Bitcoin metrics hit an all-time high ahead of the US Federal Reserve’s rate decision

- Bitcoin hashrate has witnessed a temporary surge with the rising popularity of Ordinals NFT on the BTC blockchain.

- Daily transactions on the BTC network climbed to 682,000, as a higher number of traders engaged in buying, selling and Bitcoin Ordinals trade.

- Experts are bullish on Bitcoin price ahead of the US Federal Reserve’s rate decision on May 3.

Bitcoin network’s hashrate, a key mining metric that represents the amount of processing and computing power being given to BTC has climbed with a surge in Ordinals NFT usage. The number of inscriptions in a 24-hour period on May 1, crossed 350,000, a new peak for Ordinals NFTs on the Bitcoin blockchain.

Experts have turned bullish on BTC ahead of the US Federal Reserve’s key interest rate decision.

Also read: Bitcoin traders watch US Fed’s interest rate decision to plot likely return to $30,000

Bitcoin metrics hit a peak ahead of US Fed’s interest rate decision on May 3

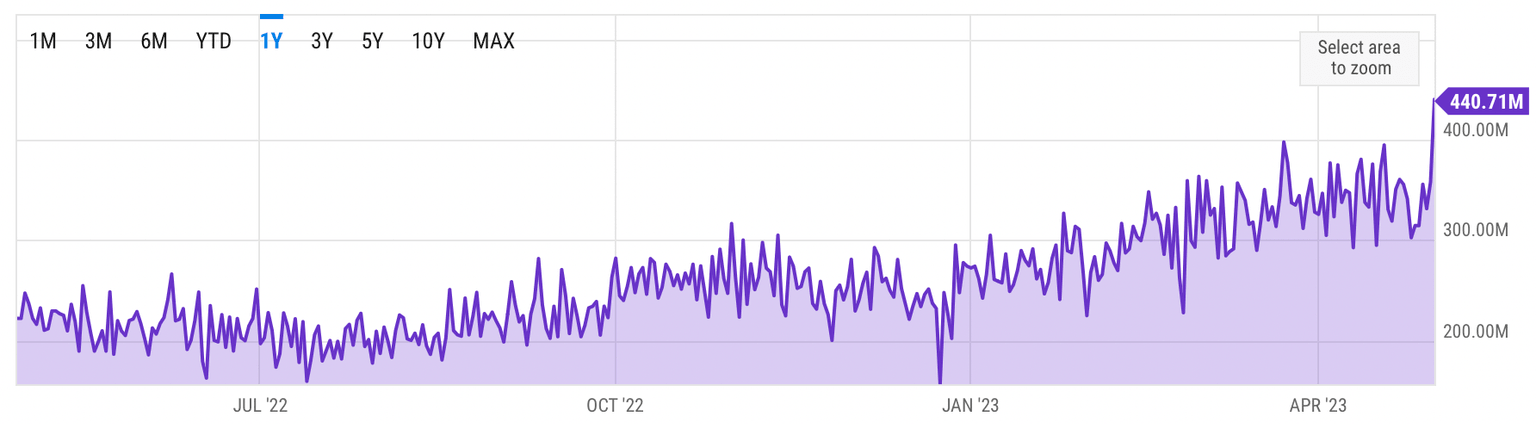

The processing and computing power given to the BTC network through mining, climbed above 440.71M TH/s on Monday. The spike in hashrate can be attributed to the increased BTC network usage by traders engaging in buying, selling and trading Ordinals NFTs on the Bitcoin blockchain.

Bitcoin Network Hash Rate

The spike in hash rate signals the stability of Bitcoin’s network and its rising utility in the crypto ecosystem.

The daily transactions on the Bitcoin blockchain climbed to 682,000 as more traders engaged in buying, selling and trading Ordinals. As transaction count climbs, there is a spike in transaction fees, the cheapest fee is nearly $0.30, nearly eight times that of its lows.

The cost of sending BTC to wallets across the blockchain is therefore significantly higher with the rising usage of the Bitcoin blockchain.

Based on the utility and transaction count, experts have turned bullish on BTC.

