- Bitcoin price is at the last leg of a distribution phase, suggesting an emerging downtrend.

- The breakout of a falling wedge during this leg adds credence to the downswing narrative.

- A daily candlestick close above $24,989 will invalidate the bearish outlook.

Bitcoin price shows a confluence of bearish developments that suggests an incoming downtrend. This development could halt the bullish outlook seen in Ethereum and other related altcoins.

Bitcoin price is ready for a dip

Bitcoin price is in a classic Wyckoff Distribution Phase, where the asset losses buying pressure and momentum as investors start to unwind their holdings to book profits. Typically, there are identifiers and five phases to determine a top formation.

- After the primary supply (PSY) is formed, the buying pressure climaxes (BC), which leads to a pullback or an automatic reaction (AR).

- After this, the price usually attempts and fails to produce a higher high, termed the secondary test (ST).

- The weakness becomes apparent as the asset produces a lower low relative to the AR and is referred to as a sign of weakness (SOW).

- This development is followed by an upthrust (UT) and a higher high, aka an upthrust after a distribution (UTAD). Quickly following this deviation is the last leg, where the asset continues to drop, signaling the formation of supply (LPSY).

Once the support levels drawn from AR and SOW are broken, the asset value plummets quickly. Interestingly, Bitcoin price is currently creating LPSY and has also formed a rising wedge, adding credence to the bearish outlook.

- Described below are potential levels where this development could lead to:

- The 30-day Exponential Moving Average (EMA) at $23,275 is the first line of defense.

- A breakdown of this level will push BTC down to support levels drawn from AR and SOW at $22,598 and $22,382, respectively.

- Beyond these barriers, investors can expect a move into the four-hour fair value gap (FVG), aka price inefficiency, at $21,440.

- The local bottom for BTC could form after a sweep of the equal lows formed at $20,750.

BTC/USDT 1-hour chart

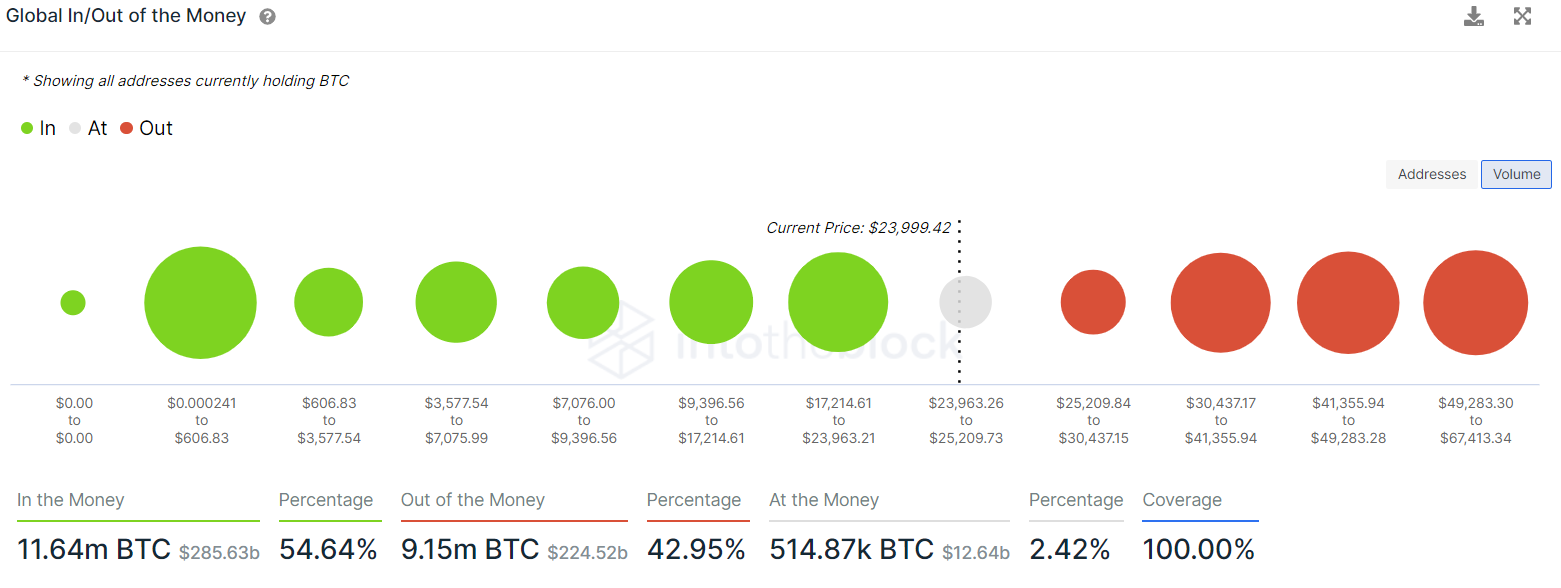

While these developments from a technical perspective are undoubtedly bearish, the on-chain metrics, especially IntoTheBlock’s Global In/Out of the Money (GIOM) model, favor a bullish outlook for Bitcoin price.

The GIOM shows that the immediate support cluster, extending from $17,214 to $23,963, contains roughly 4.16 million addresses that purchased 2.56 million BTC at an average price of $21,376.

These investors are “In the Money” and are likely to buy more if BTC ever gets down to these levels.

On the other hand, the immediate resistance cluster contains 1.39 million addresses that purchased 884,690 BTC at an average price of $29,132 are “Out of the Money” This group is likely to sell to breakeven if the Bitcoin price goes higher.

Comparatively, there are more buyers “In’The Money” than “Out of the Money”, favoring a bullish outlook.

BTC GIOM

Therefore, an invalidation of the bearish thesis will occur if Bitcoin price can flip the $25,000 psychological level into a support floor. In such a case, investors can expect this move to extend to $29,000 if the buying pressure persists.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Dogecoin and Bitcoin Cash Price Prediction: Funding rates decrease indicate weakness in DOGE and BCH

Dogecoin and Bitcoin Cash registered 3% and 8% losses on Tuesday following increased selling pressure from the futures market. The decline comes amid large-cap cryptos like Bitcoin, Ether and XRP, holding still with slight gains.

XRP could sustain rally amid growing ETF and SEC vote prospects

Ripple flaunted a bullish outlook, trading at $2.1505 on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move triggered by the swift decision by US President Donald Trump to suspend reciprocal tariffs for 90 days.

VeChain Price Forecast: VET bulls aim for a double-digit rally

VeChain price hovers around $0.023 on Tuesday after breaking above a falling wedge pattern the previous day; a breakout of this pattern favors the bulls. Bybit announced on Monday that VET would be listed on its exchange. Moreover, the technical outlook suggests rallying ahead, targeting double-digit gains.

Dogecoin, Shiba Inu and Fartcoin price prediction if Bitcoin crosses $100K this week

The meme coin market fell sharply on Monday, shedding 4.8% in market capitalization to settle at $49.25 billion, according to data compiled from CoinGecko. The sell-off coincided with increased volatility across broader crypto markets while investors rotated funds into Bitcoin briefly tested $85,000.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.