Bitcoin prepares for spike in volatility after holding steady through US stock market bloodbath

- Bitcoin and Ethereum avoided losses after US stocks plummeted over the past 24 hours.

- Investors fear that the US Federal Reserve may need to tighten monetary policy longer than expected, increasing selling pressure on risk assets.

- Bitcoin whales have accumulated $6.73 billion worth of BTC, traders await volatility.

Bitcoin (BTC) price held its ground despite the US stock market bloodbath on Thursday. Large-wallet investors started accumulating BTC, buying the asset at a discount through the dip. Accumulation by whales signals incoming volatility in the largest crypto asset by market capitalization.

Also read: Ethereum rival Cardano sharks gobble up 331 million ADA tokens, fuels fear of mass sell-off

Bitcoin could witness a spike in volatility following the recent whale accumulation

Bitcoin large-wallet investors, also known as whales, have scooped up $6.73 billion in BTC, fueling anticipation of incoming volatility in the asset’s price. Over the past 24 hours, Bitcoin price held steady at $16,845 despite the bloodbath in the US stock market seen on Thursday.

Investors are reconsidering the US Federal Reserve (Fed)’s policy decisions. There is a likelihood that the central bank could pivot anytime soon, to a more dovish monetary policy. This could typically result in a price decline in risk assets like Bitcoin.

Positive economic data has re-kindled fears that the US Federal Reserve may need to tighten monetary policy longer than expected. This could increase the downward pressure on risk assets like Bitcoin and Ethereum, as 2022 draws to an end.

In Messari’s Ryan Selkis’ 168-page report with his 2023 predictions for cryptocurrencies, the analyst believes the market direction is influenced by macroeconomic outlook and regulation.

Whales influence capital supply in crypto markets. Therefore, renewed accumulation of BTC by large-wallet investors implies Bitcoin price could experience volatility before the end of 2022. Large wallets scooped up 400,000 BTC through crypto winter since November 9, based on data from crypto intelligence platform Whalemap.

BTC accumulation by whales

Bitcoin price at risk of decline after Death Cross

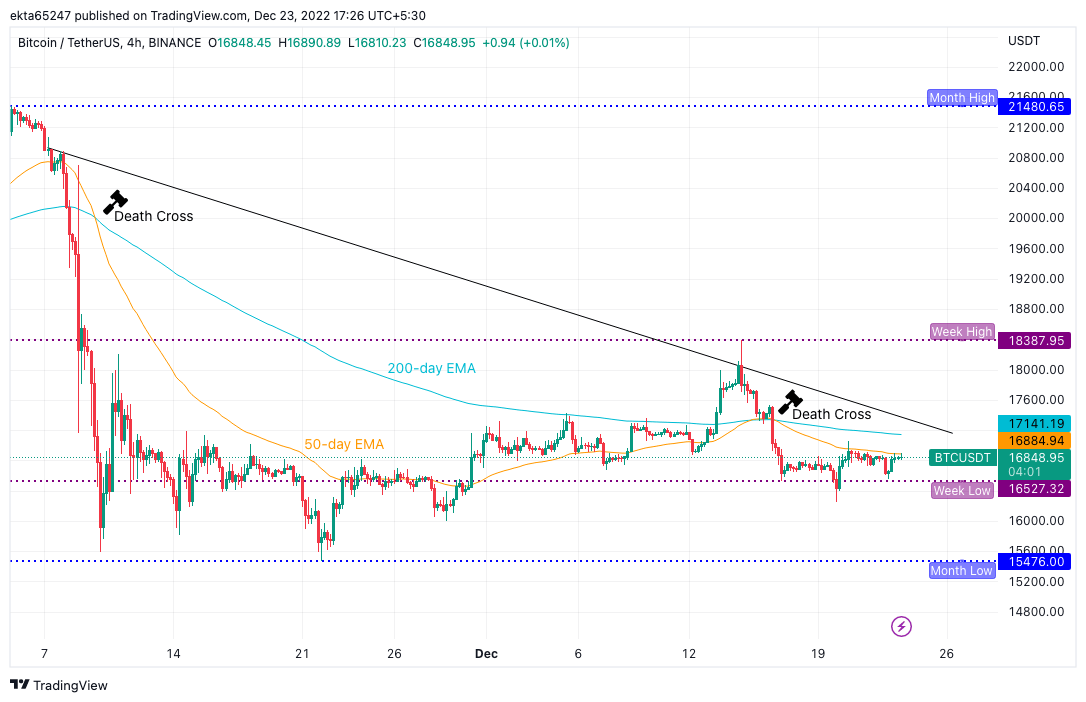

Bitcoin price chart below reveals a Death Cross pattern, where the 50-day Exponential Moving Average (EMA) crosses under the 200-day EMA. The Death Cross in the chart below was seen in the second week of November and resulted in a steep decline from $20,000 to $16,000 within the same week.

The most recent Death Cross in the third week of December is a clear bearish re-test for Bitcoin. Capo of Crypto, a leading technical analyst, argues that Bitcoin’s downtrend is intact and the crypto market as a whole is not prepared for fresh upcoming losses.

Experts on crypto Twitter remain firmly bearish.

BTC/USDT 4H Binance price chart

Bitcoin price could invalidate the bearish thesis if BTC crosses the resistance levels at the 50-day EMA at $16,884 and 200-day EMA at $17,141. Bitcoin price outlook for the end of 2022 remains bearish.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.