Bitcoin open interest hits $19 billion as Jim Cramer declares BTC ‘indestructible’

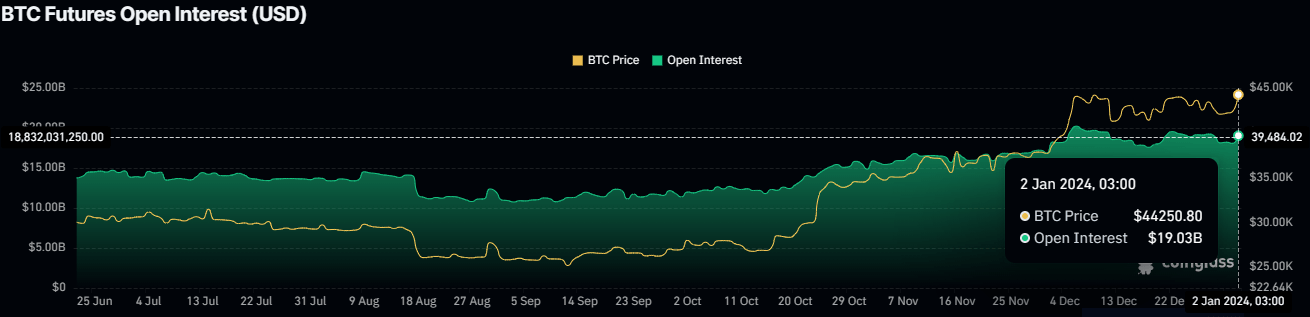

- Bitcoin open interest has reached $19.03 billion amid spot BTC ETF-related anticipation.

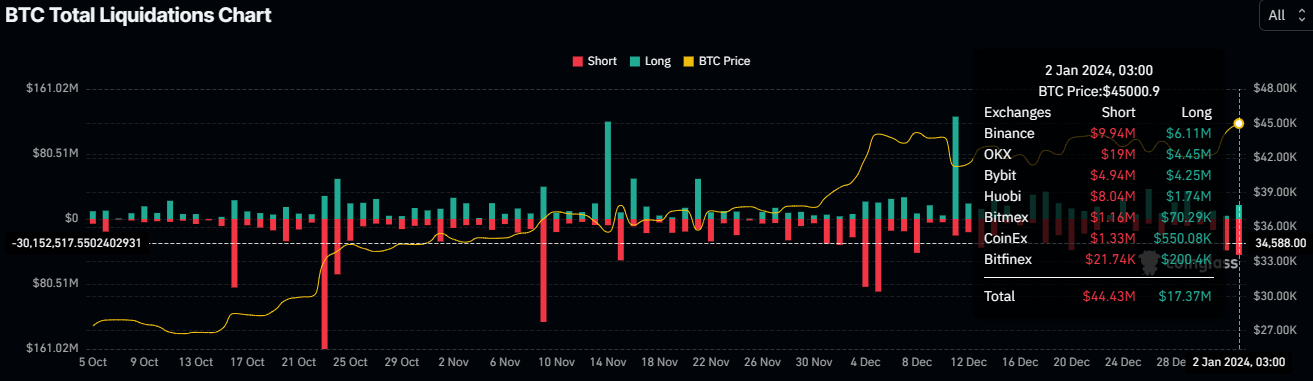

- With up to $44.44 million short positions liquidated against $17.38 million longs, Jim Cramer says BTC is indestructible.

- The comment has sparked controversy of a bullish versus bearish outcome, considering the MadMoney host’s repute as “Inverse Cramer.”

- Meanwhile, Bitcoin price remains above the midline of the weekly supply zone at $43,860, a move favoring the upside.

Bitcoin (BTC) price is trading with a bullish bias, breaking above the midline of a weekly supply zone. This is a bullish move, suggesting the likelihood of the continuation of the primary trend. However, as the market continues to bask in the optimism of this breakout, recent assertions by former hedge fund manager and host of CNBC’s Mad Money, Jim Cramer, have spurred confusion.

Also Read: BTC coils up for one last buy opportunity before potential 2024 spot ETF rush

Bitcoin open interest hits $19 billion

Bitcoin (BTC) open interest stands at $19.03 billion, indicating the sum of all long and short positions that remain open for the king of cryptocurrency.

BTC Open Interest

The voluminous open interest comes as the market anticipates approval from the US Securities and Exchange Commission (SEC), after a Reuters report indicated that the financial regulator could give a decision on the filings between January 2 and 3.

