- India could be banning cryptocurrencies in the near future.

- Some experts still believe that Bitcoin will drop to $7,400 before reversing upwards again.

Bitcoin is opening the door for more declines after failing to hold ground above $10,800. As covered by FXStreet, the failure to push for a reversal above $10,800 on Monday would demoralize the bulls who would eventually want to create fresh demand for the world’s largest cryptocurrency at a lower level.

The trading has been leaning towards a sell-off since the opening session on Tuesday. The Asian trading hours saw Bitcoin plunge massively from highs around $10,326 to a low around $9,935 (hit during the European session).

As Bitcoin continues to seek support, the cryptocurrency space in India is fearing the worst after a committee formed by the government present a draft bill and a report recommending the banning of digital currencies. The CEO of Binance, Changpeng Zhao commenting on the proposed ban said that cryptocurrency does not depend on “any one country” to thrive.

“Cryptocurrency will survive regardless of any one country. Most countries that try to ban bitcoin cause their citizens to want cryptocurrency more,” Zhao said.

Bitcoin price technical picture

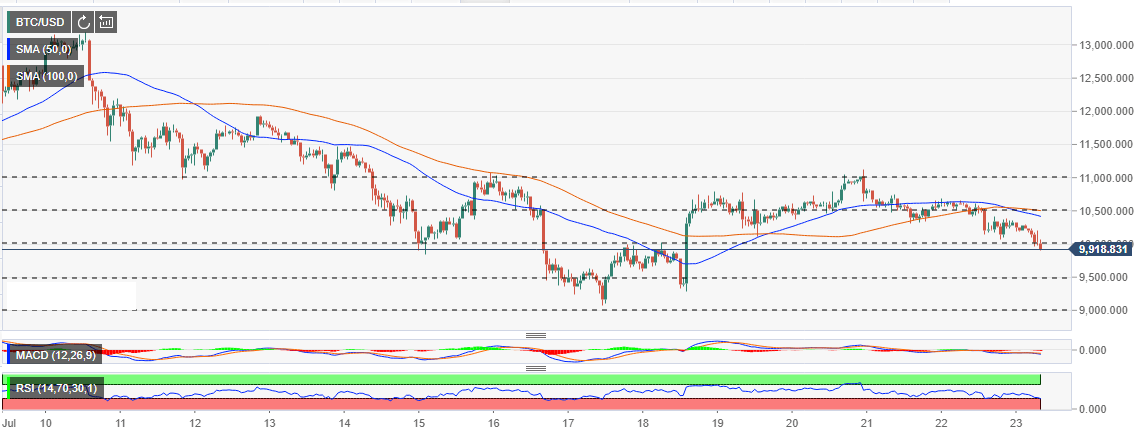

At press time, Bitcoin is trading at $9,935 amid a building bearish momentum. The potential for declines is massive as observed with the technical levels. The Relative Strength Index (RSI) digging deeper inside the overbought. The RSI has been unable to recover to levels above 70 after the drop on July 21.

The downward sloping trend shows prevailing bearish momentum is getting stronger. The next support target is at $9,500 with $9,000 remaining as the major support in the short-term. However, not that some experts still believe that Bitcoin will drop to $7,400 before reversing upwards again.

BTC/USD 1-h chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP show signs of short-term correction

Bitcoin price edges slightly down during the Asian session on Wednesday. Ethereum and Ripple followed BTC’s footsteps and declined slightly; all coins’ technical indicators and price action suggest a possible short-term correction on the cards.

Ripple investors book $1.5 billion in profits after RLUSD launch, XRP struggles near $2.58 resistance

Ripple is up 3% on Wednesday after witnessing significant profit-taking among its investors following the launch of the RLUSD stablecoin. Whales have soaked up the selling pressure from profit-takers as XRP struggles near the $2.58 resistance level.

Alleged anti-crypto Caroline Crenshaw denied renomination vote to serve as SEC Commissioner

The Senate Banking Committee had scheduled a vote for Wednesday regarding the reappointment of Securities and Exchange Commission Commissioner Caroline Crenshaw, but this vote was canceled on Tuesday.

Ethereum Price Forecast: RWA tokenization could boost ETH's price in 2025, Bitwise

Ethereum is down 3% on Tuesday following Bitwise predictions of increased RWA tokenization boosting appeal for the top altcoin. Meanwhile, large whales have continued accumulating ETH in the past month.

Bitcoin: BTC reclaims $100K mark

Bitcoin briefly dipped below $94,000 earlier this week but recovered strongly, stabilizing around the $100,000 mark by Friday. Despite these mixed sentiments this week, institutional demand remained strong, adding $1.72 billion until Thursday.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.