Why experts are bullish on Bitcoin

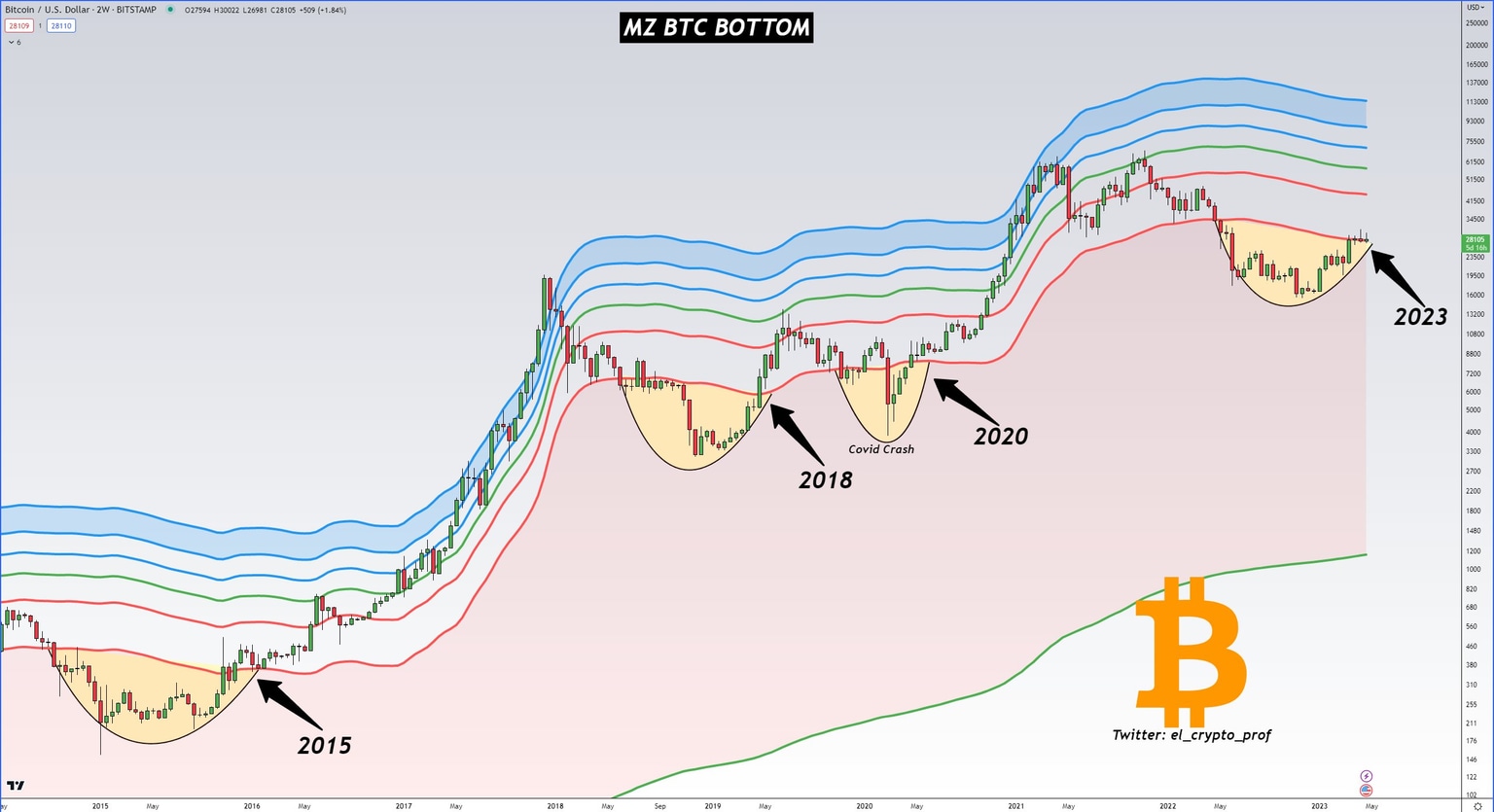

Crypto trader and expert El Crypto Prof evaluated the Bitcoin price trend and noted that BTC reclaimed the 0.236 line on its chart. The last time BTC reclaimed this level, it witnessed a massive price rally.

BTC/USD price chart

As seen in the chart above, on three instances in 2015, 2018, and 2020, when Bitcoin price climbed above the red line, that represents the 0.236 level, it witnessed an explosive rally.

While most traders are bearish on Bitcoin, the expert is bullish as BTC climbs past the red line yet again, ahead of a key macroeconomic event, the US Federal Reserve’s rate hike decision.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.