Bitcoin miners join the selling spree, is $17,000 next for BTC price?

- Bitcoin miners have been reducing their BTC reserves since January 21, adding to the list of factors driving the asset’s correction.

- The sale of Bitcoin by miners has increased the selling pressure on the largest asset by market capitalization.

- Experts believe rising selling pressure alongside other bearish factors in the market could push Bitcoin price to the volume gap between $19,500 or $16,600.

Bitcoin miners have been intensively reducing their BTC reserves. This is one of the factors driving the asset’s price lower. Sale of Bitcoin by miners has increased the selling pressure on BTC.

Also read: Will Bitcoin begin its recovery rally ahead of US Nonfarm Payrolls data?

Why are Bitcoin miners shedding their BTC holdings?

Bitcoin miners validate transactions and add them to a public ledger called the blockchain. Each time a miner adds a new block of transactions, they earn 6.25 BTC as a reward. The dollar value of the reward fluctuates with the volatility in Bitcoin.

Miners sell their Bitcoin holdings typically to cover operational costs. Since January 21, 2023 miners have been intensively reducing their BTC reserves, one of the factors driving Bitcoin price lower.

Bitcoin sale by miners has increased the selling pressure on the largest asset by market capitalization.

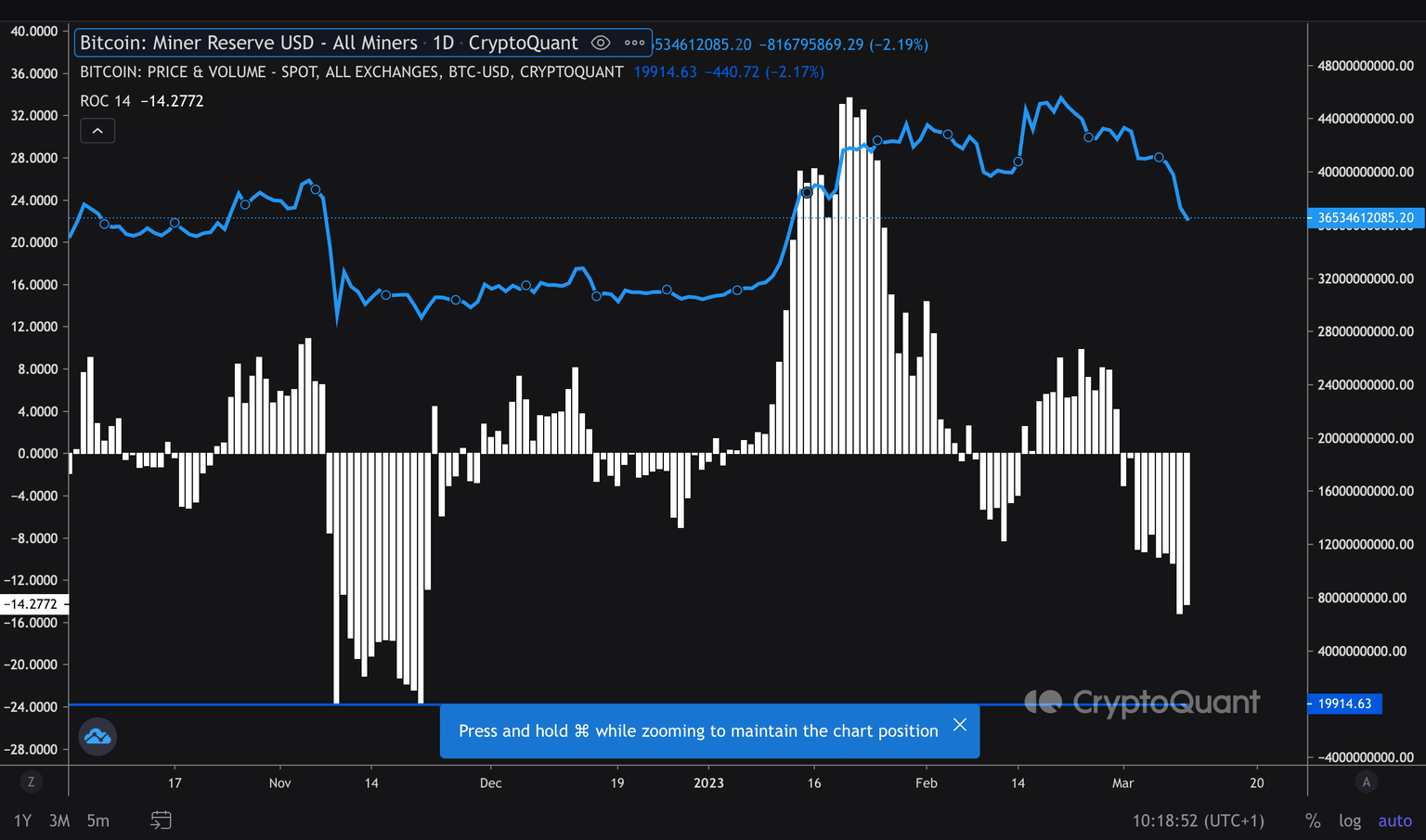

Bitcoin miner reserve USD as seen on CryptoQuant

Analysts at CryptoQuant believe that rising selling pressure from BTC miners, alongside other factors influencing the asset could push Bitcoin to either $19,500 or $16,600. The current uncertainty in cryptocurrency prices is driven by Fear, Uncertainty and Doubt (FUD) from Silvergate’s voluntary liquidation, macroeconomic outlook, KuCoin hit by lawsuit and Huobi Token’s flash crash.

Technical experts identified a volume gap between the $19,500 and $16,600 level and accordingly, analysts believe it could be a challenge for Bitcoin to find a local bottom in intermediate zones.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.