Bitcoin poised for decline as on-chain data shows negative bias

- Bitcoin trades above $58,000, failing to recover from Sunday's 3.6% decline.

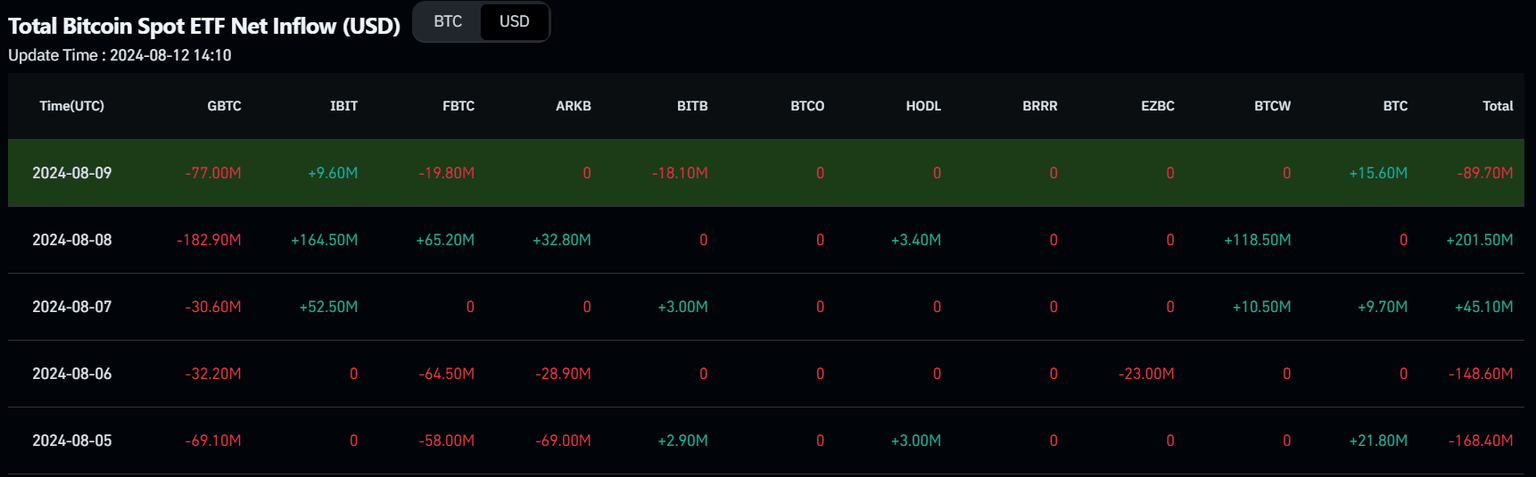

- Exchange-traded funds (ETFs) tracking Bitcoin listed in the US recorded 160.10 million outflows last week

- On-chain chain data shows negative signs for BTC, signaling a bearish trend ahead.

Bitcoin (BTC) is trading slightly above $58,000 on Monday after failing to recover from a 3.6% decline on Sunday. Last week, exchange-traded funds (ETFs) tracking Bitcoin in the US experienced average outflows of $160.10 million, while on-chain data indicates negative signals, suggesting a bearish trend ahead.

Daily digest market movers: Bitcoin struggles around $58,000 as on-chain data shows negative bias

- As reported by news agency TASS, Russian President Vladimir Putin has officially signed a law legalizing cryptocurrency mining in Russia. The new legislation introduces key concepts such as digital currency mining, mining pools, and mining infrastructure operators. It reclassifies mining activities as part of turnover rather than digital currency issuance.

- During a recent government meeting, President Putin emphasized the importance of "seizing the moment" to establish a legal framework for digital currencies, highlighting their potential to boost Russia's economic development and the necessity for proper regulation and infrastructure.

- According to the cybersecurity group VE Sin Filtro on Friday, Venezuela recently blocked access to the crypto exchange Binance and other online platforms amid nationwide protests over the country's disputed election results, a situation confirmed by Binance's official Latin America account on X on Saturday. However, there has been no announcement from the Venezuelan government regarding this action or any indication of when it might be resolved.

Bloqueado Binance en CANTV

— VE sin Filtro (@vesinfiltro) August 10, 2024

Esta noche detectamos un bloqueo DNS al exchange de criptomonedas @Binance, el cual afecta el normal funcionamiento de su web y su aplicación móvil.

El bloqueo fue detectado por primera vez a las 8:15 PM de hoy #9Ago pic.twitter.com/aivmVT2VNi

Estimados Binancians,

— Binance Latinoamérica (@BinanceLATAM) August 10, 2024

Al igual que varios sitios web de empresas de diferentes segmentos en Venezuela, incluidas las redes sociales, las páginas de Binance han estado enfrentando restricciones de acceso.

Queremos asegurarles que sus fondos están SAFU bajo nuestros robustos…

- Bitcoin briefly surpassed $62,600 on Thursday, marking a 25% increase in just over three days from last Monday's decline. As is often the case, average traders have been caught off guard. Meanwhile, social volume searches reveal a sudden surge in excitement over potential Bitcoin prices reaching $70,000 to $75,000, signaling that Bitcoin price has reached possible local price top.

Bitcoin Social Volume chart

- According to Coinglass's data, BTC's long-to-short ratio is 0.972. This ratio below one generally reflects bearish sentiment in the market, as more traders anticipate the price of the asset to decline, bolstering Bitcoin's bearish outlook.

BTC long to short chart

- Additionally, the Bitcoin Spot ETF data shows that it recorded total outflows of $160.10 million last week. Monitoring these ETFs' net flow data is crucial for understanding market dynamics and investor sentiment. The combined Bitcoin reserves held by the 11 US spot Bitcoin ETFs stand at $48.81 billion.

Total Bitcoin Spot Etf chart

Technical analysis: BTC eyes for a relief rally before downtrend resumes

Bitcoin's price was repeatedly tested and rejected by the 61.8% Fibonacci retracement level of $62,066 (drawn from the swing high of $70,079 on July 29 to the August 5 low of $49,101). On Monday, it trades slightly lower by 0.1% at $58,659.

If the $62,066 level holds as resistance, aligning with the broken trendline and the 100-day Exponential Moving Average at approximately $63,021, selling pressure may rise.

Failure to surpass $62,066 could lead to a 19% drop, potentially revisiting the $49,917 daily support level.

The Relative Strength Index (RSI) and Awesome Oscillator (AO) indicators on the daily chart are trading below the neutral levels of 50 and zero. These momentum indicators strongly indicate bearish dominance.

BTC/USDT daily chart

However, if Bitcoin closes above the August 2 high of $65,596, it would establish a higher high on the daily chart, potentially driving a 6% increase in its price to challenge the weekly resistance at $69,648.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.