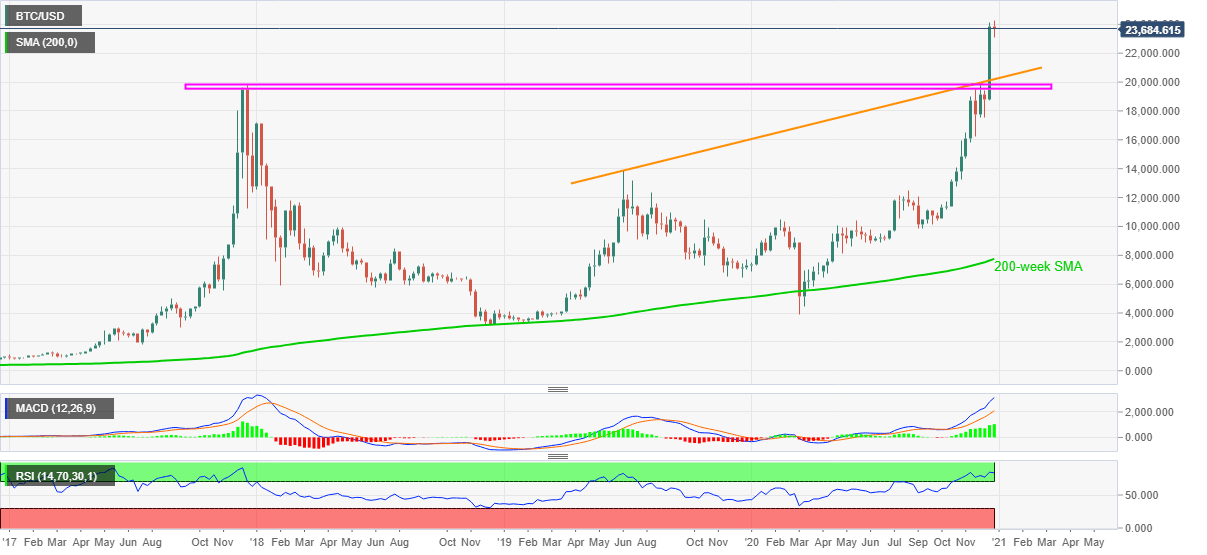

Bitcoin Price Analysis: BTC bulls have reasons to keep 24,000 on radar

- BTC/USD defies pullback from 24,300, recently bid from 23, 110.

- Bullish MACD, sustained break of key resistances favor bulls.

- Sellers need to break 19,500 for fresh entry.

BTC/USD prints 1.0% intraday gains while flashing 23,695 as a quote during early Monday. In doing so, the crypto major reverses the pullback moves from the latest record high of 24,300 while bouncing off 23,110 off-late.

Although overbought RSI conditions warn bulls, a sustained upside break of the 2017 peak, as well as an upward sloping trend line from June 2019, keeps the pair buyers hopeful.

As a result, BTC/USD bulls might not hesitate to eye the 30,000 psychological magnet as an immediate target ahead of moving on to the more strong fundamental hints of the 100,000 landmark.

Read: Bitcoin price at $100,000 is overly conservative, says on-chain analyst Willy Woo

On the contrary, any further pullbacks may eye for the 20,000 round-figure. Though, sellers will remain cautious until witnessing a downside break of the 19,500 mark, comprising late-November tops.

Overall, the BTC/USD is up for a long northward journey but intermediate corrections can’t be ruled out.

BTC/USD daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.