- BTC buyers appear struggling on the road to recovery.

- Technical set up still remains in favor of the bears in the near-term.

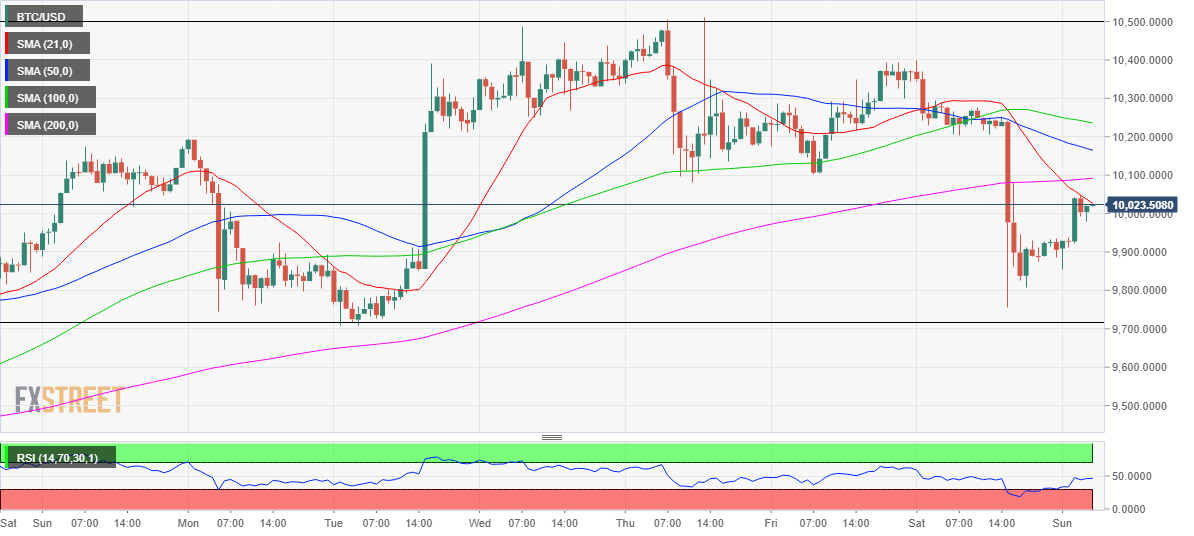

- BTC/USD breached 10k for the first in four days in a wild Saturday trading.

Bitcoin (BTC/USD), the most favorite cryptocurrency, witnessed a volatile Saturday and slipped below the 10k mark for the first time in four days. The spot saw some aggressive selling after the bulls failed to defend the key support around 10,080 (as well predicted here), exposing the 9,700 level. On Sunday, the BTC buyers seem to have returned, as they strive to extend the recovery mode beyond the 10k level. At the time of writing, Bitcoin battles 10k, gaining 1% on the day while down nearly 2.75% over the last 24 hours. Its market capitalization now stands at $182.06 billion, down from $186.27 billion seen before the late-Saturday slump.

Technical Overview

BTC/USD hourly chart

From a technical perspective, the corrective slide in the No. 1 coin accelerated only after the 21-hourly Simple Moving Average (SMA), now at 10,035, pierced both 50 and 100-HMAs from above. The spot saw a fresh leg lower and subsequently reached a new four-day low at 9,755.78 after the bulls caved into the 200-HMA support near 10,080. At the same time, the hourly Relative Strength Index (RSI) extended its south-run and entered the oversold territory.

As for Sunday’s trading so far, the bearish 21-HMA continues to cap the recovery attempts while the hourly RSI remains below the mid-line. Only a sustained break above the latter would offer some fresh signs of life to the BTC bulls. But the key horizontal 200-HMA support-turned-resistance, now at 10,090 needs to be taken out for a move back towards the 10,200 level. In the near-term, the bearish bias still remains intact as long as the price trades below the 200-HMA and therefore, a re-test of the 9,700 mark (key horizontal trendline support) cannot be ruled out.

BTC/USD key levels to watch

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP Price Prediction: How Ripple's alignment with the $18.9T tokenization boom could impact XRP

Ripple (XRP) approached the critical $2.00 level during the Asian session on Friday after a minor correction the previous day reinforced higher support at $1.95.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH show weakness while XRP stabilizes

Bitcoin (BTC) and Ethereum (ETH) prices are hovering around $80,000 and $1,500 on Friday after facing rejection from their respective key levels, indicating signs of weakness. Meanwhile, Ripple (XRP) broke and found support around its critical level.

Can Trump's tariff pause and declining inflation keep Bitcoin afloat? Experts weigh in

Bitcoin (BTC) dived below $80,000 on Thursday despite US Consumer Price Index (CPI) data coming in lower than expected and President Donald Trump's 90-day reciprocal tariffs pause on 75 countries.

Bitcoin miners scurry to import mining equipment following Trump's China tariffs

Bitcoin (BTC) miners are reportedly scrambling to import mining equipment into the United States (US) following rising tariff tensions in the US-China trade war, according to a Blockspace report on Wednesday.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.