Bitcoin (BTC) neared $50,000 on Dec. 22 as hopes began to appear that the price correction could be over.

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

Get bullish once $50,500 breaks – Analyst

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hit highs of $49,600 on Bitstamp – its highest since Dec. 13.

A cross-crypto boost from turmoil in the Turkish lira Monday lingered in spirit as Bitcoin and altcoins stayed higher, with attention now focusing on the new year and price levels above $50,000.

“The first breakthrough has happened on Bitcoin. But, we still need to break enough levels to state that we’re bullish," Cointelegraph contributor Michaël van de Poppe declared overnight.

“Overall, a breakthrough at $50.5-51.5K and I’m convinced. Also, 2022 should become a great year overall.”

With $50,000 constituting psychological resistance, others turned to on-chain metrics for further proof of underlying strength on Bitcoin.

Among them was fund manager Dan Tapiero, who noted bullish signals on the moving average convergence divergence (MACD) indicator in what has historically been a time to buy.

“Rallies start when least expected/when tired bulls give up,” he summarized.

MACD involves the relationship between two exponential moving averages on BTC/USD, and a rebound from a downtrend has preceded price run-ups.

BTC/USD 1-day candle chart (Bitstamp) with MACD. Source: TradingView

The last time the buy signal appeared was at the end of September, right before Bitcoin rose to top new all-time highs just over one month later.

Sentiment index almost doubles

In more encouraging signs for investors, altcoins began posting more significant daily gains through Wednesday.

Ether (ETH), the largest altcoin by market capitalization, maintained $4,000, while standout Terra (LUNA) was up 16% at the time of writing.

Ripple’s XRP token traded up 9%, with none of the top 10 cryptocurrencies by market cap in the red.

“If I’d want to position myself well, I’d want to buy into crypto at this stage,” van de Poppe added.

“The sentiment is still not the best, while many altcoins are down a lot, some even 80% since their ATH. The adoption is even growing and price-wise, those coins are in heavy support zones.”

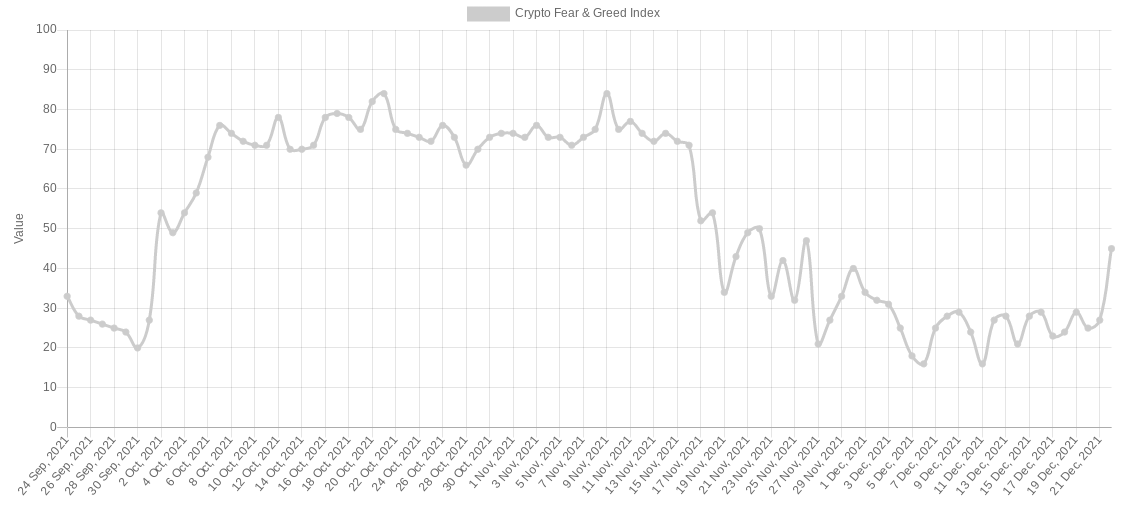

The Crypto Fear & Greed Index saw a significant uptick overnight, jumping from 27 to 45 but still characterizing the market as being in “fear” mode.

Crypto Fear & Greed Index. Source: Alternative.me

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Ripple update: XRP shows resilience in recent crypto market sell-off

Ripple's XRP is up 6% on Tuesday following a series of on-chain metrics, which reveals investors in the remittance-based token held onto their assets despite the wider crypto market sell-off last week.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

Six Bitcoin mutual funds to debut in Israel next week: Report

Six mutual funds tracking the price of bitcoin (BTC) will debut in Israel next week after the Israel Securities Authority (ISA) granted permission for the products, Calcalist reported on Wednesday.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.