Bitcoin rallied to a five-month high Friday ahead of a monthly U.S. jobs report that could cement expectations the Federal Reserve (Fed) will start unwinding crisis-era stimulus starting in November.

The top cryptocurrency by market value rose to $56,100, hitting the highest since May 12 and taking the month-to-date gain to 27%. It was recently trading about $55,270.

Bitcoin rallied to a five-month high Friday ahead of a monthly U.S. jobs report that could cement expectations the Federal Reserve (Fed) will start unwinding crisis-era stimulus starting in November. The top cryptocurrency by market value rose to $56,100, hitting the highest since May 12 and taking the month-to-date gain to 27%. It was recently trading about $55,270. The U.S. non-farm payrolls (NFP) report scheduled for release at 12:30 UTC on Friday is expected to show the world’s largest economy added 500,000 jobs in September, more than double August’s 235,000 additions. The jobless rate is expected to have dropped to 5.1% from 5.2%, according to FXStreet.

Since the onset of the coronavirus pandemic in early 2020, bitcoin has become sensitive to critical macro data releases, like the NFP, influencing the Fed’s monetary policy. This time, however, the cryptocurrency could ignore the data, even if it beats estimates and cements the case for the Fed taper. A weak report would, in any case, be positive for asset prices in general.

The indifference is because the bitcoin market is currently focused on speculation that U.S. regulators will soon approve a futures-based bitcoin exchange-traded fund (ETF), opening doors for more mainstream money. The cryptocurrency appears to be on a solid footing, having decoupled from stocks and bounced hard from $40,000 despite adverse macro developments on institutional participation, as hinted by the surging premium in futures listed on the Chicago Mercantile Exchange (CME).

“Bitcoin is looking too strong here,” said Pankaj Balani, CEO of Delta Exchange. “The cryptocurrency has digested all the negative news that has come out of China in the past few weeks, which is a very positive sign.”

“There has been fresh spot buying activity in BTC, and looking at the price action, we expect to see a fresh ATH in the coming weeks,” he said, referring to an all-time high. The current record is $64,801, reached in April.

According to Singapore-based QCP Capital, there has been an overwhelming amount of outright buying in CME-based futures. “There are many reasons to be bullish; the stabilization of the Evergrande situation, possible upcoming approvals for BTC ETFs in the U.S., more traditional finance stalwarts like Soros Fund Management turning crypto-positive,” QCP Capital said.

Analysts told CoinDesk last month that bitcoin would remain resilient to any Fed taper. Being at the far end of the risk curve, bitcoin likely priced in an early end of stimulus during the May slide from $58,000 to $30,000. That was when the taper concerns first surfaced.

“The crypto [world] isn’t paying too much attention to quantitative easing [stimulus], and there is certainly a lot of money floating around the system, though, looking to invest in crypto projects at the moment,” Anthony Vince, global head of trading at GSR, told CoinDesk last month.

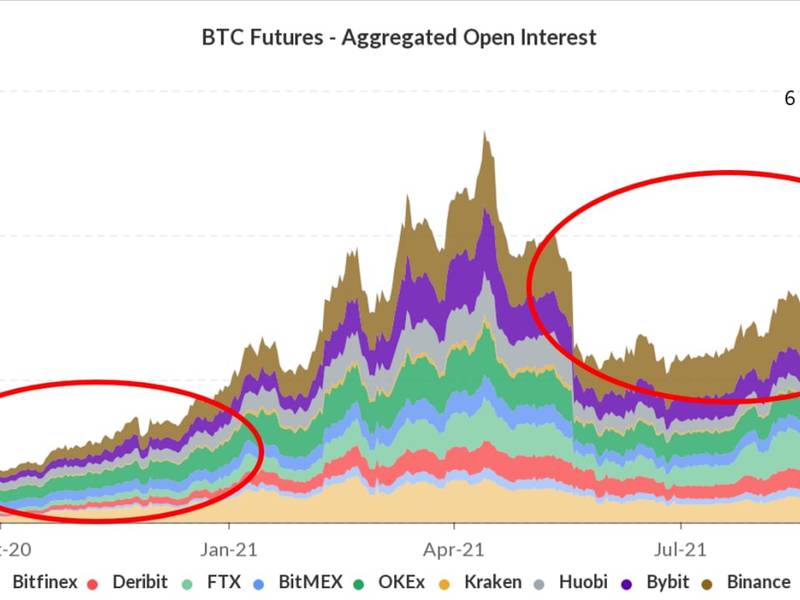

QCP Capital is cautiously bullish and foresees pullback if leverage, as measured by futures open interest, continues to rise. “BTC OI is reaching levels [seen in chart below] that tend to precede market sell-offs. We will start to be cautious of potential downside risk if OI levels continue spiking,” QCP Capital said in its Telegram channel.

Open interest in futures contracts has more than tripled in one year, making the market more vulnerable to leverage washouts than a year ago.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.