Bitcoin pinned below $38K as investors stash record $756 billion with Fed

Bitcoin bulls ducked for cover as the Federal Reserve started paying interest rate returns on cash deposits via its reverse repurchase program.

Bitcoin (BTC) suffered as investors moved a record amount of cash in Federal Reserve's overnight facility after the central bank started paying interest on the money.

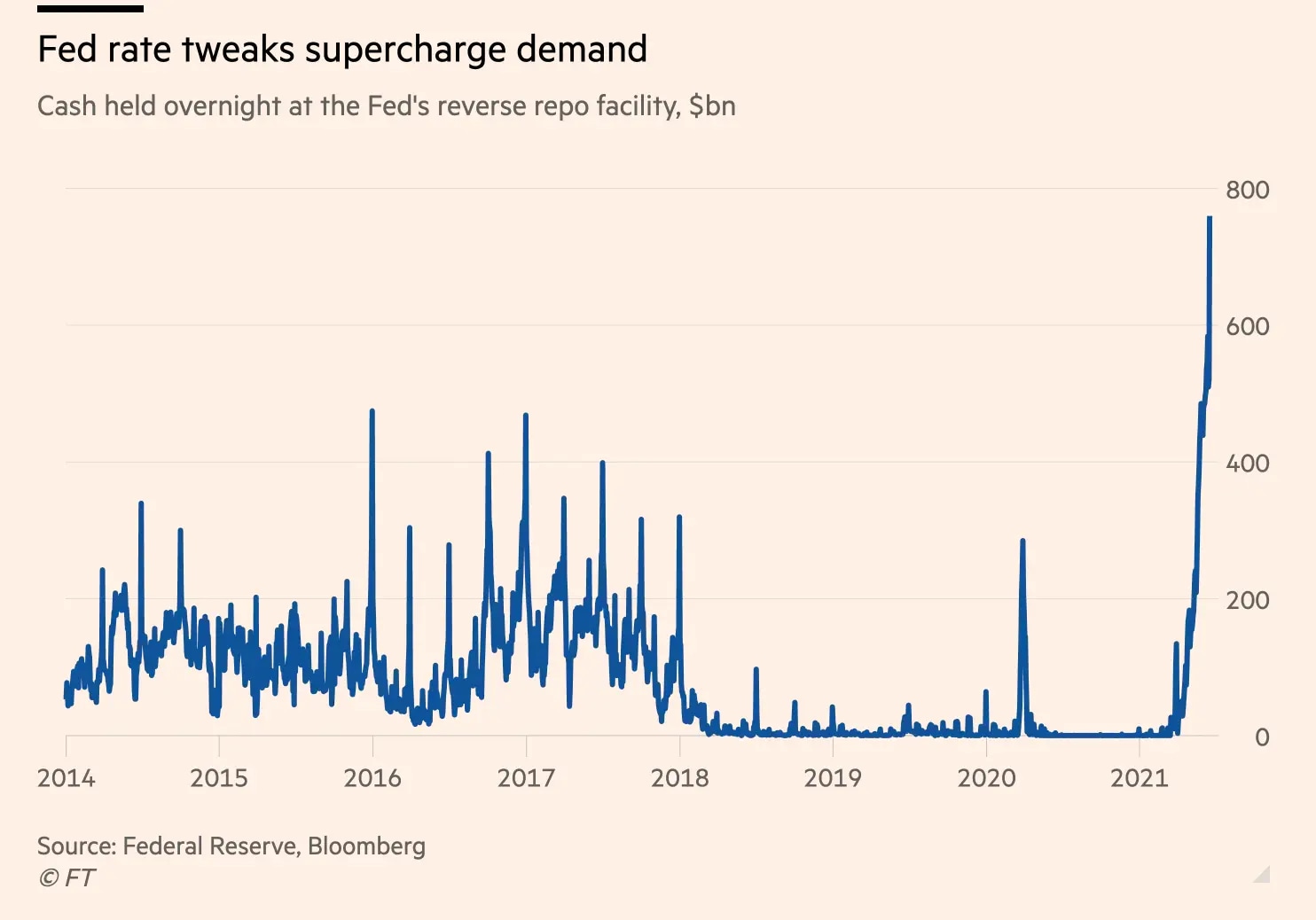

The U.S. central bank received $756 billion via its reverse repurchase program from nearly 70 market participants on Thursday. The stash is about $172B higher than the one deposited last week and roughly $235B more than on Wednesday, wherein only 53 investors tapped the facility.

