- Bitcoin mining difficulty increased by 3.22% to 49.55 trillion, hitting a record high.

- The increase in on-chain activity over the past few weeks has resulted in a rise in the number of miners on the network.

- Rise in hashrate signals strength in Bitcoin’s network security as it lowers chances of an attack.

The Bitcoin network ushered in a mining difficulty adjustment, increasing it by 3.22%. Typically, an increase in mining difficulty of a Proof-of-Work (PoW) network is indicative of network health and resilience to attacks.

Also read: Solana captures new users as Bitcoin and Ethereum struggle

How a rise in BTC mining difficulty influences Bitcoin price

Bitcoin is a Proof-of-Work asset and its mining difficulty represents the security and resilience of the BTC network against attacks. The metric measures the difficulty of mining a block on the Bitcoin network and relies on the number of miners actively mining on BTC blockchain.

Mining difficulty can have an indirect influence on the asset’s price. When difficulty rises, the cost of mining a Bitcoin block increases and miners typically offset this rise by selling their rewards to cover higher operation costs.

Higher costs of operation can potentially be related to an increasing volume of BTC being sold by miners, representing a higher influx of supply. If there is demand across crypto exchanges to absorb the supply, BTC price is likely to remain unchanged, but a fluctuation in demand could result in selling pressure on the asset.

Rising on-chain activity has ushered in higher hashrate

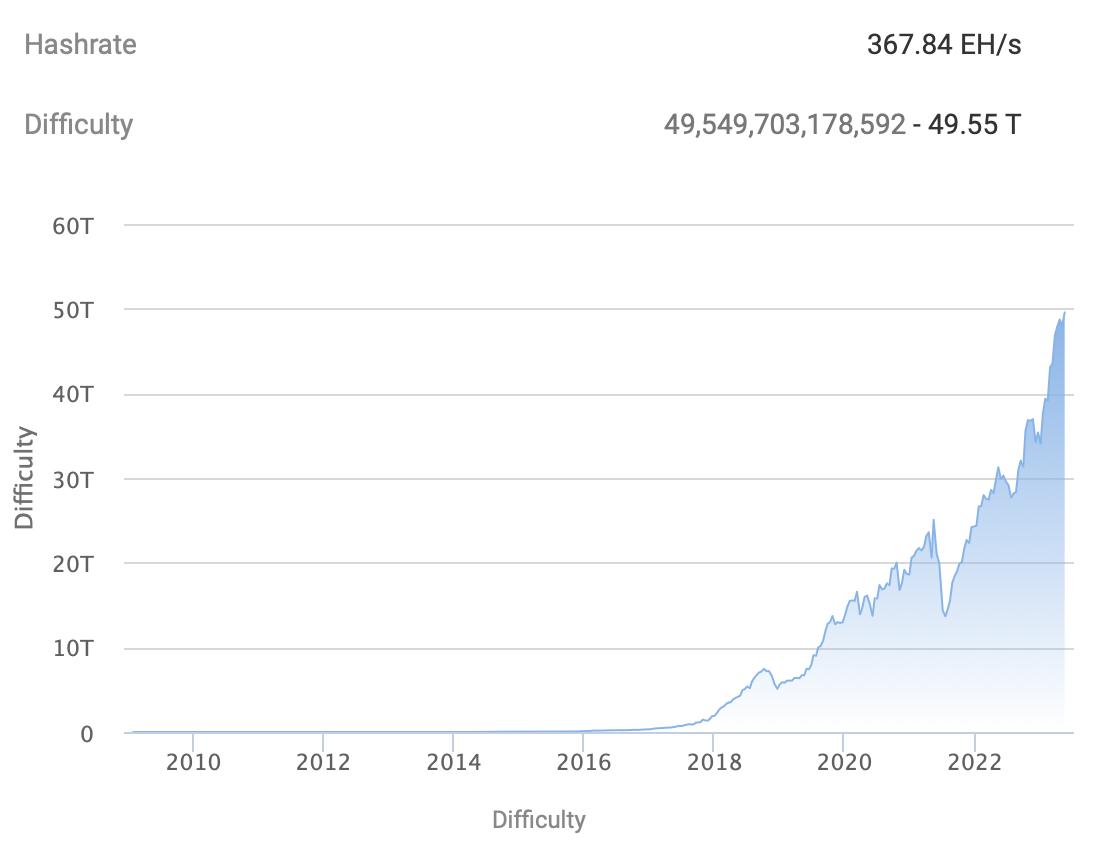

Bitcoin network’s hashrate also increased following the 3.22% rise in mining difficulty at block height 790,272. The mining difficulty is at 49.55 trillion, breaking a record high for the PoW asset.

Bitcoin mining difficulty

The current average hashrate is 367.84 Exahash per second (EH/s). Colin Wu, a Chinese reporter and crypto analyst, attributes the rise in popularity of Ordinals and BRC-20 token standards to the growth in the number of miners on the network and the subsequent increase in the hashrate.

Bitcoin ushered in a mining difficulty adjustment at block height 790,272, and the mining difficulty increased by 3.22% to 49.55 T, breaking through a record high. The current average hasjrate is 354.55 EH/s. The recent popularity of Ordinals BRC20 has led to more mining…

— Wu Blockchain (@WuBlockchain) May 18, 2023

Impact on Bitcoin price

If there is a lack of retail participation or demand across cryptocurrency exchanges, the influx in supply from miners selling BTC to cover operation costs could increase the selling pressure on the asset.

The supply on exchanges metric on Santiment measures the volume of BTC held by cryptocurrency exchanges and can be used to track the selling pressure on the asset.

%20[13.51.57,%2018%20May,%202023]-638199975198877717.png)

Bitcoin supply on exchanges v. price

At press time, there is no significant shift in the supply on exchanges. However, this is the metric that traders need to watch to determine the direction of Bitcoin price volatility in the short term.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.