- “Our job is to rise above that, finding our own intrinsic source of motivation, to come in and do our best work,” writes Brian Armstrong.

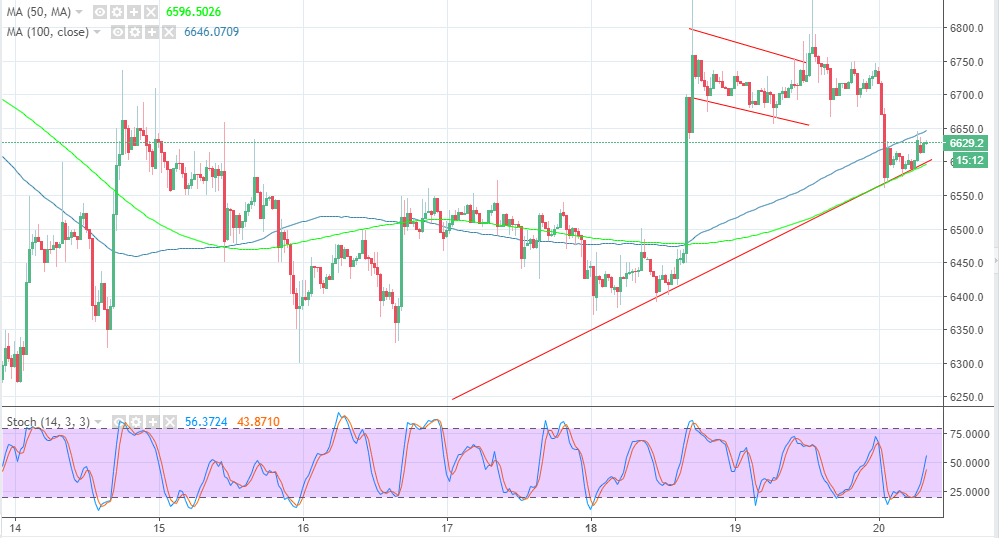

- Bitcoin price is currently trading between the support and resistance highlighted by the moving averages.

Bitcoin price broke below the bullish flag pattern I explored in yesterday’s price analysis. BTC/USD closed the session on Tuesday at $6,769.94 followed by a sharp descent during the Asian trading hours on Wednesday. The descent is likely a reaction to the hacking that took place on South Korea’s Bithumb exchange where hackers made away with at least $31 million in cryptos. The exchange has, however, said that they will compensate the customers for the lost funds.

In other news, the CEO of one of the oldest cryptocurrency exchanges, Coinbase has encouraged the employees not to worry about the falling Bitcoin price. Brian Armstrong told the staff that the down cycle was bound to come, however, he reassures them that this is the time to go above the hype brought by surging prices. He was also talking to the larger crypto community when he wrote on Twitter:

“After many years of this, I've come to enjoy the down cycles in crypto prices more. It gets rid of the people who are in it for the wrong reasons, and it gives us an opportunity to keep making progress while everyone else gets distracted.” Armstrong added in another tweet, “I want to encourage you all to ignore the price of crypto and the headlines which will inevitably start to come up. Our job is to rise above that, finding our own intrinsic source of motivation, to come in and do our best work, regardless of what other people think.”

Bitcoin price analysis

Bitcoin price is currently trading between the support and resistance highlighted by the moving averages. For instance, the 100 SMA is limiting gains slightly below $6,650 while the short-term 50 SMA is supporting the price slightly below $6,600. The largest crypto is correcting lower mid-week although we saw a considerable bullish trend yesterday that spiked above $6,750, tested but did not break the key resistance at $6,800. There is a bullish trend forming, besides the buyers are gathering strength to break above $6,650 before attacking the critical level at $6,700. The price is supported at $6,600, although the lower demand zone at $6,450 is still within reach as long as Bitcoin is trading below $7,000.

Read more: Bitcoin price analysis on Tuesday 19.

BTC/USD 30’ chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH eyes $2,200 resistance as Fidelity seeks ETH ETF staking approval

Ethereum is up 3% on Tuesday following Cboe BZX's filing with the Securities & Exchange Commission for Fidelity to permit staking in its spot Ethereum ETF. Grayscale and 21Shares have also made similar filings with the SEC to stake their holdings.

Franklin Templeton files for XRP ETF as SEC delays decision on Canary and Grayscale filings

Franklin Templeton filed an S-1 with the Securities & Exchange Commission on Tuesday to launch the Franklin XRP Trust. Following its filing, the SEC announced it would delay its decision on XRP ETF applications from Canary Capital and Grayscale.

Shiba Inu Price Prediction: SHIB hits seven-month low as Ethereum TVL drops $14B after Pectra upgrade

Shiba Inu price hit $0.00001 on Tuesday, testing seven-month lows before rebounding 6%. On-chain data shows investors withdrawing funds from the Ethereum ecosystem after the Pectra upgrade could spark further losses.

Crypto Today: ETH, ADA and XRP traders panic ahead of Mt. Gox’s $930M BTC repayments

Cryptocurrencies market capitalization falls to $2.75 trillion as it declines by another 4% on Tuesday. Ethereum, Dogecoin and Chainlink emerge as top losers among the 20 largest assets.

Bitcoin: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin price extends its decline on Friday, falling over 5% so far this week. BTC uncertainty and volatility spikes liquidated $1.67 billion as the first-ever White House Crypto Summit takes place on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.