Bitcoin no longer correlated to US stocks, crypto analytics Firm Block Scholes says

Bitcoin's (BTC) fortune is no longer tied to sentiment in the U.S. stock markets.

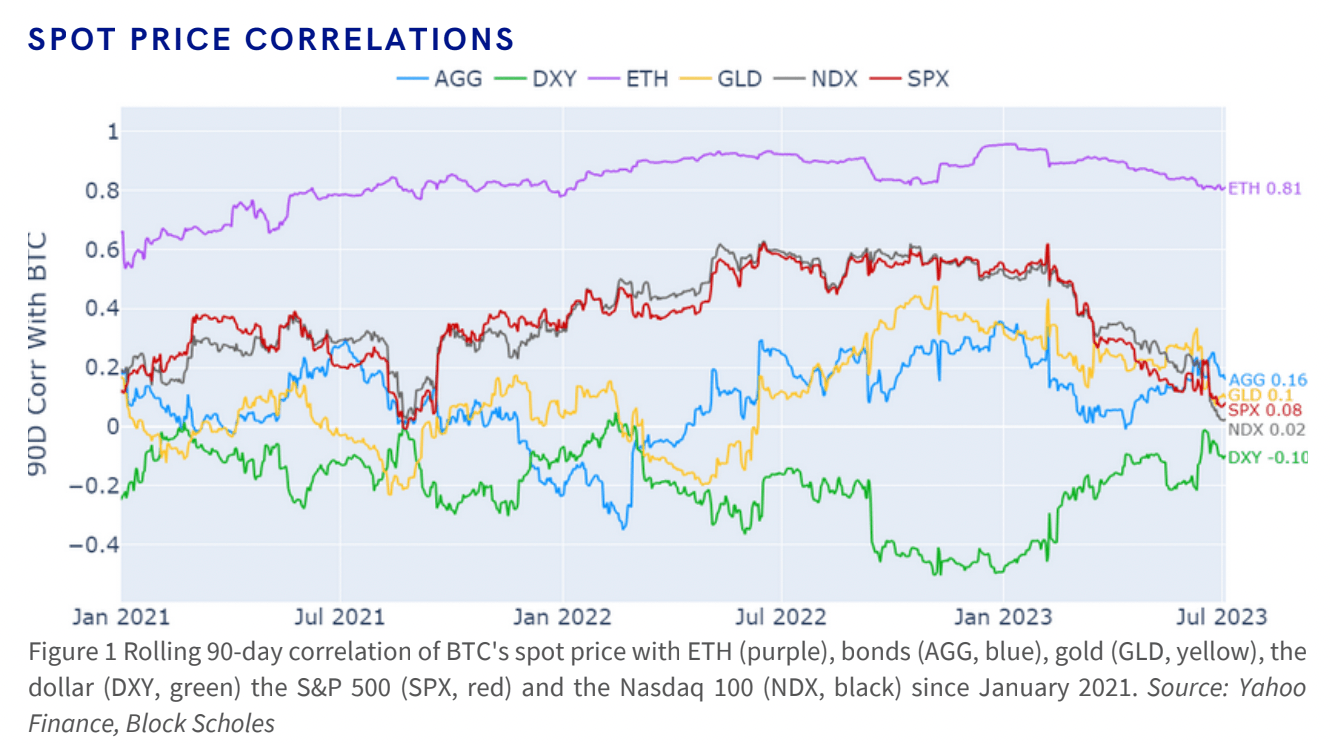

The 90-day rolling correlation of changes in bitcoin's spot price to changes in Wall Street's tech-heavy equity index, Nasdaq, and the broader index, S&P 500, has declined to near zero. That's the lowest in two years, according to data tracked by crypto derivatives analytics firm Block Scholes.

"It [the correlation] is now at the lowest level observed since July 2021, when BTC was between its twin peaks in April and November," Andrew Melville, research analyst at BlockScholes, said in an email.

"The fall in correlation has happened as both assets have retraced losses sustained throughout last year's tightening cycle," Melville added.

The dwindling correlation with traditional risk assets means that crypto traders focusing solely on traditional market sentiment and macroeconomic developments may face disappointment.

Bitcoin exhibits a near-zero statistical relationship with Nasdaq and S&P 500. (BlockScholes, Yahoo) (BlockScholes, Yahoo)

ETF narrative

The recent spot bitcoin exchange-traded fund (ETF) filings by BlackRock (BLK), Fidelity, WisdomTree (WT), VanEck, Invesco (IVZ) and others have brought optimism to the crypto market.

Since BlackRock's filing on June 15, bitcoin has produced a return of 25%, ignoring the range bound activity in the U.S. stock indices.

Per Ilan Solot, co-head of digital assets at Marex Solutions, the ETF narrative can be broken down into three parts – frontrunning the launch, flows post-the-spot ETFs go live and validation of crypto as an asset class.

"Investment product flow in coming months could be a litmus test for the latter, so I’ll be watching it closely," Solot tweeted.

To the bears' dismay, investor interest in exchange-traded products has increased since June 15.

"Globally, BTC ETPs experienced inflows of 13,822 BTC in June, with the inflows kicking in after the BlackRock announcement on June 15," Vetle Lunde, senior research analyst at K33, said in a note to clients on Tuesday, discussing the impact of the ETF narrative. "The flows have been strong across jurisdictions, with Canadian and European spot ETPs and U.S. futures ETFs all experiencing solid inflows."

While the ETF narrative is currently in the driver's seat, some macroeconomic factors, like potential fiat liquidity pressures, still warrant attention, analysts told CoinDesk.

Bitcoin changed hands at $30,830 at press time, per CoinDesk data.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.