- Bitcoin will continue moving in a tight range.

- The Golden Cross on the short-term picture sends bullish signals.

- The price may extend the correction to $10,000 before the growth is resumed.

Bitcoin attempted a recovery above $10,500 on Sunday, September 13, but failed to hold the ground. At the time of writing. The pioneer digital currency is changing hands at $10,350, mostly unchanged since the start of the day. Moreover, the coin has been oscillating in a tight range for over a week now amid the high indecision level on the market. While Bitcoin HODLers sit tight and wait for the prices to resume the upside momentum, speculative traders might feel frustrated and start looking for clues to understand what's going on and when moon again.

Let's have a closer look at the technical picture to see if the breakthrough is coming.

BTC/USD daily chart

On a daily chart, BTC/USD rebounded from the upper boundary of the recent consolidation range at $10,500. The chances are that the price will retest the channel support before the bulls launch another recovery attempt. Bitcoin dived below $10,000 on numerous occasions during the previous wee; however, each time, a thick layer of buy orders located around that area pushed it back.

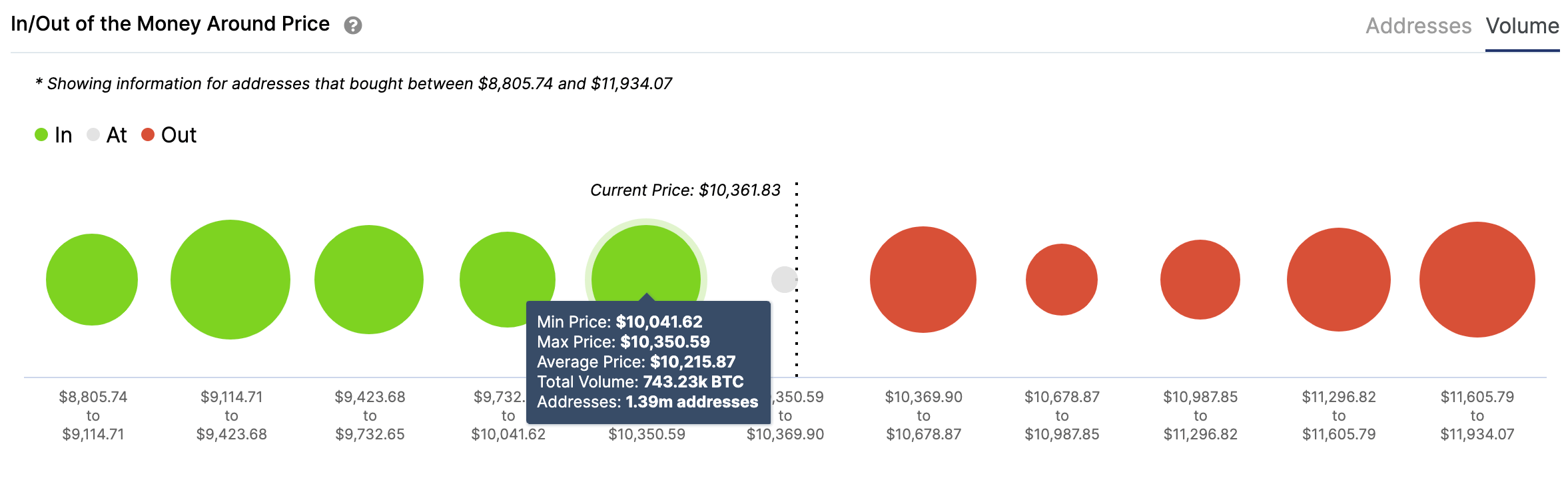

Meanwhile, BTC positioning data shows that nearly 1.4 million addresses with over 750,000 coins have their breakeven point on the approach to $10,000. This barrier is followed by another pack of 700k addresses with the breakeven in the range from $10,000 to $9,700. Most likely, bears will have a hard time making their way through these thick protective layers of protective. However, if they succeed, the sell-off may gain traction with the next focus on $9,200-$9,000, which coincides with the longer-term correction target, as explained in detail in our weekly forecast. The daily SMA200 and weekly SMA50 add credibility to this support area.

Bitcoin's In/Out of the Money data

Source: Intotheblock

If we zoom in to the 4-hour timeframe, the price is supported by SMA50 at $10,270. This local barrier separates BTC from a decline to the lower line of the sideways channel. The series of Dojis and candles with small bodies confirm the market's indecisiveness, which means we may stay in the current range a little bit longer. Also, the market positioning implies that a wall of supply in the area of $10,400-$10,600 may slow down the recovery. However, once it is out of the way, the upside momentum is likely to gain traction with the next focus on the psychological barrier of $11,000, followed by the 4-hour SMA200 at $11,200.

BTC/USD 4-hour chart

On the 1-hour chart, the short-term price movements are limited by SMA50 on approach to $10,400 and SMA200 at $10,250, which confirms the range-bound state of the market. However, the Golden Cross that has transpired on this time frame is a distinct bullish signal. The Golden Cross is a situation when a short-term SMA crosses the long-term SMA from the downside.

BTC/USD 1-hour chart

To conclude: BTC/USD is locked in a tight range and may continue moving sideways for the time being as there are substantial technical and fundamental barriers both on above and below the current price. The short-term indicators imply that BTC/USD may be ready for an extended recovery; however, this signal should be confirmed by a sustainable move above $10,500-$10,600. Once this happens, $11,000 will come into focus. On the other hand, a failure to clear the upside barrier will push the price towards the lower boundary of the range of $10,000, which is strong enough to slow down the decline and create another bullish impulse. Otherwise, the sell-off will continue towards the long-term correction target at $9,000.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-637356659802674442.png)

-637356660195028000.png)

-637356660546436818.png)