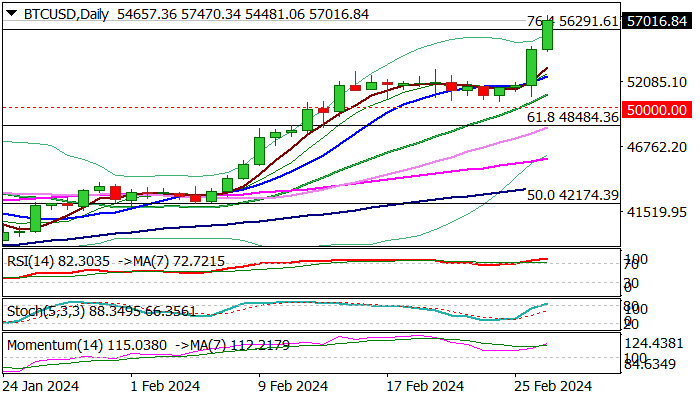

Bitcoin extends sharp rise into second consecutive day and hit levels near 57500 for the first time since December 2021 on Tuesday.

Two-day rally has registered around 4.5% gains and signaled continuation of larger uptrend, after investors quickly changed view from extended consolidation phase into fresh and large longs, executed by large market players.

In my yesterday’s comment, I pointed to psychological 50000 zone as strong support, but left some space for deeper pullback, which was expected to be a healthy correction and offer better buying levels, although markets proved to be more bullish than anticipated and quickly changed the sentiment.

Bitcoin also received strong boost from the recent approval of Bitcoin exchange traded funds (ETF) which is gaining pace and lifts the price.

The latest advance contributed to Bitcoin’s impressive monthly performance in February (up 35% for the month, in the biggest monthly advance since October 2021).

Bulls broke above important Fibo barrier at 56219 (76.4$ of 68911/15437 downtrend) close above which to boost technical signals for extension towards initial targets at 59047 (Dec 2021 high) and 60000 (psychological).

Res: 57470; 58000; 59047; 60000

Sup: 56291; 54481; 52869; 51000

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

Crypto bloodbath: $325 billion market cap vanishes amid selling pressure

The Kobeissi Letter reports on Tuesday a $325 billion wipeout in the crypto market capitalization since Friday. Additionally, Bloomberg reports that Citadel Securities, a firm with $65 billion in assets, is exploring a role as a Bitcoin and crypto liquidity provider.

Bitcoin edges below $90,000, ending its long streak of consolidation

Bitcoin (BTC) continues to trade in red, reaching a low of $88,200 during Tuesday’s early Europen trading session and hitting the lowest level since mid-November after falling 4.89% the previous day.

Shiba Inu holders unload 61.5 billion tokens in the last ten days

Shiba Inu price hovers around $0.000013 on Tuesday after dropping nearly 12% the previous day. Supply Distribution data shows that whale wallets have decreased SHIB holdings in the last ten days.

XRP eyes further downside as Trump to implement tariffs on Mexico, Canada, in March

Ripple's XRP joined the wider crypto market decline, plunging nearly 10% on Monday following President Donald Trump reiterating that the US will kick off tariffs on Mexico and Canada.

Bitcoin: BTC demand and liquidity conditions remain weak

Bitcoin price has been consolidating between $94,000 and $100,000 since early February, hovering around $98,000 at the time of writing on Friday. Despite this consolidation, US Bitcoin spot ETFs data recorded a total net outflow of $489.60 million until Thursday, hinting signs of weakness among institutional investors.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.