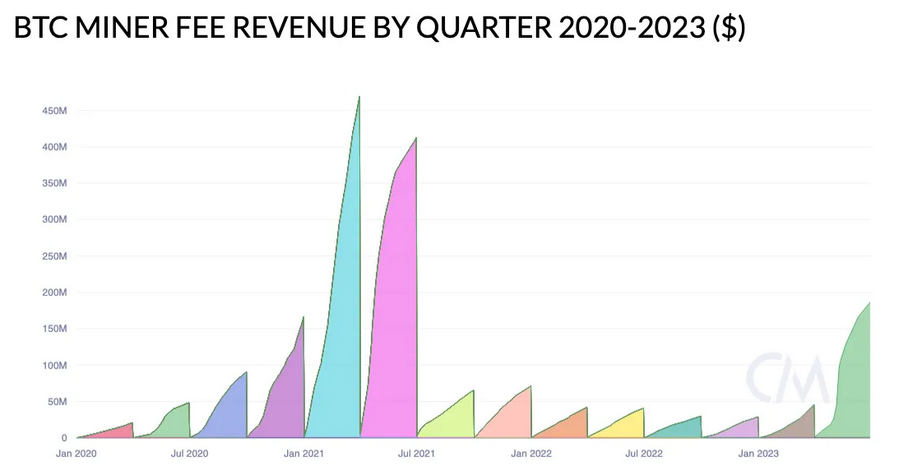

Bitcoin (BTC $30,836) miners made a lofty $184 million from transaction fees in the second quarter of 2023 — far more than they pocketed throughout the entire year of 2022 — as Bitcoin’s price surged and BRC-20 tokens flourished.

The $184 million payout is a more than 270% increase from Q1 2023, and it is the first quarter to have surpassed the $100 million mark since Q2 2021, according to a July 5 report from cryptocurrency analytics platform Coin Metrics.

Bitcoin miners earned more from fees in Q2 than the previous five quarters combined. Source: Coin Metrics

Bitcoin miners receive transaction fees whenever a new block has been validated — the amount of which is determined by the data volume and user demand for block space.

Coin Metrics said the jump in fees was due to Bitcoin’s recent price surge bolstering “top-line revenues” and the advent of BRC-20 — a new token standard on Bitcoin network introduced in March to mint and transfer fungible tokens like Ordinals inscriptions — adding:

The token standard does unlock experimental new use cases for Bitcoin’s core transaction types and accelerates the push to scale Bitcoin with the Lightning Network.

However, it is worth noting that transaction fees represented only 7.7% of the total $2.4 billion made by miners over the quarter.

The remainder came from Bitcoin block rewards, with miners currently rewarded 6.25 BTC for solving each block. This is set to fall to 3.125 BTC after the network’s next halving cycle, expected to occur around May 2024.

Bitcoin miners also had other reasons to celebrate in the second quarter, according to the firm.

In May, the Bitcoin mining industry “notched a win” with the Biden Administration’s proposed Digital Asset Mining Energy (DAME) tax being blocked.

In this special edition of State of the Network, we take a data-driven look at the most important events that impacted the digital assets industry from Q2 2023.

— CoinMetrics.io (@coinmetrics) July 5, 2023

Get the insights here: https://t.co/xpcE27j1Fz#FutureofFinance #PutTruthtoWork pic.twitter.com/67RDHKA2bT

Bitcoin miners also enjoyed easier macroeconomics conditions in the quarter too, with “receding inflation pressures” translating to lower electricity prices for United States-based miners, Coin Metrics noted.

However, with Bitcoin’s hashrate continuing to reach new all-time highs over the last 12 months, competition in the mining fee market is also tightening, Coin Metrics explained:

Competition remains as fierce as ever, with Bitcoin’s hashrate breaking new highs during the quarter at 375 EH/s [...] We see that the overall network’s efficiency continues to increase with the adoption of modern ASICs such as the S19 XP.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Polygon joins forces with WSPN to expand stablecoin adoption

WSPN, a stablecoin infrastructure company based in Singapore, has teamed up with Polygon Labs to make its stablecoin, WUSD, more useful in payment and decentralized finance.

Coinbase envisages listing of more meme coins amid regulatory optimism

Donald Trump's expected return to the White House creates excitement in the cryptocurrency sector, especially at Coinbase, the largest US-based crypto exchange. The platform is optimistic that the new administration will focus on regulatory clarity, which could lead to more token listings, including popular meme coins.

Cardano's ADA leaps to 2.5-year high of 90 cents as whale holdings exceed $12B

As Bitcoin (BTC) gets closer to the $100,000 mark for the first time — it crossed $99,000 earlier Friday — capital is rotating into alternative cryptocurrencies, creating a buzz in the broader crypto market.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: Rally expected to continue as BTC nears $100K

Bitcoin (BTC) reached a new all-time high of $99,419, just inches away from the $100K milestone and has rallied over 9% so far this week. This bullish momentum was supported by the rising Bitcoin spot Exchange Traded Funds (ETF), which accounted for over $2.8 billion inflow until Thursday. BlackRock and Grayscale’s recent launch of the Bitcoin ETF options also fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.