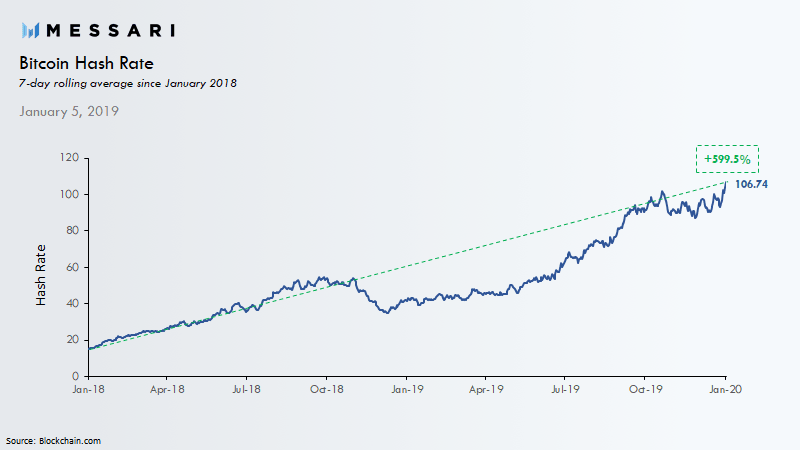

Bitcoin Price Analysis: BTC/USD closes in on $8k as mining hashrate hits 2020 all-time high

- Bitcoin hashrate growing significantly as miners increase activity in anticipation of the May 2020 halving.

- Bitcoin brushes shoulders with $8,000 amid revived interest geared towards breaking critical barriers in 2020.

Bitcoin is concentrating on breaking key barriers towards $8,000. The largest cryptocurrency spent most of December in consolidation between $7,000 and $7,500. The recent break above $7,800 seems to have revived the buyers’ interest in the digital asset. Besides, Bitcoin tested $8,000 resistance on Monday before retreating to the current $7,916.

The Bitcoin community is counting the months before the historic halving event takes place. The mining rewards halving occurs every four years due to code integrated in the blockchain by Satoshi Nakamoto. Miners' rewards per block will be slashed by half from 12.5 BTC to 6.25 BTC. The event is expected to bring with it increased demand amid scarcity of supply and high volatility.

Meanwhile, Bitcoin’s hash rate continues to surge before the May 2020 halving. The hashrate measured on a seven-day basis hit an all-time high of 106 EH/s. Bitcoin’s network hashrate recovery has been tremendous over the past year from 40 EH/s at the beginning of 2019.

Bitcoin price technical analysis

Bitcoin's prevailing trend is bullish and supported by the upward-pointing RSI. The indicator has recovery impressively from 2020 low at 28.57 to levels above 70. If the price continues to ignore the RSI’s oversold conditions, BTC could easily sail above $8,000.

As far as support is concerned, $7,500 is the key support likely to come in the bull's recue in the event of a reversal. The 50 SMA and the 100 SMA on the 4-hour chart are inline to offer support as well. In addition to that $7,000 and $6,500 will come in handy especially if Bitcoin bears swing in with a revenge mission.

BTC/USD 4-hour chart

-637139633268002137.png&w=1536&q=95)

-637139633268002137.png&w=1536&q=95)

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren