the intraday lows of $8,922. The American session is likely to remain bullish as volatility stays high. Other major cryptocurrencies such as Ripple and Ethereum are also on the rise. The coins have gained 1.9% and 2.0% respectively.

The daily chart shows the RSI looking upwards above 70 (overbought zone). It means that the coin has the potential to move towards $9,500.

BTC/USD daily chart

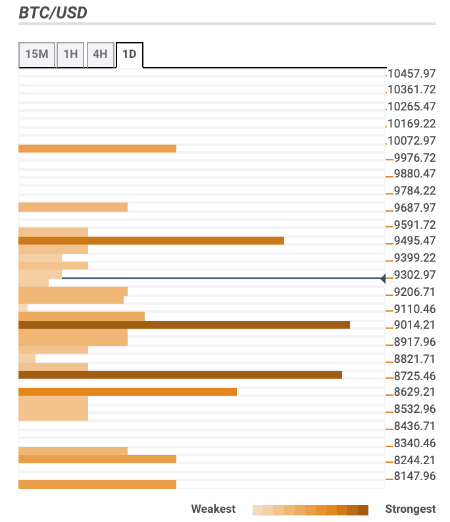

Let’s have a closer look at support and resistance levels clustered around the current price.

Resistance levels

$9,500 – the highest level of the previous week and the highest level of the previous month

$9,700 – Pivot point 1 week Resistance 1

$10,000 – Pivot point 1 month Resistance 1

Support levels

$9,000 – 1-hour SMA100 and SMA50, daily SMA5, 15-min SMA200

$8,800 – 23.6% Fibo retracement monthly, 4-hour SMA50, 1-hour SMA200, 38.2% Fibo retracement weekly

$8,600 - the lower line of the 4-hour Bollinger Band, Pivot Point 1 day Support 2

BTC/USD, daily

Author

Tanya Abrosimova

Independent Analyst

-637243722872744161.png&w=1536&q=95)