- BTC/USD bears battle 50-day SMA following a downside break of two-month-old support line.

- Late-February low lures sellers ahead of $41,300-450 key support-zone.

- Bulls need to cross February top for re-entry.

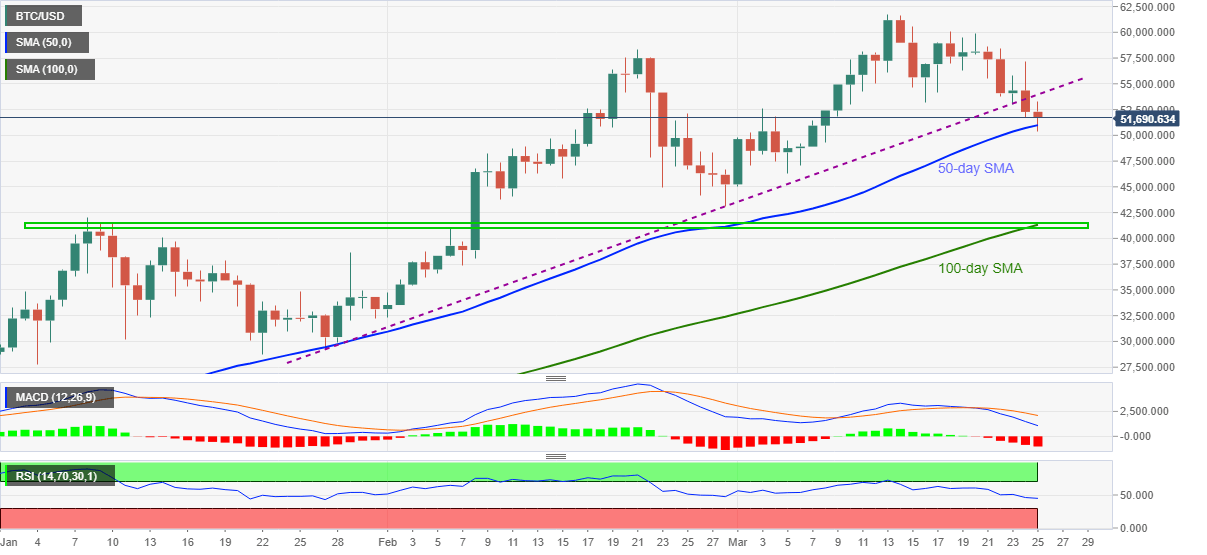

Bitcoin fades recent corrective pullback while dropping back to $51,700 during early Friday. In doing so, the cryptocurrency major battles 50-day SMA while keeping Wednesday’s downside break of an ascending trend line from January 27.

Given the bearish MACD and downward sloping RSI, not overbought, favoring the key support break, now resistance, BTC/USD is up for further losses. However, a clear break below the $51,000 threshold, around 50-day SMA, becomes necessary for the sellers’ conviction.

Following that, the quote’s slump towards lows marked on February 10 and 28, respectively around $43,700 and $43,050, can’t be ruled out.

However, any further losses will be challenged by an area comprising 100-day SMA and early 2021 tops, near $41,450-300.

On the flip side, a corrective pullback beyond the previous support line, at $53,850 by the press time, will have to piece February top near $58,350 to convince the BTC/USD bulls.

BTC/USD daily chart

Trend: Further weakness expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Why LIBRA meme coin promoted by Argentina President Milei is crashing?

LIBRA meme coin promoted by Argentina’s President Javier Milei is making headlines again, crashing nearly 15% on the day. A local Argentine media outlet, Perfil, reported that lawyer Gregorio Dalbón had requested Interpol for a red notice to be issued for Hayden Davis.

Metaverse narrative stalls as price action fades, but on-chain data signals continuing accumulation

Metaverse tokens Sandbox, Decentraland and Axie Infinity continue to face correction since they topped in early December. A Glassnode report suggests that despite price pullback, on-chain activity suggests holders accumulation.

DeFi user loses over $700K USDC in a sandwich attack that experts suggest could be money laundering

A DeFi trader became the subject of discussion among crypto community members on Wednesday after losing more than $700K worth of stablecoins to a sandwich attack on the Uniswap v3 protocol.

Tether on-chain activity surges to a six-month high with 143,000 daily transfers

Tether (USDT) stablecoin on-chain activity has rapidly risen, with over 143,000 daily transfers, surging to a 6-month high. Moreover, the USDT Network growth metric increases, indicating greater blockchain usage.

Bitcoin: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin price extends its decline on Friday, falling over 5% so far this week. BTC uncertainty and volatility spikes liquidated $1.67 billion as the first-ever White House Crypto Summit takes place on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.