Amid this expectation, a typical mix of FOMO (fear of missing out) and the ‘buy the rumor sell the news’ situation saw bitcoin price rise 7% on January 7, breaching the midline (mean threshold) of the weekly supply zone at $43,860. A break and close above this level is a good sign, suggesting the primary trend could continue. The supply barrier extends between $40,387 and $46,999.

BTC/USDT 1-week chart

With this surge, up to $44.43 million short positions have been liquidated against $17.37 million long positions. This means that the expectations of traders that had taken short positions on BTC have been defied as the trend continues to favor the longs.

BTC liquidations

Jim Cramer says BTC is indestructible

Amid pronounced optimism in the market, Jim Cramer has planted doubt because of his positive comments about BTC. Speaking on CNBC, he declared Bitcoin as being “indestructible”, adding, "It can NOT be killed; the tech is here to stay." Cramer also described the king of cryptocurrency as “A technological marvel that’s here to stay,” acknowledging “The SEC has been against it the whole time.”

JUST IN: Jim Cramer declares Bitcoin is indestructible, stating, "It can NOT be killed; the tech is here to stay."

— Good Morning Crypto (@3TGMCrypto) January 2, 2024

“It’s a technological marvel that’s here to stay! The SEC has been against it the whole time”

“This is a remarkable comeback that was unexpected.” #Bitcoin… pic.twitter.com/6jDVgD9SSP

While the comments suggest the Mad Money host may have reversed his previously bearish stance on Bitcoin in the face of possible spot BTC ETF approvals, it is impossible to ignore his reputation as the 'Inverse Cramer.'

For instance, in February, the television personality said Silicon Valley Bank (SVB) stock was a buy at $320. As of March 30, however, the stock was going for a penny.

Jim Cramer said Silicon Valley Bank was a buy last month at $320

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 10, 2023

Today it is being closed by California regulators pic.twitter.com/x1xMBTrQTS

In early March, Cramer told investors to sell their Bitcoin (BTC). However, as it would turn out, the king crypto rallied around 20% two weeks after that particular comment. These, among other instances, birthed the assumption that when Cramer says to go right, you go left!

How to become a millionaire shorting market.

— Petr Royce (@petrroyce) March 27, 2023

- Short what Jim Cramer recommends

- Sell BTC when Saylor announces he bought

Over time, market players have grown to believe the easiest way to win big is to do the opposite of Cramer's recommendation.

Former Binance CEO on ‘Inverse Cramer’ assumption

In a late March 2023 post, Cramer said that he would not do business with Binance, adding that the exchange was “way too sketchy.”

After listening to Tim Massad on last night's show (former head of the CFTC) I would not do business with Binance. Just way too sketchy

— Jim Cramer (@jimcramer) March 31, 2023

While the statement was negative, it gave direction to many who were sitting on the fence following a CFTC lawsuit, because of the ‘Inverse Cramer’ narrative.

Perfect, now I’m ready to deposit back to #Binance

— Carl From The Moon (@TheMoonCarl) March 31, 2023

Thanks Jim, best confirmation I could have gotten.

Binance and former CEO Changpeng Zhao were under a CFTC investigation for allegations of offering unregistered derivatives products and helping US-based customers avoid compliance controls through VPN.

Even the then Binance CEO had noticed Cramer’s comment, reacting with what was interpreted as “thank you.”

— CZ BNB (@cz_binance) March 31, 2023

Nevertheless, as it turned out in November, Binance and CEO capitulated to the US Department of Justice (DoJ), which brings back to mind the “sketchy” reference by Cramer early last year.

Also Read: Binance capitulation to DoJ harmed its case against the US SEC

However, Cramer has diluted his latest statement on BTC being indestructible with a post on X, saying, “If everybody knows it is going up because it always goes up when a tightening cycle is over, can it do what everyone expects? Today!!”

If everybody knows it is going up because it always goes up when a tightening cycle is over, can it do what everyone expects? Today!!

— Jim Cramer (@jimcramer) January 2, 2024

It leaves a lot to speculation, which underscores the need for traders and investors to conduct their own research and invest only when they are prepared to lose all the money you invest. This is because crypto is a high-risk investment and every market participant should not expect to be protected if the market goes the other way.

Read Spot BTC ETF: Analyzing sell the news event if an approval does come

Crypto ETF FAQs

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.