A reverse repo facility takes in cash majorly from money-market funds and government-sponsored banks. Until Wednesday, the service offered eligible users a return interest of zero percent.

But after the Federal Reserve signaled faster and sooner interest rate increases — in 2023 instead of previously anticipated 2024, the facility moved its revere repo rate up to 0.05% and interests on excess reserves rates, which banks deposit 0.15% from 0.10%.

Putting excess cash to earn interest

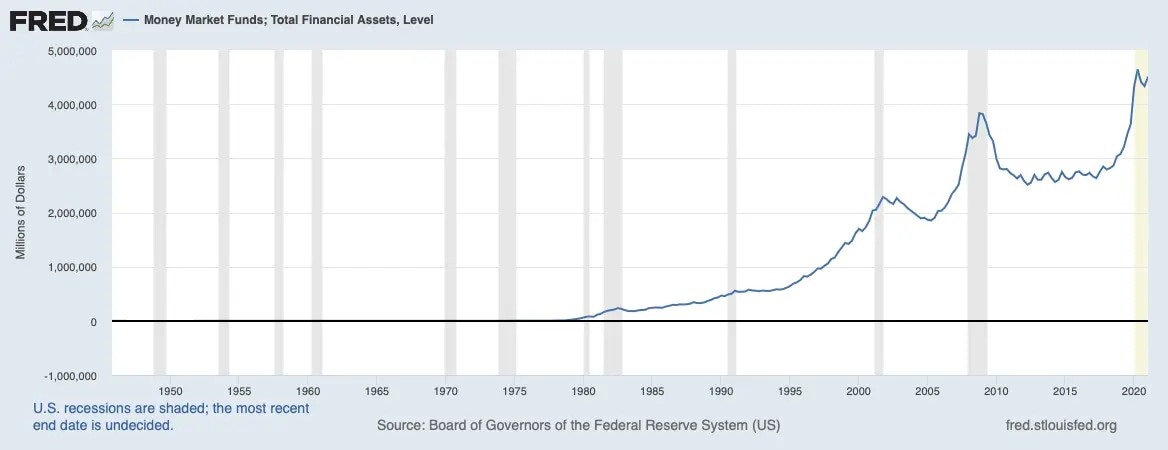

Primarily due to quantitative easing for the U.S. economy, excessive dollar liquidity has been pouring into money market funds that later invest this in short-term government securities. Higher demand for those securities has often sent their yields into negative territories.

Negative-yielding securities in response to Fed's quantitative easing turned out to be one of the major bullish catalysts for Bitcoin and other digital assets since March 2020. Against traditional debts, the cryptocurrency sector promised better returns and, in some cases, consistent yields from the emerging decentralized finance industry.

But with Fed throwing a curveball at the markets with its hawkish tones, mainstream investors have been turning to facilities that seem less risky than Bitcoin or gold and promise a decent yield. As a result, the Fed's repo market records its most enormous inbound cash flow.

"We appear to be seeing a growing inversely proportional correlation between the price of Bitcoin and the Reverse Repo market from the Fed," said Petr Kozyakov, co-founder and CEO at crypto wallet service Mercuryo. He added:

"Many investors choose the more volatile Bitcoin as it promises higher returns. However, with the current market trends, some BTC investors are perhaps offloading their positions as the dollar outlook is vital at this point.

The U.S. dollar, also considered a haven against market uncertainties, rose to 92.70 against a basket of top foreign currencies this Friday. That marked the greenback's highest level since mid-April. Bitcoin reacted negatively to a stronger buck.

Bitcoin and the U.S. dollar index's response to the Fed's rate hike signal [so far]. Source: TradingView.comç

Bitcoin shall overcome?

