Bitcoin (BTC $30,282) miners are sending record amounts of BTC to centralized crypto exchanges.

In a June 27 tweet, on-chain analytics platform Glassnode reported an all-time high in Bitcoin miner revenue sent to exchanges.

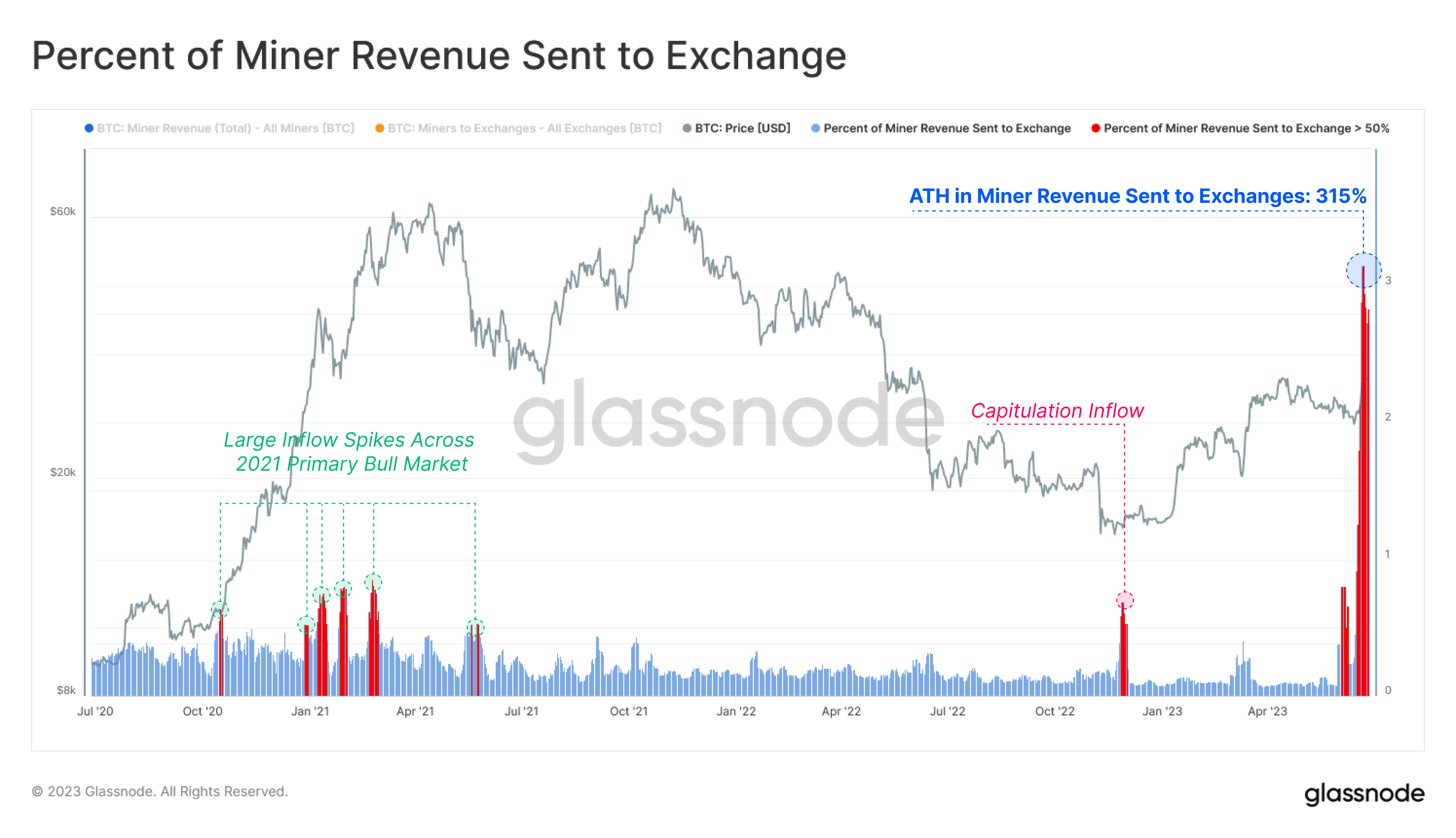

Percent of miner revenue sent to exchanges. Source: Glassnode

It noted that there was currently an “extremely high exchange interaction,” from Bitcoin miners which had sent a record $128 million to exchanges over the past week. This is equivalent to 315% of their daily revenue, the analytics platform noted.

There have been several spikes in miner revenue sent to exchanges during the 2021 bull run as they took profits. There was also a capitulation inflow in late 2022 as markets hit their cycle bottom.

However, this latest spike has dwarfed them all by a considerable margin.

Usually, when miners send BTC profits to exchanges they do so in preparation to cash out to cover their expenses and take profits.

This past week would be a good time to do so since BTC hit its highest price of the year so far, touching $31,185 on June 24.

At the time, CryptoQuant co-founder and CEO Ki Young Ju echoed the sentiment, stating that the current price-to-earnings ratio was at an “attractive price for miners to sell.”

Bitcoin prices are yet to be affected however, as the asset remains slightly above the $30,000 threshold at the time of publication.

Nevertheless, the current $31,000 price zone is a major resistance level for BTC, with markets failing to break it in mid-April and again in late June. If bulls can't break new ground future losses are expected, especially if miners start liquidating.

Bitcoin mining profitability, or hash price, has increased slightly over the last week due to the rise in BTC prices. It is currently $0.076 TH/s (terahashes per second) per day, according to HashrateIndex.

Despite the price of Bitcoin increasing more than 88% year-to-date, miners are still facing some tough challenges. Profitability has slumped more than 30% since July last year and is down over 80% since the peak of the 2021 bull market.

When combined with almost record hash rates of 377 EH/s and peak difficulty levels, Bitcoin miners are still facing an uphill battle.

Increasing hash rates and difficulty, combined with higher energy prices, have put downward pressure on mining profitability. This means that selling their hard-earned Bitcoin may prove an unpleasant necessity to cover expenses.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.