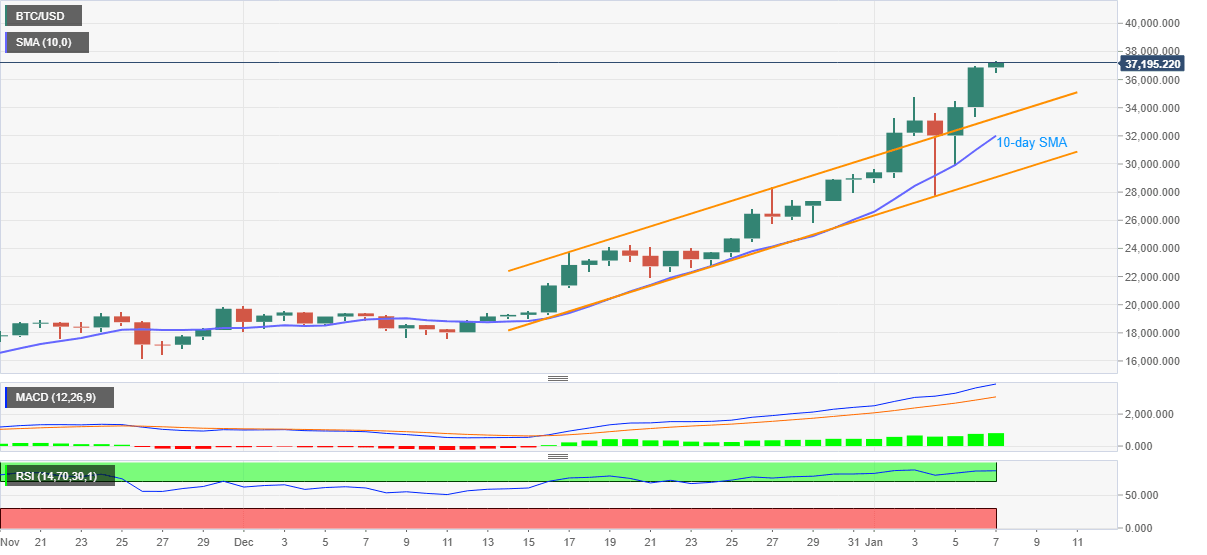

Bitcoin Price Analysis: BTC refreshes record high above 37,000

- BTC/USD remains on the bids for the third consecutive day as it refreshes the record top.

- Bulls cheer sustained trading above 10-day SMA, three-week-old rising channel.

BTC/USD buyers are unstoppable as they poke 37,300 during early Thursday. The crypto leader has been on the north-run since mid-December and gained further acceptance after recently crossing the resistance line of a short-term ascending trend channel.

Other than the successful trading above the stated channel and 10-day SMA, bullish MACD also favors BTC/USD upside.

That said, the quote is for the 37,500 and the 38,000 round-figures as immediate targets ahead of challenging the 40,000 psychological magnet.

However, the bulls are likely to be probed as RSI conditions are overbought, which in turn requires a cautious favor to the further buying.

On the contrary, a downside break of the stated channel’s upper line, at 33,285 now, can recall short-term BTC/USD sellers.

Though, a clear downside break of 10-day SMA and the channel support, respectively around 32,000 and 29,060, will be needed to open doors for the bears.

BTC/USD daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.