- Bitcoin staged a mild recovery during early Asian hours.

- Satis Group's research expects to see BTC at $96,00o by 2023.

Bitcoin has moved towards $7,000 handle and shifted during early Asian hours. The digital coin No.1 has shifted to the positive territory having gained 0.26% since the beginning of Friday, though it is still in red on a daily basis. The coin is trapped in a narrow range amid nervous, indecisive trading.

To the moon by 2023

Meanwhile, the new report prepared by Satis Group engaged in Initial Coin Offering (ICO) advisory business, suggests that Bitcoin price may surge to $96,000 within five years, while total cryptocurrency market capitalization will reach $3.6T in 2028. As for the altcoins, the company forecasts substantial price growth for Monero (XMR) and Decred (DCR), while Bitcoin Cash and XRP are likely to lose value.

"Currency and Privacy networks will be the largest beneficiaries, as the most fundamental value will stem from a store of value use cases," the report says.

Bitcoin's technical picture

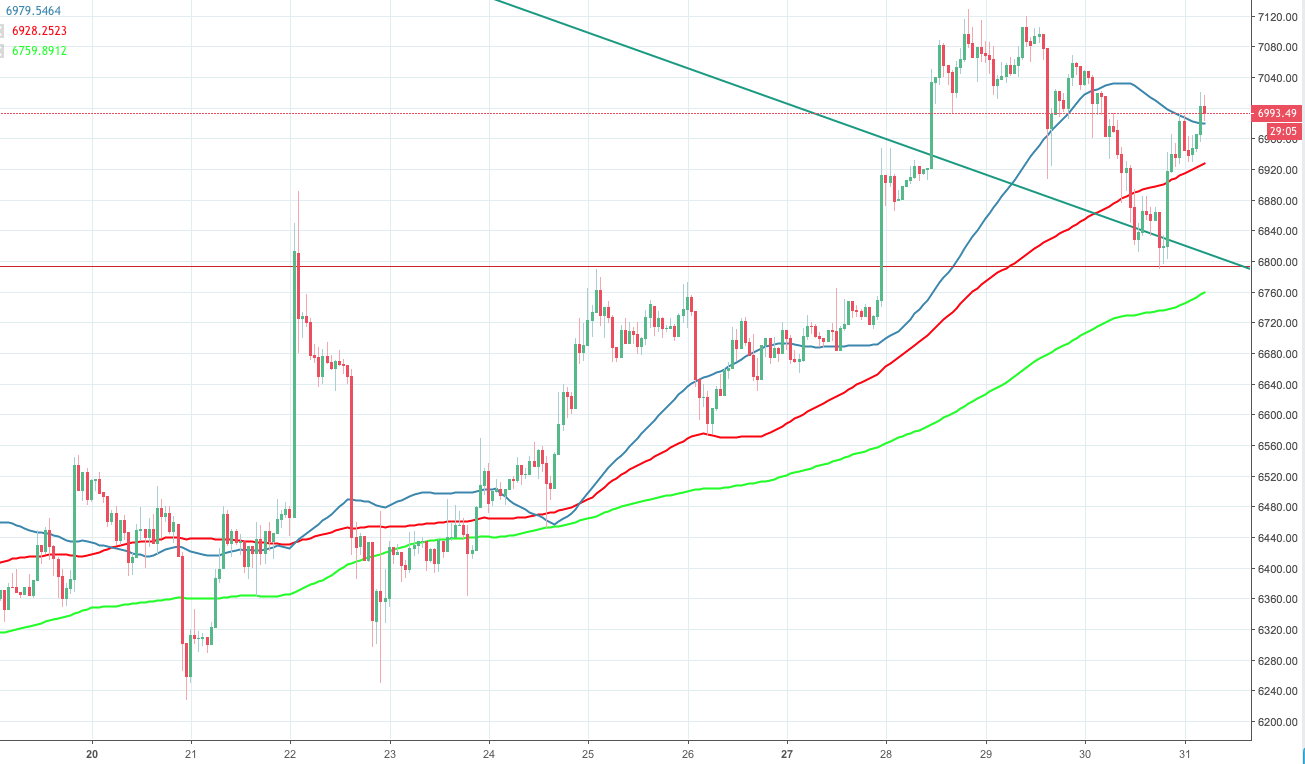

BTC/USD jumped above SMA50 (1-hour chart) currently at $6,979, but $7,000 is still to be taken out. The recent attempts to get above that level proved to be unsuccessful though the bullish momentum may grow when European players join the game. The ultimate short-term target is Tuesday's high at $7,128. On the downside, the first support is created by SMA100 (1-hour) at $6,928, followed by DMA100 at $6,900. A strong support area generated by a confluence of 23.6% Fibo retracement, Thursday's low and downside trendline is likely to limit the decline.

BTC/USD, 1-hour chart

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls target $100,000 BTC, $2,000 ETH, and $3 XRP

Bitcoin (BTC) is stabilizing around $95,000 at the time of writing on Wednesday, and a breakout suggests gains toward $100,000. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and hovered around their key levels.

Tether mints 3 billion USDT on Ethereum and TRON as markets stabilize

Tether ramps up its minting activity amid surging demand for stablecoins, often signaling heightened trading and liquidity needs. The issuer of the leading stablecoin by market capitalization has minted 2 billion USDT on Ethereum and an additional 1 billion USDT on the TRON network.

SEC delays decision on Franklin Templeton’s spot XRP ETF to June 2025

The Securities and Exchange Commission (SEC) has postponed its decision on Franklin Templeton’s spot XRP ETF, extending the review period to June 17, 2025. XRP traded at approximately $2.24 at press time, rising 7% over the past week, according to CoinGecko.

Trump Media announces new token launch and native crypto wallet in latest Shareholder letter

Trump Media unveils plans to launch a utility token and crypto wallet to monetize Truth Social and expand its streaming services. Markets react with a 10% drawdown on the Solana-hosted official TRUMP memecoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.