Bitcoin Price Analysis: BTC/USD aims back at $9,000 – Confluence Detector

- BTC/USD has resumed the recovery after a sharp sell-off.

- The pivotal level s created by $9,000.

Bitcoin resumed the recovery after a sharp sell-off on Thursday. The first digital coin has gained over 3% since the start of the day and settled above $8,900. A move towards $9,000 is a clear possibility now. The total market capitalization of Bitcoin is $162 billion, while its average daily trading volume is $53 billion.

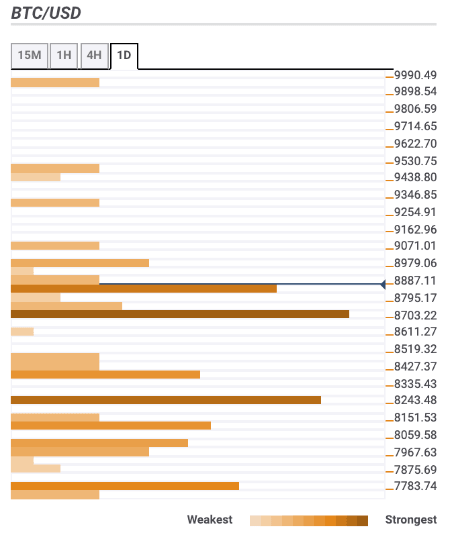

BTC/USD: Confluence levels

On the intraday chart, BTC/USD is moving along the upside-looking 1-hour SMA50. This line serves as local support (currently at $8,770), while the overall trend remains bullish as long as the price stays above this area. There are several technical barriers both above and below the current price; however, the way to the North looks more likely at this stage. Let’s have a closer look and support and resistance levels:

Resistance levels

$9000 - 61.8% Fibo retracement daily

$9,500 - the highest level of the previous day

$9,950 - Pivot Point 1-day Resistance 1

Support levels

$8,700 – 23.6% Fibo retracement daily and monthly, the lowest level of the previous four hours

$8,250 – 38.2% Fibo retracement daily 1-hour SMA100

$8,000 – daily SMA100 and SMA200

BTC/USD, 1-day

Author

Tanya Abrosimova

Independent Analyst