- Bitcoin is facing a post-halving dilemma that could see it either soar to new all-time highs or nosedive to $4,000.

- Bitcoin buyers’ efforts channeled after the dip to $8,100 limited by the resistance under $9,000.

Bitcoin is currently exchanging hands at $8,683 at the time of writing. The price has recovered slightly from the dip to $8,100. An intraday high has been achieved at $8,812 (short term resistance level). Glancing further up $9,000 is the next resistance; that if broken could pave the way for the leg up to the critical resistance at $10,120 (previous week high).

In the event $10,120 is broken riding on high trading volume, the following target is $10,650 (a very strong seller congestion area). Most traders anticipate that if $10,650 is broken, rally to new all-time highs would come into play.

On the flip side, if the rally is rejected at $10,120 post-halving, Bitcoin is likely to spiral under the recent support at $8,100 and refresh levels in the $7,000’s range. It is vital that support at $7,800 holds for a bullish scenario. However, if broken BTC/USD could nosedive to $6,000 and you can expect a retest of $5,200 and $4,000 support areas respectively.

In the meantime, reward halving is to take place in less than 24 hours. Bitcoin dumped to $8,100 two days before the event; the fall is likely to allow more people to join the market. However, resistance under $9,000 continues to limit the bulls’ efforts.

Read more: How Coronavirus pandemic is poking holes in anticipated post-halving Bitcoin rally?

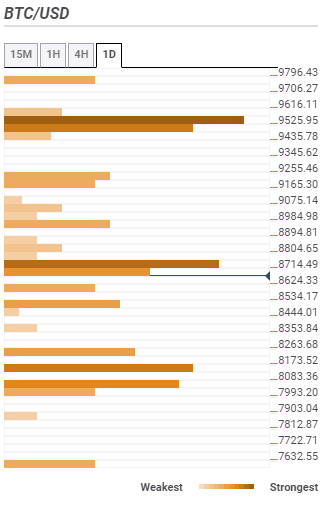

Bitcoin confluence resistance and support areas

Resistance one: $8,714 – as highlighted by the previous low 4-hour, Fibonacci 23.6% one-month, the Bollinger Band 15-minutes middle and the 100 SMA 15-mins.

Resistance two: $9,525 – Is the zone where the Fibonacci 38.2% one-week and the pivot point one-day resistance one converge.

Support one: $8,534 – Highlights the Fibo 23.6% one-day and the Bollinger Band one-day middle curve.

Support two: $8,173 – Home to the previous low one-day.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls target $100,000 BTC, $2,000 ETH, and $3 XRP

Bitcoin (BTC) is stabilizing around $95,000 at the time of writing on Wednesday, and a breakout suggests gains toward $100,000. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and hovered around their key levels.

Tether mints 3 billion USDT on Ethereum and TRON as markets stabilize

Tether ramps up its minting activity amid surging demand for stablecoins, often signaling heightened trading and liquidity needs. The issuer of the leading stablecoin by market capitalization has minted 2 billion USDT on Ethereum and an additional 1 billion USDT on the TRON network.

SEC delays decision on Franklin Templeton’s spot XRP ETF to June 2025

The Securities and Exchange Commission (SEC) has postponed its decision on Franklin Templeton’s spot XRP ETF, extending the review period to June 17, 2025. XRP traded at approximately $2.24 at press time, rising 7% over the past week, according to CoinGecko.

Trump Media announces new token launch and native crypto wallet in latest Shareholder letter

Trump Media unveils plans to launch a utility token and crypto wallet to monetize Truth Social and expand its streaming services. Markets react with a 10% drawdown on the Solana-hosted official TRUMP memecoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.