Bitcoin Price Analysis: BTC trading volumes are growing, but the price is stuck

- Bitcoin trading volumes have increased strongly over the last days.

- BTC/USD is jammed between strong support and resistance levels.

Bitcoin settled marginally above $8,000 and stayed under pressure on Monday. The first digital coin has lost over 1% of its value since the beginning of Monday and retreated from the intraday high registered at $8,193. At the time of writing, BTC/USD is changing hands at $8,083, above SMA50 weekly (currently at $7,790).

Bitcoin trading volumes are on the rise

The trading volumes of the first digital asset jumped by 126%, according to the recent research published by Arcane Research. However, the increase may be partially explained by low activity during the New Year holiday season.

The 7-day average real trading volume* sees a nice pump after the worrying low levels during the holiday. With almost $1.5 billion traded on Jan 8, the market recovered sharply from the disappointing $192 million that were traded on Jan 1.

The experts noted a strong correlation between Bitcoin and gold prices that became obvious following the recent military conflict in the Middle East. Both Bitcoin and gold accelerated growth after the US attacked the military base in Iran and killed one of the top-Iranian generals.

Once the tensions started to ease, the safe-haven assets, including BTC and gold, retreated from the recent highs. According to Arcane Research, the correlation between Bitcoin and gold returned to the levels of 2016.

The upcoming launch of CME options on Bitcoin futures is another factor behind the increased Bitcoin's trading volumes. The investors are anticipating the launch of the new derivatives, according to JP Morgan analysts.

BTC/USD: technical picture

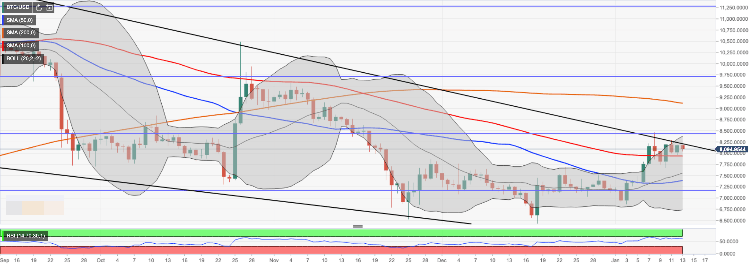

From the technical point of view, a sustainable move below the above-said SMA50 bodes well for Bitcoin's long-term perspective. However, the coin is still sitting inside a downside wedge formation while its upper boundary at $8,200 serves as a critical resistance level. We will need to see a sustainable move above this handle for the upside to gain traction. Once it happens, the next resistance of $8,450 will come into focus. It is reinforced by the recent high of $8,464 and 50% Fibo retracement for the upside move from December 2018 low to July 2019 high. This area may serve as a backstop for BTC for the time being.

On the downside, the initial support is created by a psychological $8,000. It is followed by the above-mentioned SMA50 weekly at $7,790 and the lowest level of the previous week at $7,313. The area of $7,300-$7,350 limited Bitcoin's recovery at the end of December. This support area reinforced by SMA50 daily located on approach. Once it is broken, another strong support of $7,150 will come into focus. It is created by 61.8% Fibo retracement.

Considering the downward-looking RSI on a daily chart, the bearish scenario looks more likely at this stage.

BTTC/USD daily chart

Author

Tanya Abrosimova

Independent Analyst