Bitcoin price analysis: $ 7,265 to cap the bounce amid rising wedge breakdown

- Bitcoin trades flat on Saturday, with bias leaning to the downside.

- Rising wedge breakdown spotted on hourly sticks, with bears eyeing 7,075.

- However, a rebound cannot be ruled out in the near-term.

Bitcoin (BTC/USD), the most favorite cryptocurrency, is trading little changed so far this Saturday, having run into stiff resistances aligned near 7,265 region on its multiple upside attempts.

The no. 1 coin saw a temporary reversal on Friday, having formed three back-to-back doji candles on the daily chart earlier this week. Despite the bounce, the sellers appear to have returned over the last hours, as the market is unwilling to buy into any short-lived optimism. At the press time, the spot hovers around 7,250, almost unchanged over the last 24 hours while down nearly 4% on a weekly basis. Its market capitalization now stands at $ 131.56 billion or 66.60% of the total crypto market value.

Technical Overview

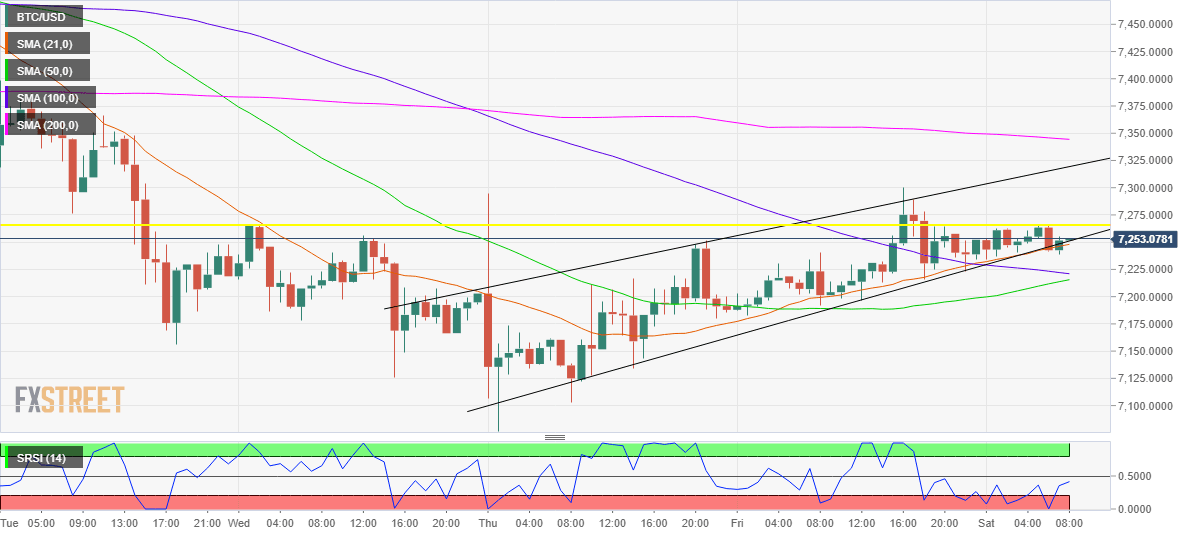

A rising wedge pattern breakdown (bearish reversal pattern) was confirmed on the hourly chart last hour after the spot breached the ascending trendline (pattern) support at 7,245. Therefore, the immediate support now awaits around 7,220 region, where the 50 and 100- hourly Simple Moving Averages (HMA) coincide. The selling pressure will intensify below the last, opening floors for a test of the pattern target aligned at 7,075, in absence of strong relevant supports.

However, an interim bounce-back towards the key supply zone near 7,265 cannot be ruled out, with the hourly Relative Strength Index (RSI) having rebounded from oversold territory towards the midline. Should the bulls manage to take out the above-mentioned hurdle, a test of the pattern upper trendline resistance at 7,317 is inevitable.

BTC/USD 1-hour chart

BTC/USD Levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.