Bitcoin price to hit $125,000 in 2024 according to Matrixport research

- Bitcoin is now 20,780 blocks away from the fourth halving event.

- Asset manager Ric Edelman says financial advisors are waiting for BTC Spot ETF approval to provide Bitcoin to clients.

- BTC price is on track to hit its $40,000 target according to a crypto analyst.

Bitcoin is inching closer to the anticipated fourth halving event, scheduled for April 17, 2024, tentatively. BTC price is likely to rally to its $40,000 target; analysts consider this level a “magnet” for Bitcoin.

At the time of writing, Bitcoin price is at $38,141, on Binance. BTC yielded 2.27% gains in the past week.

Also read: Kyber exploiter asks for complete control of all assets after nearly $50 million exploit

Daily Digest Market Movers: Bitcoin closer to halving event, Spot ETF approval anticipation brews

- Analysts at digital asset platform Matrixport believe Bitcoin price could hit $125,000, post the fourth halving event. Historically when mining rewards are slashed in half, Bitcoin becomes scarce and there is a rally in the asset. The target is derived from the inflation model of analysts at Matrixport.

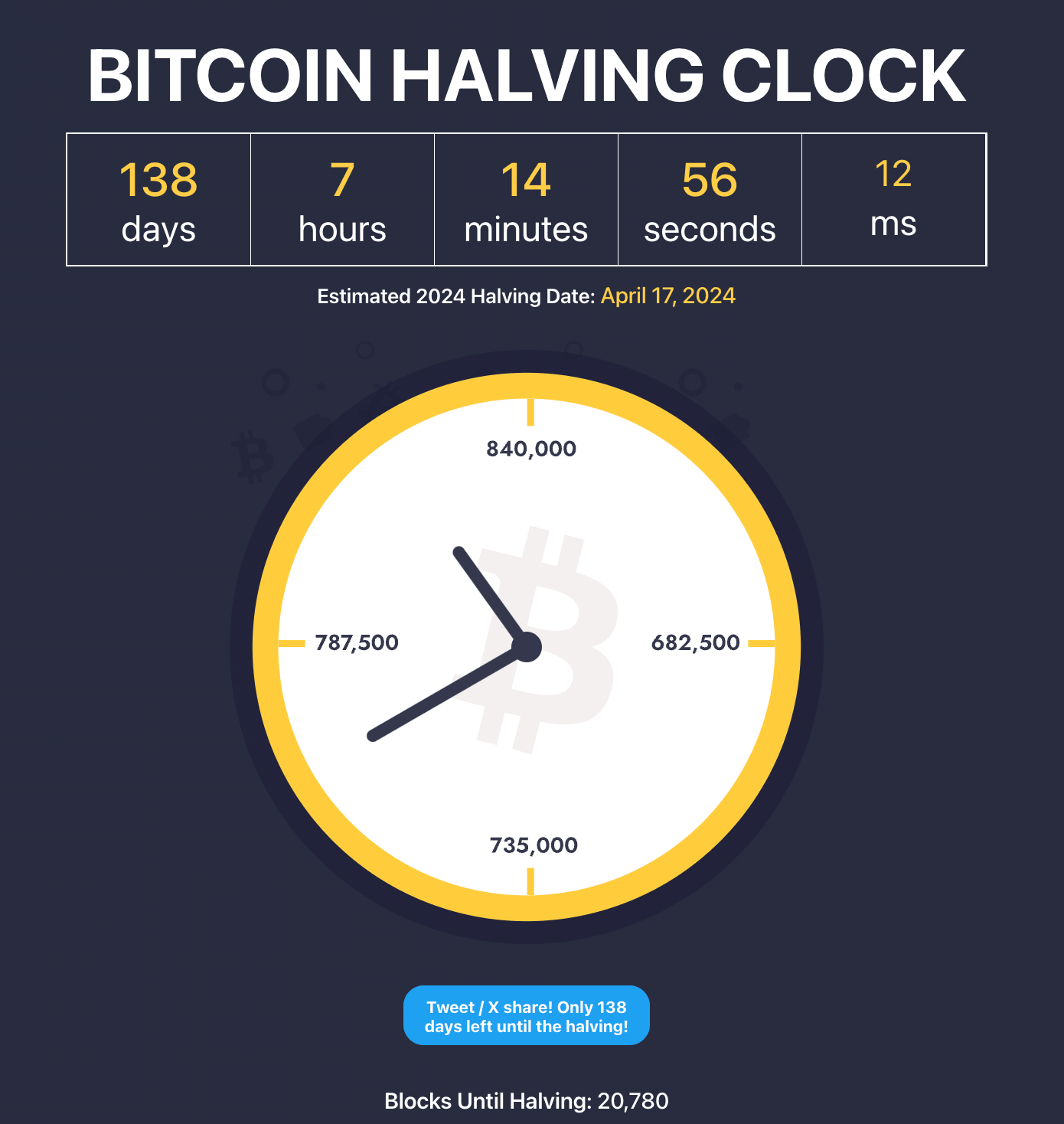

- Bitcoin’s halving events are considered key milestones in the asset’s cycle. Halving helps counteract inflation in Bitcoin and maintain the asset’s scarcity. The fourth halving event is scheduled for April 2024 and BTC is now 20,780 blocks away from it, according to data from buybitcoinworldwide.

Bitcoin halving clock

- Bitcoin Spot ETF approval anticipation is brewing among holders. Ric Edelman, founder of the Digital Assets Council of Financial Professionals (DACFP), believes that 77% of advisors are waiting for spot Bitcoin ETF approvals to provide crypto asset exposure for clients.

- Edelman revealed that a recent survey indicated that 47% of financial advisors personally own Bitcoin, this gives credibility to their recommendation to clients, according to the asset manager.

- MicroStrategy, one of the largest BTC holding institutions added 16,130 Bitcoins to its holdings, at an average price of $36,785 per token. The business intelligence firm now holds 174,530 BTC, worth nearly $5.28 billion, with an average price of $30,252. More institutions are expected to line up to acquire BTC tokens, likely when a batch approval for Spot Bitcoin ETFs comes.

MicroStrategy has acquired an additional 16,130 BTC for ~$593.3 million at an average price of $36,785 per #bitcoin. As of 11/29/23, @MicroStrategy now hodls 174,530 $BTC acquired for ~$5.28 billion at an average price of $30,252 per bitcoin. $MSTR https://t.co/hSEZyzGBsr

— Michael Saylor⚡️ (@saylor) November 30, 2023

Technical Analysis: $40,000 is a magnet for Bitcoin

Bitcoin price sustained above the $38,000 level, yielding 1% gains on the day. Pseudonymous crypto analyst, CryptoKaleo, evaluated the Bitcoin price trend and identified $40,000, as a magnet for Bitcoin price. The analyst predicts a BTC price rally to $40,000.

BTC/USDT 1-hour chart

Alex RTB, analyst behind the X handle @rutradebtc reaffirms Kaleo’s prediction and argued that BTC is likely to hit the $40,000 target this week. The analyst identified an ascending triangle setup in the Bitcoin price chart, a bullish continuation pattern.

BTC/USDT 4-hour chart

A daily candlestick close below $37,500 is likely to invalidate the bullish thesis for Bitcoin price.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.