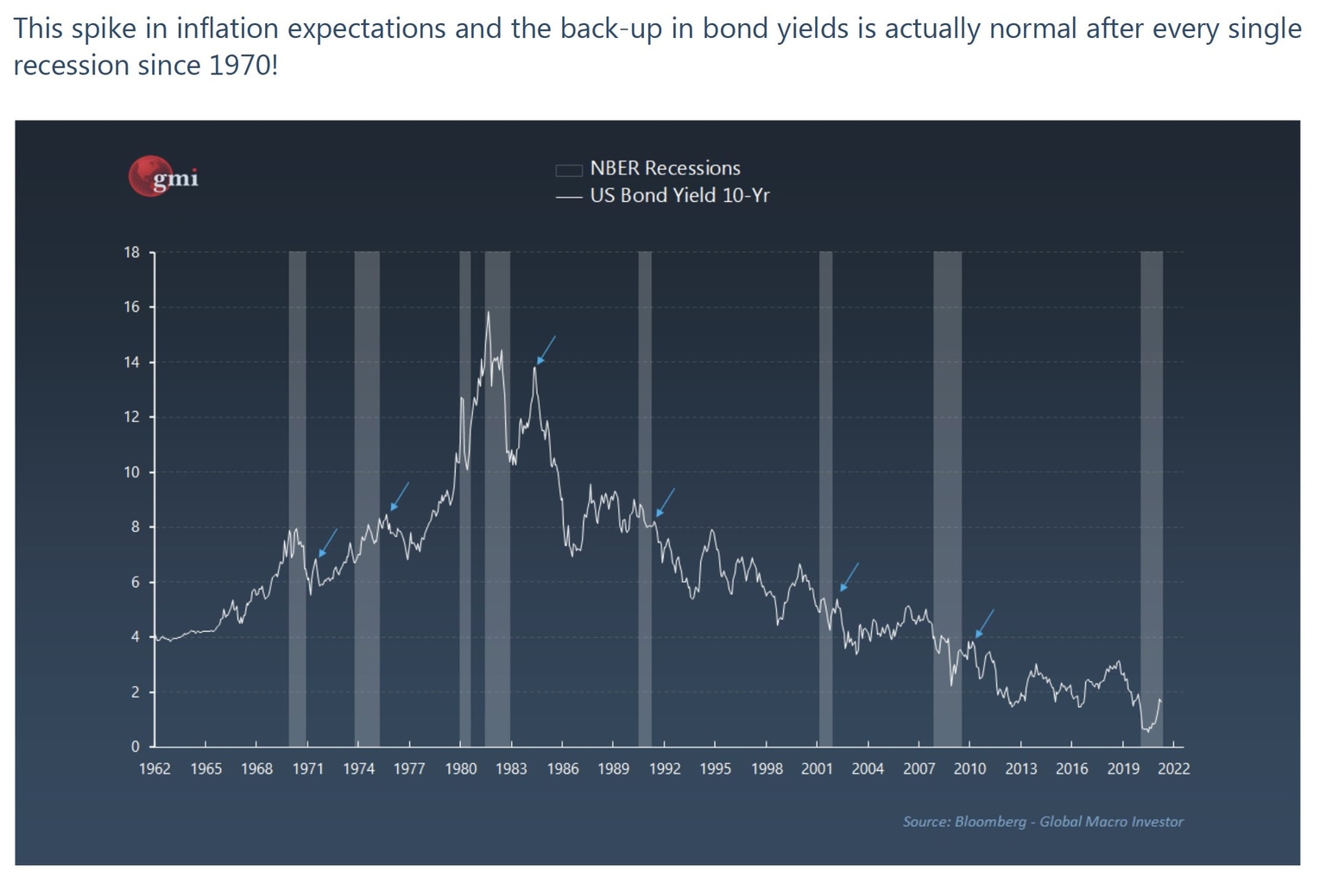

Raoul Pal, the founder/CEO of Global Macro Investor, said the dollar's climb killed the inflation narrative. Nevertheless, the macroeconomic analyst stressed that the Fed-led tapering woes wouldn't hurt alternative hedging assets like Bitcoin and gold in the long run.

He noted that the U.S. government tends to push through more stimulus packages that expand the Fed balance sheets. That means the central bank keeps buying the sovereign debt, thereby pushing bond yields lower. Pal said:

"My view remains that H2 is weaker than expected and inflation fears subside for now, and growth looks patchy. That results in more stimulus (not tightening) in Q4.

U.S. 10-year Treasury note yield dropped after every recession since 1980. Source: Bloomberg, Global Macro Investor

The analyst added that the dollar's recovery trend would stabilize in the second half of 2021. Eventually, the capital would start flowing back into gold and crypto markets.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.